Today one bitcoin costs about $20 thousand. Where will it be in 5 years? And is it a good idea to do it now?bet?

Last week we discussed structure,allowing to consider investment opportunities as rates. If you remember, there are six questions you need to ask to evaluate an investment opportunity:

- What is the upside potential of the deal?

- How long will it take to reach the goal?

- How likely is it that the goal will be achieved within a given time period?

- At what level of drawdown will you have to put up with losses?

- How likely is it that this level will be reached?

- How much are you willing to lose on this trade?

The idea behind these questions is quite simple.

You need to ask the first question, because if there is no growth potential, then there is no point in making a deal.

It is also important to estimate how long it may take for the bet to win back.

Are you going to invest in this deal?means that some opportunity costs must be taken into account. Even with huge growth opportunities, if it takes a very long time to bear fruit, it may not be worth it in terms of annual returns.

If there is any potential upside in a reasonable timeframe, then one needs to find out how likely it is to happen.

It's more of an art than a science.You won't get any score up to a percentage point. Is there a 50%, 75%, 90% chance that this will happen? This will matter when it comes to assessing the risk of this trade.

Since you cannot be sure that the trade will work, you need to decide when to take losses. And, of course, you need to evaluate how likely it is that you will close the trade with a loss.

Finally, you need to decide how much of the capitalbet on this deal. Here we phrase it as «how much are you willing to lose», because this is the most important question to answer when we talk about risk management.

As we saw in last week's dummy example, after you've answered these questions, you need to do some calculations to find out:

- What is the expected value of the deal?

- What is the ratio of return and risk?

- What is the expected annual return on the deal?

- What does the landscape of likely outcomes look like?

And based on these calculations, you can decide if this trade is worth risking or not.

Assessing what is reasonable potentialgrowth, over what time horizon and with what probability, is an assumption. So let's not fool ourselves by trying to create overly complex models.

Given that we are looking for deals with asymmetric returns, it is much more productive to think about it as if you were a venture capitalist.

The VC-style question to ask for Bitcoin is: What is its general target market?

I have read almost everything on the subject.Bitcoin is digital gold, so why not price it against the gold market? Bitcoin is something of a long-term store of value, so why not compare it to the housing market? Bitcoin is primordial collateral, so it should make its way into the bond market, right? And since bitcoin is the best money ever made, why not put it in parallel with US GDP?

Given an infinite amount of time, even what is least likely to happen eventually.

The problem is, we're all going to die. Therefore, we would prefer that our investments bring us some return while we are alive.

That's why I don't want to look too farforward on the scale of possibilities. What is a realistic “general target market” for bitcoin? You know that I am not indifferent to the digital gold thesis. At least for the foreseeable future, this seems to be the best use case for BTC.

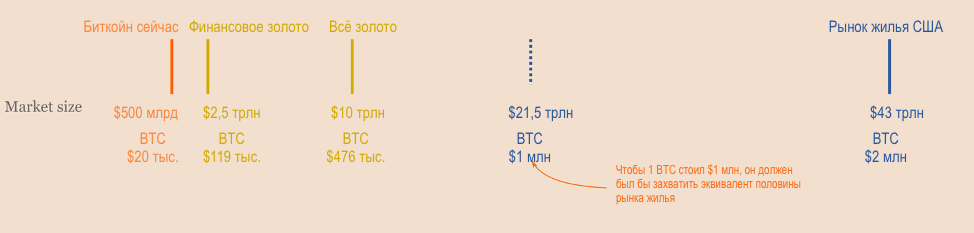

So take a look at the chart below to get some idea of the relative market sizes.

Overall target market for BTC

I'm not going to play Kathy Wood andpredict that bitcoin will hit $1 million soon. For that to happen, it would have to capture the equivalent of half the US housing market. Seems a bit ambitious when we start with a market capitalization of around $500 billion.

It would be more realistic to say that duringFor the next 5-10 years, bitcoin will continue to absorb some of the gold market share. So, based on the previous chart, a reasonable target is, say, $120k to $300k per BTC.

Okay, why not. But is it realistic to think that we will be able to reach the level of $120,000 to $300,000 within 5-10 years?

What annual return is needed to get there? Well, some quick math gives the following information:

- one BTC from $20 thousand to $120 thousand in 10 years is approximately 20% of the annual return,

- one BTC from $20,000 to $300,000 — 10 years and about 31% annual return,

- one BTC from $20 thousand to $120 thousand in 5 years - about 43% year on year,

- one BTC from $20,000 to $300,000 in 5 years – approximately 72% yield.

How much does it take for bitcoin to generate that kind of annualized return?

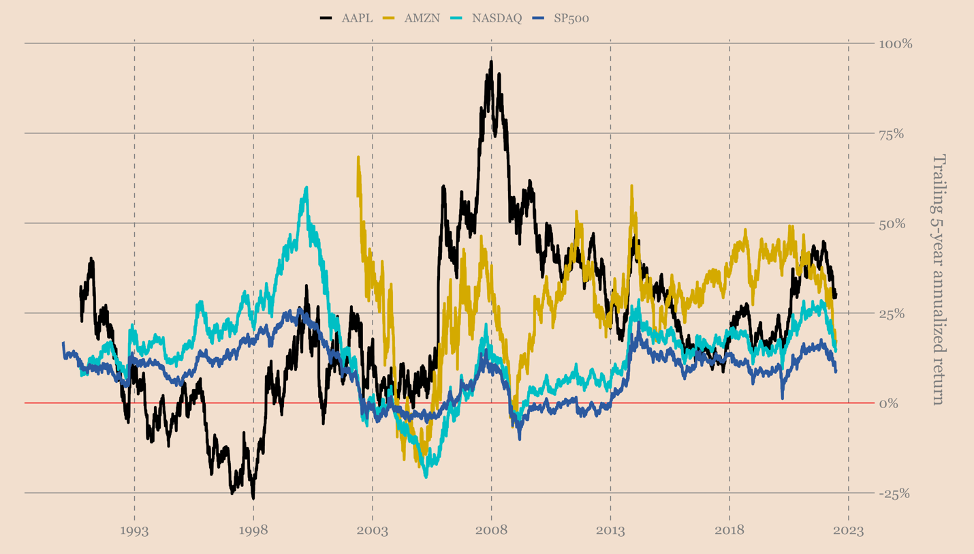

Well, let's take a look at BTC's historical yearly returns. Using a five-year interim period and excluding the initial halving cycle, we get the following chart.

Profitability for 5 years on an annualized basis

At the bare minimum, we get something like40% yield. The recent high looks more like a 170% YOY return. So asking for 20% to 170% to reach our goal sounds reasonable.

But I know some of you will ask me, what about diminishing returns?

Reasonable thought. How low do we think bitcoin's annual returns can be?

To answer this question, take a look at the chart below, which shows the dynamics of annual returns for several assets.

Profitability for 5 years on an annualized basis

If you behave like a stock index inrecent history, you can expect returns of 10% to 20% year on year. If as a mature tech giant, you can earn annualized returns of up to 50%.

Thus, you have to believe that something very bad would have to happen to bitcoin's adoption rate for its growth to drop below 20% year-on-year.

Now I'm not going to analyze all possiblegrowth scenarios. I personally think that BTC rising to $120k within 5 years is a reasonable bet. This is not a guaranteed rate, nothing is. But this is not so implausible.

Based on the drawdown patterns in previous cycles, it also seems reasonable to set a stop loss somewhere in the $10k area.

This means that our bet is structured as follows:

- BTC will grow 6 times within 5 years.

- Given the uncertainty about the recession and what the Fed will do about it, I would suggest that we have a 30% to 70% chance of hitting that target.

- We plan to exit our bet if bitcoin falls 50% below our initial level.

- How likely is Bitcoin to drop to $10,000? I would say that the probability is not more than 50%.

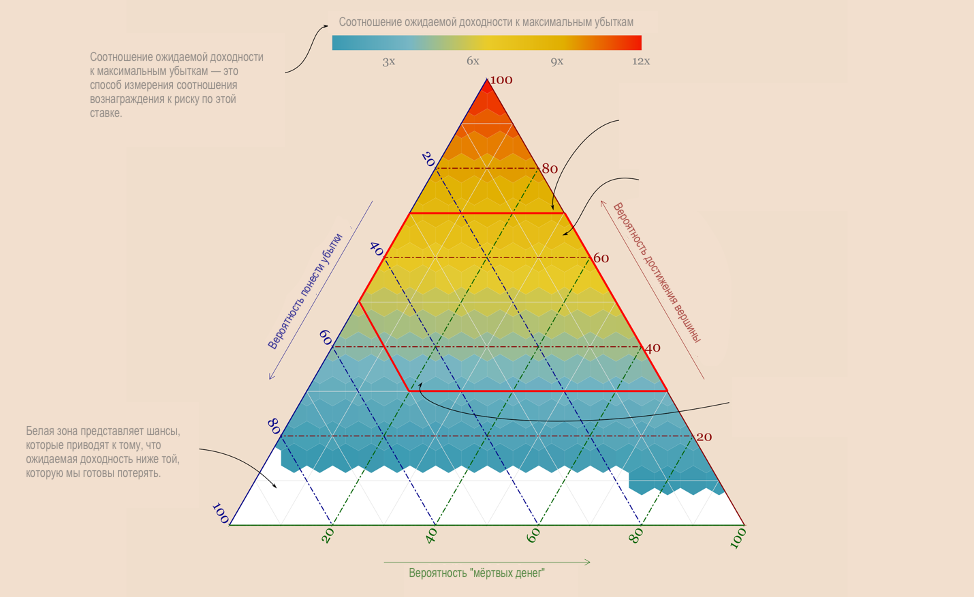

Based on this, we can summarize the range of expected outcomes for this bet with the help of the following chart.

A reasonably optimistic bet

Given the implied odds, the expected outcome should be somewhere in the red.

The question we are asking is this: if we are confident in this range of odds, should we take a bet or not?

We will make a decision based on the ratioexpected profit to the maximum loss that they are willing to incur. In the red zone, the worst-case scenario is a 4 to 1 reward to risk ratio. At best, a reward to risk ratio of 8 to 1.

I believe this is a pretty good range. So I would take this deal.

But considering a single transaction makes making a decision based on these possibilities a bit subjective. What if we compare the risk/reward ratio with other trades?

Let's try to do that next week.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.