For the third year in a row, Grayscale surveyed the investment community to study sentiment in the crypto market andBitcoin prospects.Despite the regular emergence of new cryptocurrencies, Bitcoin continues to be a source of discussion among investors, consultants, financial institutions, the media, service providers, regulators and policymakers. Grayscale analysts conducted a study to assess how the perception of Bitcoin has changed since 2019.

Introduction

Key points

Main trends

Impact of Bitcoin ETF

Bitcoin and other cryptocurrencies

Investor motivation and desires

Conclusion

Introduction

Several key themes have emerged from the current research:

- acquaintance and interest in bitcoin (and other cryptocurrencies);

- a profile of investors interested in bitcoin;

- aspects of bitcoin that stimulate investor interest;

- barriers to investing in bitcoin;

- the role that bitcoin plays in the investment portfolio;

- the impact of Bitcoin ETFs.

The main thing was to raise awareness about bitcoinas a way to preserve capital during inflation. Investors are increasingly inclined to own bitcoin as a profitable long-term investment rather than a currency.

In addition, bitcoin is increasingly taking over the elderly.investors, including retirees, who consider investment bitcoin products as part of their investment portfolios. An ETF that offers a direct reflection of the price of bitcoin is generally seen as a tool for combining traditional financial instruments with digital assets and is a potential catalyst for the wider adoption of cryptocurrency.

Research methodology

An online survey of 1,000 people in the United States was conductedby 8 Acre Perspective from August 12, 2021 to August 20, 2021. All respondents were between the ages of 25 and 64 and had sole or joint responsibility for making financial decisions in households. All respondents were involved in some form of personal investment, having invested at least $ 10 thousand in investment assets of households (excluding plans for retirement savings in the workplace or real estate) and have at least $ 50 thousand in household income.

Key points

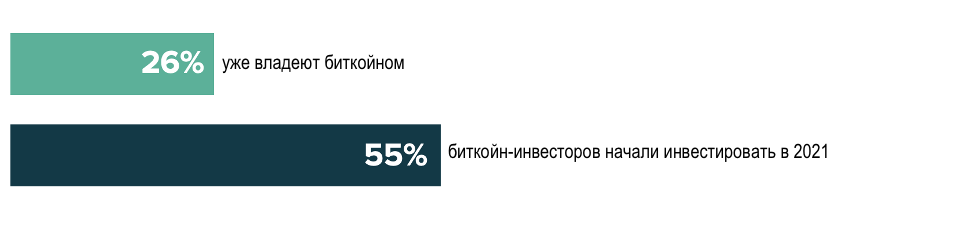

While the big banks keep breakinghead over how to interact with bitcoin, its mass adoption has already begun. The share of Americans with BTC has increased from 23% in 2020 to 26% in 2021. More than half (59%) of this cohort of investors choose to invest through a cryptocurrency trading app like eToro or Coinbase, which represents a paradigm shift from last year, when more than three quarters of investors (77%) chose bitcoin exchanges.

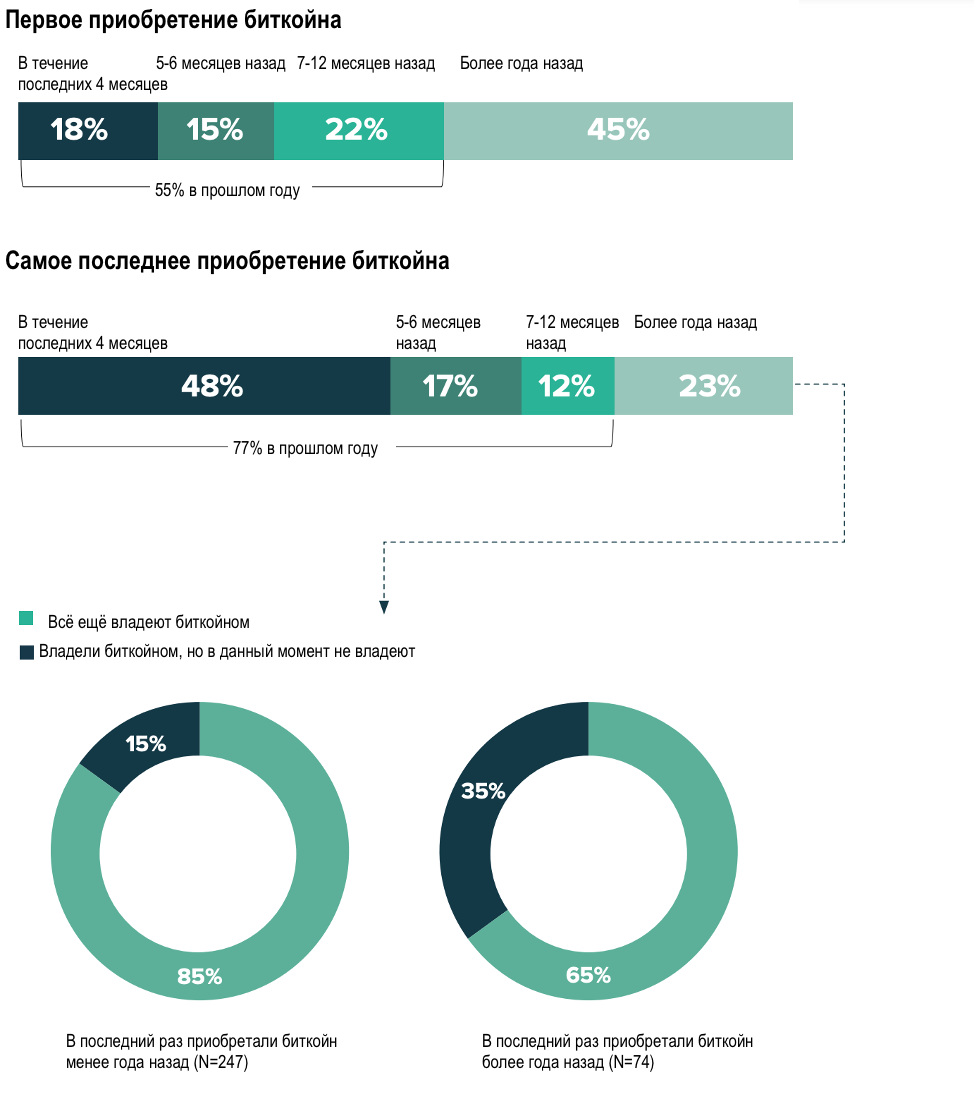

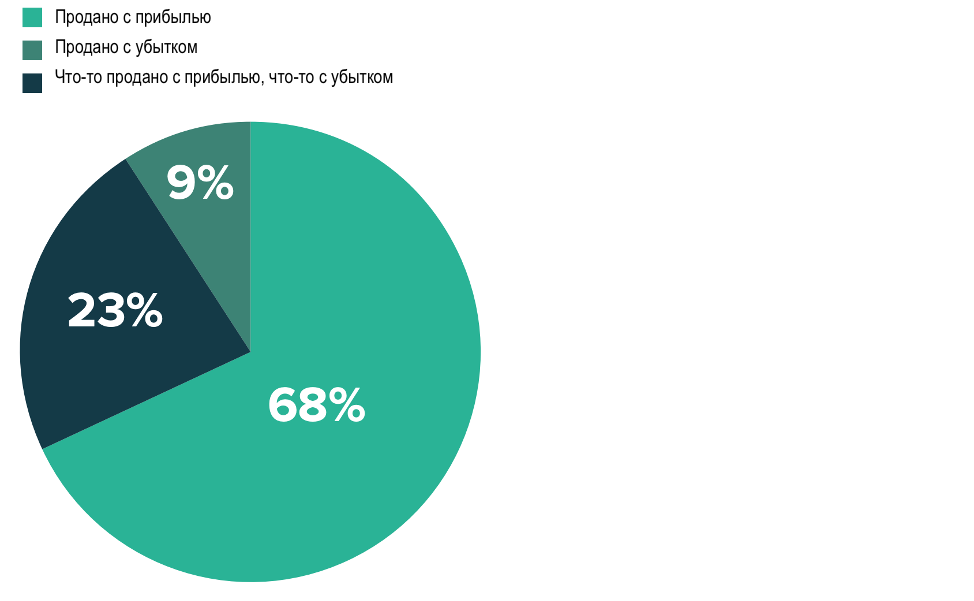

Bitcoin demand has grown significantly:more than half (55%) of current cryptocurrency investors started investing in the last 12 months. Investors are keen to buy, and this sentiment is reflected by the recent record high in November 2021, when Bitcoin moved closer to the $ 100K mark than to zero. Most of these investors are hodlers, and roughly 66% of those who bought BTC more than 12 months ago still own it today. Of those investors who sold cryptocurrency, 91% sold at a profit. Even with the growth of market segments and use cases such as Decentralized Finance (DeFi) and Non Fungible Tokens (NFT), Bitcoin still accounts for 46% of the total value of the crypto market.

More than three quarters (77%) of Americaninvestors said they would be more likely to invest in BTC if an ETF existed. In October 2021, the Bitcoin ETF concept came to fruition as the Bitcoin Futures ETF issued by ProShares debuted on the NYSE. While the bitcoin community as a whole (beyond those surveyed) tends to favor the approval of a spot-based bitcoin ETF that is backed by actual bitcoin over futures, the bitcoin futures ETF is a good start towards wider adoption. ...

BTC adoption growth

Main trends

Bitcoin's popularity continues to grow

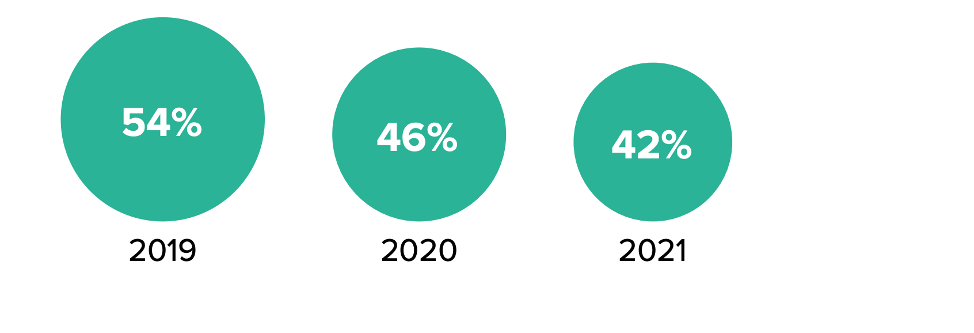

It's getting harder for investors to ignorebitcoin as its price continues to rise. The market for those interested in investment Bitcoin products increased to 59% in 2021, up from just over half (55%) in 2020 and just over one third (36%) in 2019, reflecting a steady rise in interest.

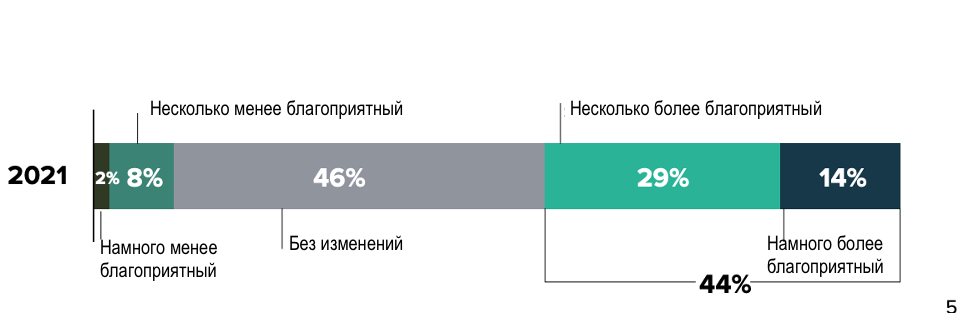

Consideration of Bitcoin Investment Products

Although the growth rates have slowed down a bit (bycompared to 2019-2020 and 2020-2021), bitcoin was at a lower level two years ago, when many considered it “very risky” or “just a fad”. Tech entrepreneur Peter Thiel shared in October 2021 that he was “underinvestment” in Bitcoin. The stability of the asset only increased as investor sentiment changed. Of those investors whose outlook on Bitcoin has changed over the past year, almost a third (29%) of them say they have a slightly more favorable outlook for 2021, while 15% say they see Bitcoin in a much more positive light. ...

Bitcoin's perceptions have become more favorable or neutral over the past year

More than a quarter (26%) of the investors surveyed have alreadyown bitcoin. Compared to last year, when just over one-fifth (23%) of survey participants owned BTC when it traded below $ 30K, this rise in interest also matches the rise in prices.

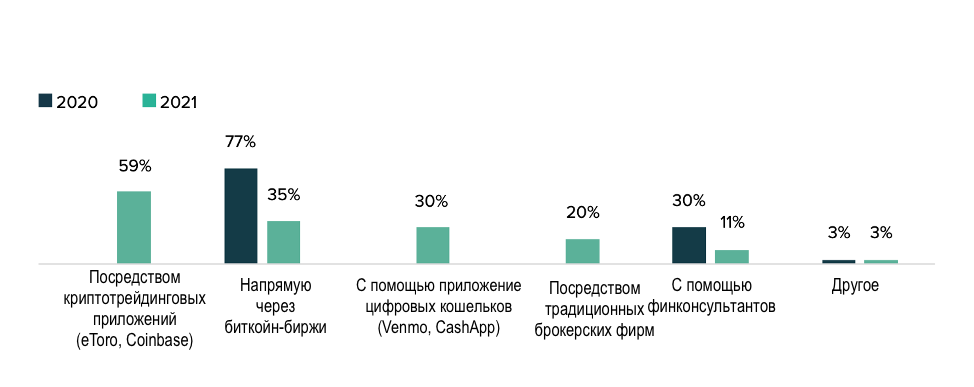

The channel over which investors preferbuying bitcoin also evolved during this period. In 2020, more than three quarters of investors chose to buy cryptocurrency directly through a bitcoin exchange, while in 2021, almost two thirds (59%) of investors chose to buy bitcoin through a cryptocurrency trading app such as eToro or Coinbase, with just over one a third (35%) of investors expressed a preference for buying bitcoin directly through the exchange.

It should also be noted that investors are increasinglyuse fintech applications to gain access to cryptocurrencies. For example, 30% of investors choose to buy Bitcoin using a digital wallet or an app like Venmo or CashApp. The growing number of investors buying bitcoin through existing fintech apps is undoubtedly a key driver for PayPal, one of the largest fintechs on the market, which backed BTC last year.

How to invest in bitcoin

The 2021 survey allowed investors to chooseseveral options, while in the 2020 survey, investors were asked to indicate their main preferences when buying BTC, so the 2021 numbers are over 100%.

Perception of bitcoin as an investment versus perception as a currency

Two main use casesbitcoin, according to the respondents, remains a means of preserving capital and a method of payment. While financial institutions continue to grapple with the role of bitcoin in the global economy, investors are clearly prioritizing this cryptocurrency as an investment with which they can accumulate long-term profits, rather than as a currency for making payments. This is a noticeable shift from 2020, when bitcoin as a currency was of more interest to investors than any other use case.

Three times as many investors would view owning bitcoin as an investment rather than a currency.

However, this year there are three times as many investorswould see bitcoin as a store of capital rather than a currency. Among them, more than a third (37%) perceive BTC as a short-term investment that can be held for less than one year in order to make "easy money".

More than half (55%) of investors perceive bitcoin as a long-term game that fits into the overall investment strategy.

Of the surveyed investors who embrace Bitcoinas a currency, one-fifth considers it as a means of payment to pay for goods and services. Another 14% would turn to Bitcoin for peer-to-peer money transfers.

Perception of bitcoin as an investment or currency

This Bitcoin use case picked up andtech entrepreneur Mark Cuban, whose NBA Dallas Mavericks accepts Bitcoin as a means of payment. Cuban said fewer fans pay in BTC than Dogecoin (DOGE) meme coins, and it is seen more as an intermediate medium of exchange.

Another sign that investors are increasinglyConsidering bitcoin as a means of preserving capital is the fact that many choose not to sell their position. More than half (55%) of surveyed investors have invested in bitcoin for the first time in the last 12 months. Among this cohort, most investors continue to hold onto BTC, reinforcing the theory that Bitcoin is viewed as a long-term investment.

Women are now thinking about bitcoin more often

The concept of what bitcoin ispurely a millennial phenomenon, no longer reflects reality. In fact, among investors with an interest in investing bitcoin products, the largest growth in 2021 was among older investors.

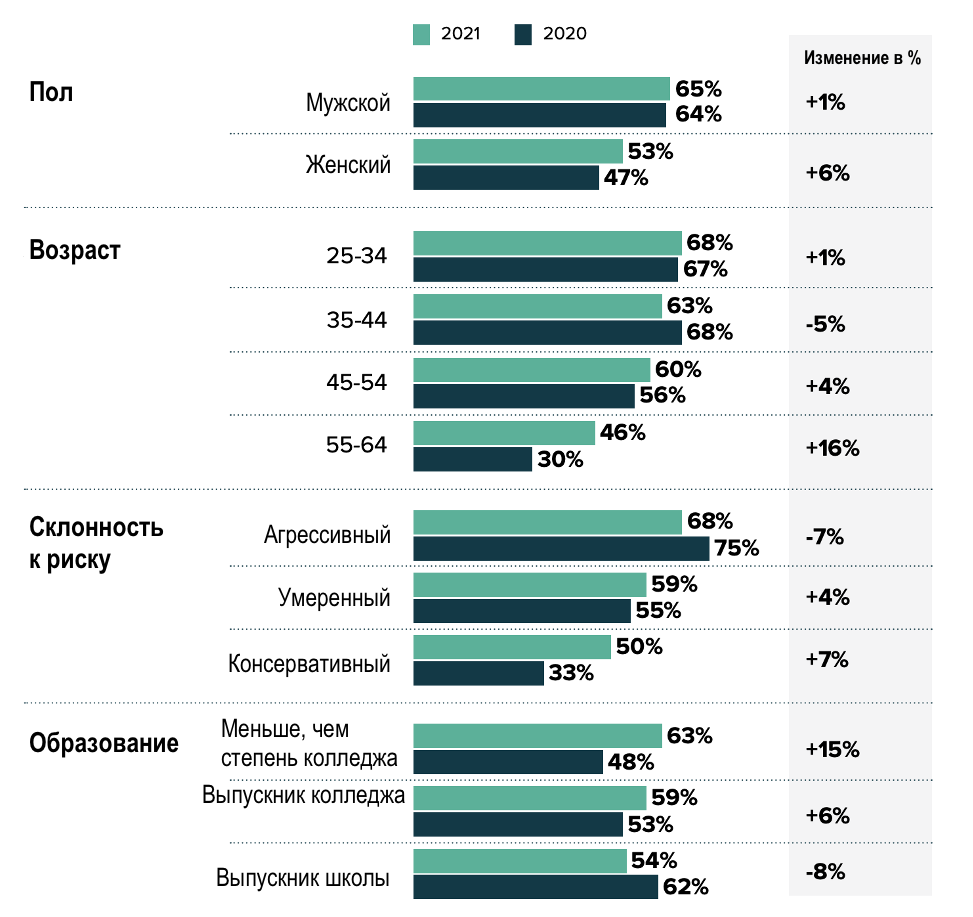

Segment of investors aged 55 to 64 in2021 is up 16% year-over-year as a percentage of the audience that will definitely or likely consider investing bitcoin products. However, interest in investment bitcoin products continues to be highest among young, male, and risk-tolerant investors, a topic that is relevant in both 2020 and 2019.

Proportion of female investors who would considerinvestment bitcoin products grew by 6% in 2021 compared to the 2020 level, while the segment of male investors in this category has remained relatively unchanged. Education level was a less important factor, as the cohort of non-college educated investors grew by a double-digit percentage (15%) in 2021 compared to the 2020 level.

% of the audience that will definitely / likely consider Bitcoin

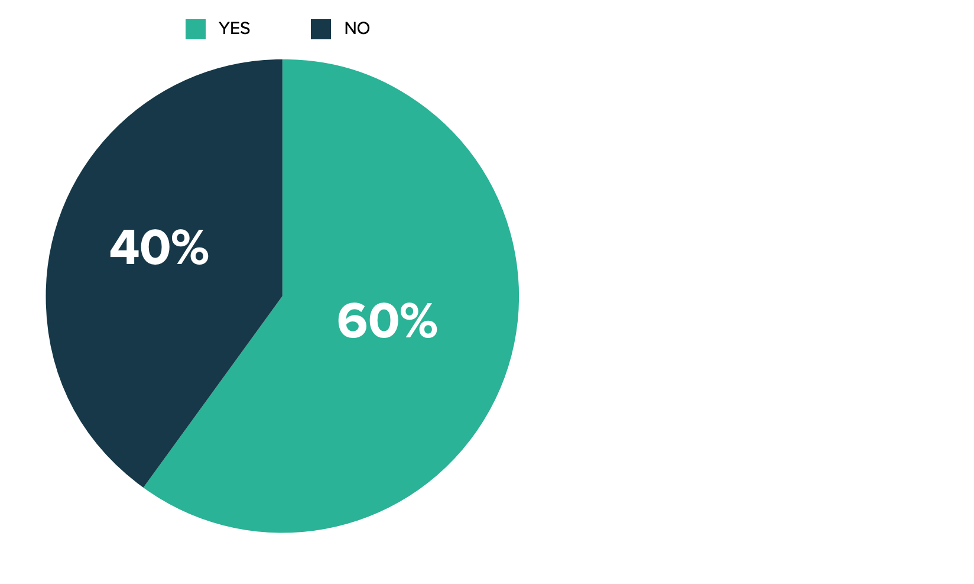

Most BTC sellers made a profit

While most bitcoin investors incurrently choose to hold the cryptocurrency, especially since the price of bitcoin continues to rise, some prefer to withdraw money. When they do this, they are most likely to make a profit. 6 out of 10 bitcoin investors have sold at least some of their digital assets, and 91% of them did it for a profit.

BTC sold

Experience of selling BTC

Impact of Bitcoin ETF

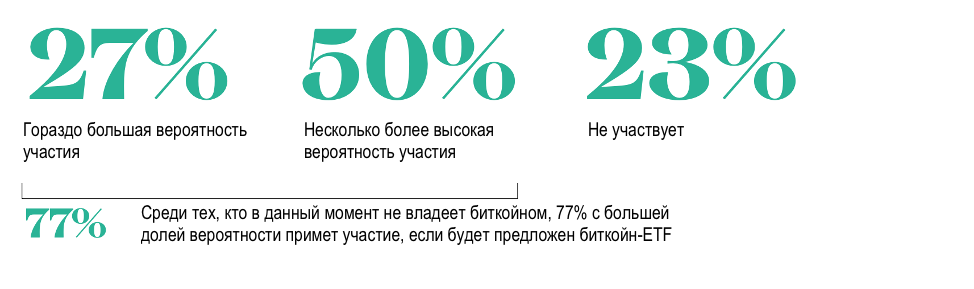

ETFs will have a significant impact on Bitcoin investments, with 77% of respondents saying they would be more likely to invest in crypto if an ETF existed.

If there was any doubt aboutthe impact of Bitcoin ETFs on the market, they were eliminated with the launch of the ProShares Bitcoin Strategy (BITO) ETF on the New York Stock Exchange in October 2021. The emergence of Bitcoin Futures ETFs was a psychologically positive development and pushed the price of Bitcoin to an all-time high. The Valkyrie Bitcoin Strategy ETF was also in development and began trading shortly thereafter.

However, the crypto community as a whole is notsatisfied with the futures-based approach and focused on a spot bitcoin ETF that could drive further growth. Bloomberg Intelligence analysts Eric Balchunas and James Seyffart argue that Bitcoin Futures ETFs are not the best solution for retail or long-term investors looking to access Bitcoin. Without directly tracking the market price of bitcoin through a futures ETF, many agree that an ETF backed by a spot BTC will provide more benefits to the average investor.

With the US Securities and Exchange CommissionPending Grayscale Investments' Grayscale Bitcoin Trust application, symbol: GBTC, the world's largest bitcoin fund to be converted to a spot ETF.

According to the survey, approximately three quarters (77%)investors said they would have a better chance of increasing their exposure on the crypto market if ETFs are available. The results tended to be the same among male and female investors and were strong across all generations.

Impact of Bitcoin ETFs on Bitcoin Market Participation

Among those who do not currently own Bitcoin, 77% would be more likely to take part in owning an asset if a Bitcoin ETF were offered.

Bitcoin and other cryptocurrencies

Bitcoin remains the most popular cryptocurrency, but there is significant awareness of other cryptoassets as well.

The cryptocurrency market has been flooded with new tokens,thanks in large part to the rise of Decentralized Finance (DeFi). However, Bitcoin remains the most popular: 99% of investors said they knew about the first cryptocurrency, while 68% of investors said they had enough knowledge to be familiar with it.

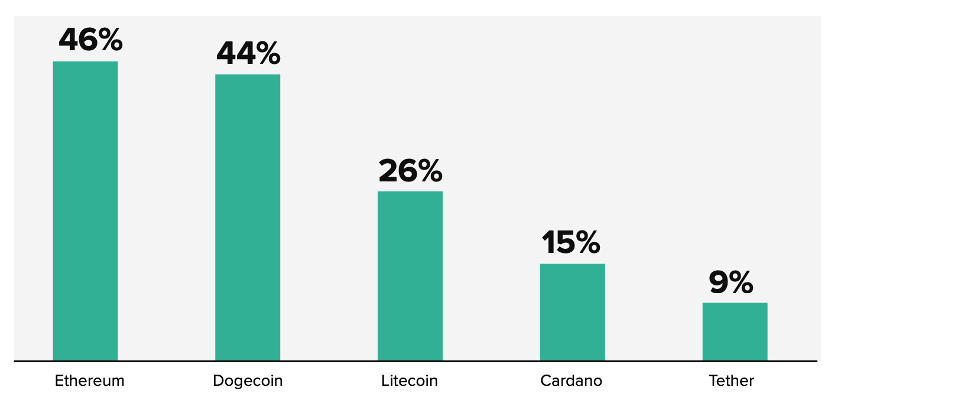

However, this does not mean that investors have not heardabout other cryptocurrencies. In fact, they are very knowledgeable about other burgeoning digital assets, including the Dogecoin, which was created as a meme, but gained notoriety.

More than half of the investors knew about DOGE and ETH.Nearly three-quarters (74%) of investors have heard of Dogecoin, which exceeds the level of awareness of Ethereum (56%).

More than a quarter of investors were knowledgeable about Litecoin, Tether and Cardano.

Litecoin, Cardano and Tether are also on the radar of investors, with the awareness level of each of the cryptocurrencies exceeding 25%.

Ownership of other cryptocurrencies among current bitcoin owners

Most of the investors who own bitcoin also own at least one other cryptocurrency.

Investing in cryptocurrency is not the samea case where there is only one winner. Most of the investors who own bitcoin (87%) also have access to one or more altcoins. The most popular altcoins include Ethereum, DeFi and NFT projects, as well as Dogecoin.

Investor motivation and desires

Bitcoin's track record remains the most motivating factor

When it comes to investor interest inbitcoin, investors are most concerned about its “performance track record,” an attitude that fits the theme of bitcoin as a long-term investment. However, slightly less attention is paid to the capital preservation function: 42% in 2021 compared to 46% in 2020 and 54% in 2019.

High demand for bitcoin education

Education also plays a key role: 42% of investors want to know more about Bitcoin.

The desire to learn more dropped slightly from 47% and49% in 2020 and 2019, respectively, reflecting the growing familiarity with Bitcoin, but it still remains the second most important desire among investors considering this asset.

With such a high demand for additionaleducation Financial service providers should pay attention to how well they are meeting investor requirements to better understand this new asset class. As the survey results show, increasing awareness and understanding of bitcoin is closely related to a greater likelihood of making an investment decision.

Factors That May Affect Interest in Bitcoin (% High Positive Impact Rating)

Over 30% of investors want Bitcoin to be offered in more financial institutions.

Understanding the risks associated with investing in bitcoin

Risk is still a weighty factor,when it comes to investing in bitcoin. More than half (58%) of surveyed investors consider risk to be a topic of interest. Older investors are particularly keen to understand the risks of bitcoin, with over two-thirds (69%) of investors aged 55 to 64 saying it is important. Conversely, young investors aged 25 to 34 named risk in less than half (46%) of the cases. Last year, 21% of investors surveyed cited risk as the top reason to avoid Bitcoin altogether as an investment. As the survey results show, increasing awareness and understanding of bitcoin is closely related to a greater likelihood of making an investment decision.

Bitcoin's expected level of risk (on a 10-point scale, where 1 is very low risk and 10 is very high risk)

More positive perception

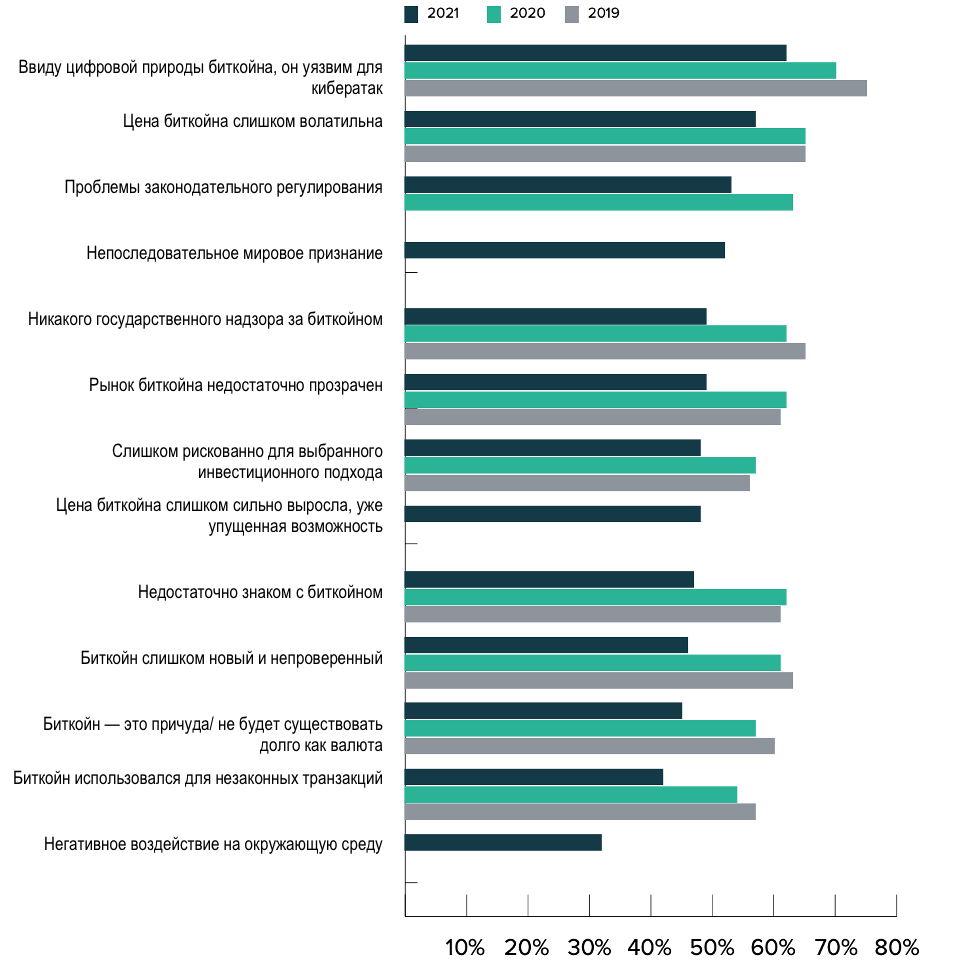

Investors are accepting bitcoin and are less worried about risks than in previous years, the main ones being cyberattacks, volatility and regulation.

Of those investors who are not interested inBitcoin, 58% cite the vulnerability of a digital asset to cyber attacks as the main reason. More than half of investors (53%) blame the volatility of bitcoin for their disinterest, while 51% say their apathy for bitcoin is caused by legislative regulation.

Concerns about investing in Bitcoin (% rating 4-5 on a 5-point scale, where 5 is “very concerned” and 1 is “not at all concerned”).

What motivates investors?

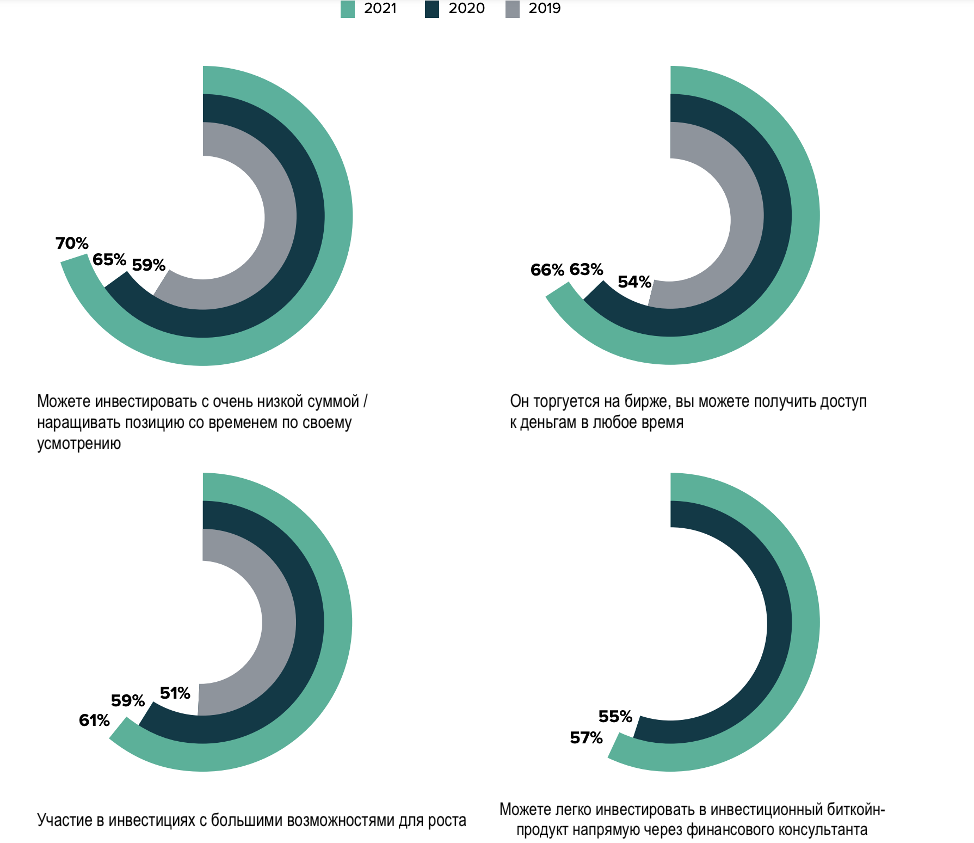

Investors are more interested than everin investing in investment bitcoin products, if they have the ability to start with a very low amount and grow the position over time. This feature motivated investors in almost three quarters (70%) of cases in 2021, up from 65% and 59% in 2020 and 2019, respectively. This makes sense as the inevitability of Bitcoin ETFs has grown over the years.

In two thirds of cases, investors are motivatedinvest in bitcoin because it is traded on exchanges and they can access liquidity at any time. This trend has also become more and more important in the last couple of years.

Motivating Bitcoin Investment Consideration Messages (% rating 4-5 on a 5-point scale, where 5 is very motivating and 1 is not motivating at all)

Conclusion

Bitcoin prices and interest have reached all-time highs as an increasing number of individuals and institutions are now working with the digital currency asset class.

2021 was a pivotal year for the adoption andBitcoin adoption. El Salvador served as a major catalyst when it became the first country in the world to accept Bitcoin as a legal tender in September 2021. Meanwhile, inflation around the world is rising with no signs of declining, putting Bitcoin in the spotlight as a way to preserve capital.

Bitcoin is on top.Billionaire investors Paul Tudor Jones, Ray Dalio and Peter Thiel have touted bitcoin as a valuable asset in the current environment of rising inflation, in some cases preferring digital gold to the precious metal.

Twelve years since its first appearancebitcoin has faced seemingly insurmountable hurdles but has managed to maintain its demand. While some top executives, such as JPMorgan CEO Jamie Dimon, remain skeptical of bitcoin and the digital currency asset class, seasoned Wall Street traders are increasingly turning to the opportunities provided by the leading digital asset.

Investors demonstrated not onlywillingness, but also the desire to make room for bitcoin in their portfolios. In addition, the adoption of Bitcoin has become a phenomenon of all generations, and baby boomers are increasingly interested in gaining access to digital investment products.

The launch of the Bitcoin ETF was an important milestone towards whichinvestors showed great interest. Applications for the spot Bitcoin ETF are still pending, including the Grayscale Bitcoin Trust (GBTC).

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>