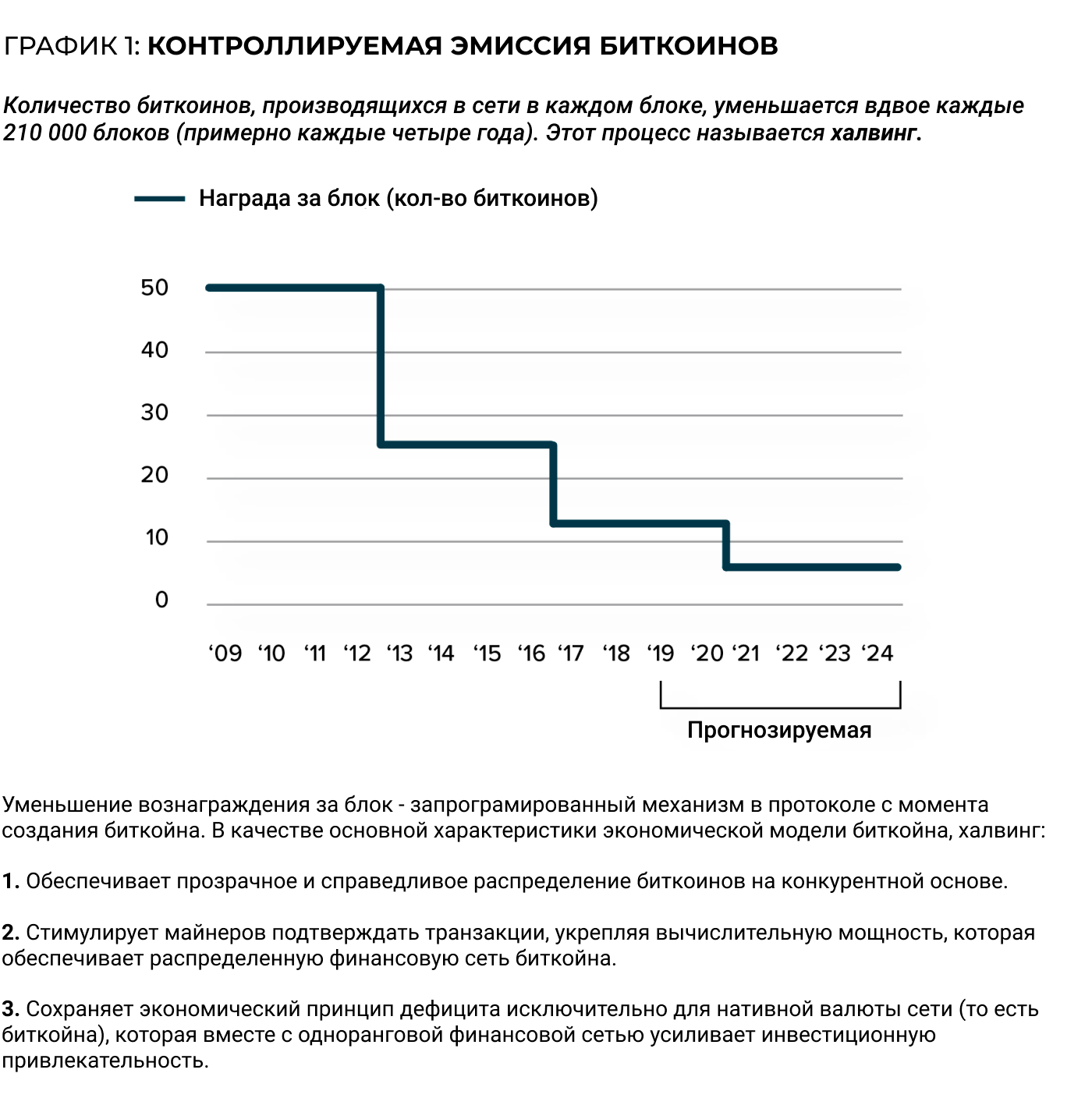

Features of the issue of cryptocurrency No. 1 make it competitive compared to conventional currencies. HalvingBitcoin halves the reward of BTC miners per block.

Next Expected Reduction Dateremuneration for each block created in the bitcoin network - May 24, 2020. Starting this day, 6.25 will be provided for each block instead of the current 12.5 bitcoins.

Such an event occurs on the Bitcoin network every four years. As of March 15, 2019, 17.6 million bitcoins were mined, which is approximately 84% of the total cryptocurrency.

How does this affect the price of cryptocurrency?

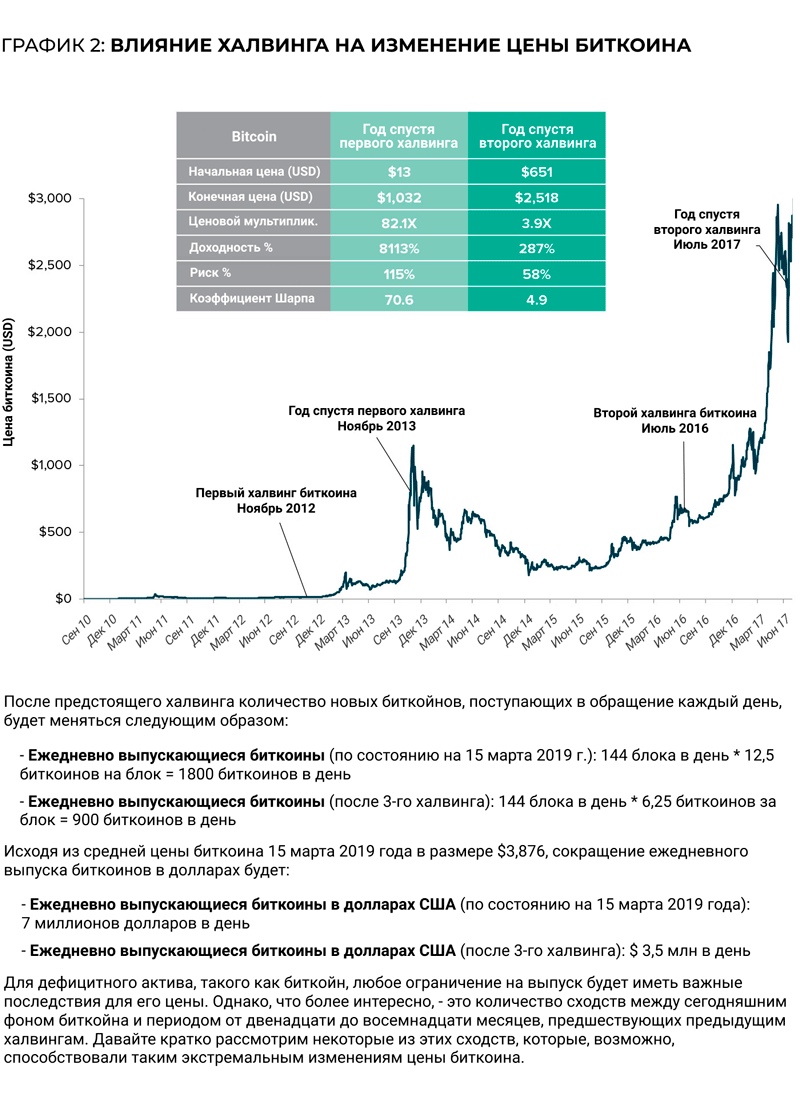

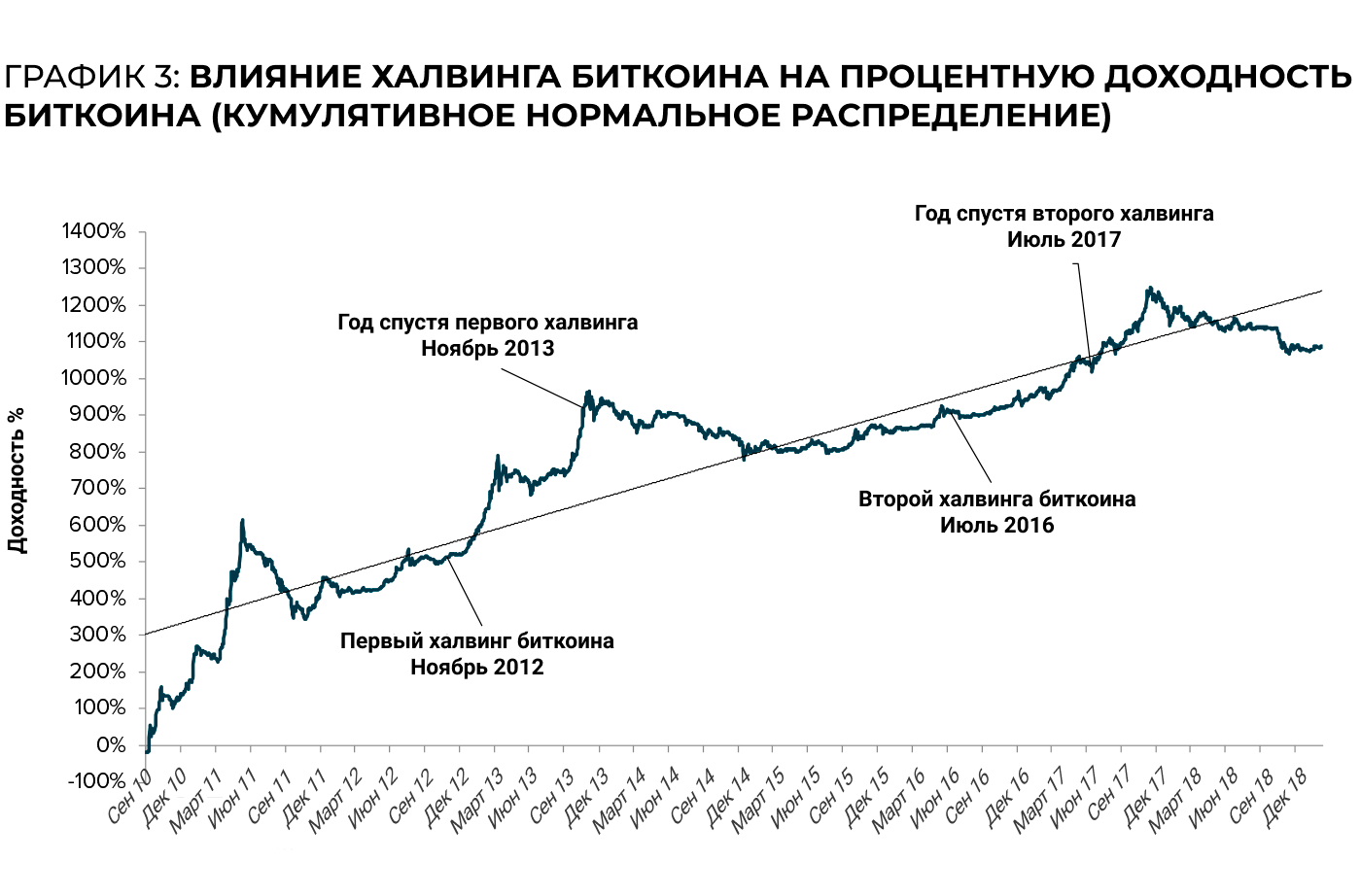

As noted by the analyst known on Twitter asnicknamed Rhythm Trader, before the first halving, which occurred in November 2012, the price of Bitcoin was $2.55. And a year after this event, it rose to $1,037.

Curiously, after that, the cryptocurrency fell in pricealmost four times, up to $ 268. However, the second halving, which happened in July 2016, allowed not only to return to 1037 dollars, but to overcome this level 2.5 times: bitcoin eventually went up to 2525 dollars - in July 2017.

The analyst concludes:Buying Bitcoin now that it is down about 80% from its all-time high is an option that investors should seriously consider. Indeed, if you pay attention to the current price of Bitcoin, which is about 4 thousand dollars, there is an opinion that in the event of a further fall, we will never see a price lower than 3 thousand dollars per Bitcoin.

Be that as it may, the offer of bitcoins on the marketwill fall. Now, miners extract 1,800 of these crypto assets daily when 144 blocks are registered, and after the next halving, it will be only 900 BTC per day.

Rhythm Trader concludes that "the inflation ratefor cryptocurrency will be reduced to 1.8%.” The analyst points out that this is less than the “ceiling” of price growth that is set by the US Federal Reserve and the European Central Bank (ECB). Meanwhile, some commentators have drawn attention to the fact that 1.8% is the growth rate of the Bitcoin supply, similar to the change in the money supply.

However, an increase in the money supply is not alwayscorrelates with how prices for goods and services change: the latter depends on the rate of saving in society, the speed of money circulation in the economy, the level of competition, and also on a number of other factors.

Meanwhile, the main conclusion is correct:The supply of bitcoins on the market is ultimately limited. In addition, there remains the opportunity to produce even more cryptocurrencies, as the rate at which such assets appear on the market decreases. According to this indicator, Bitcoin will overtake gold, becoming a rarer asset. After the birth of another 210 thousand bitcoins, the fourth halving will occur, which will approximately occur in 2024.

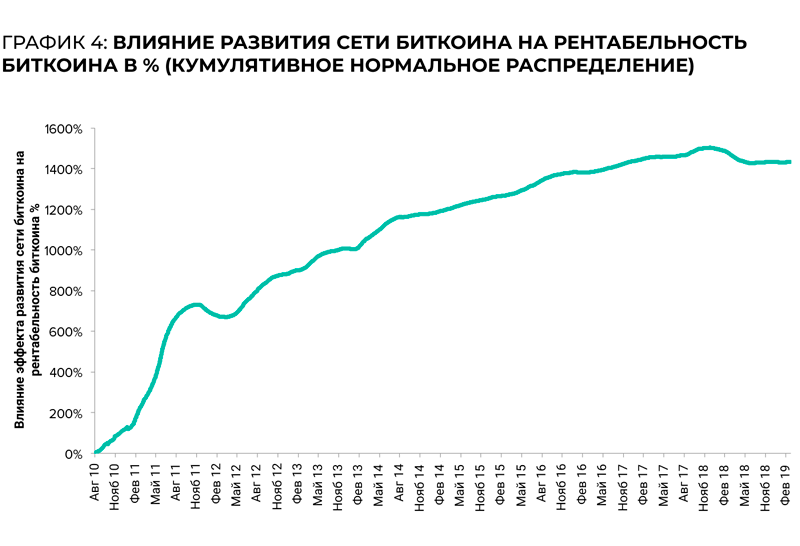

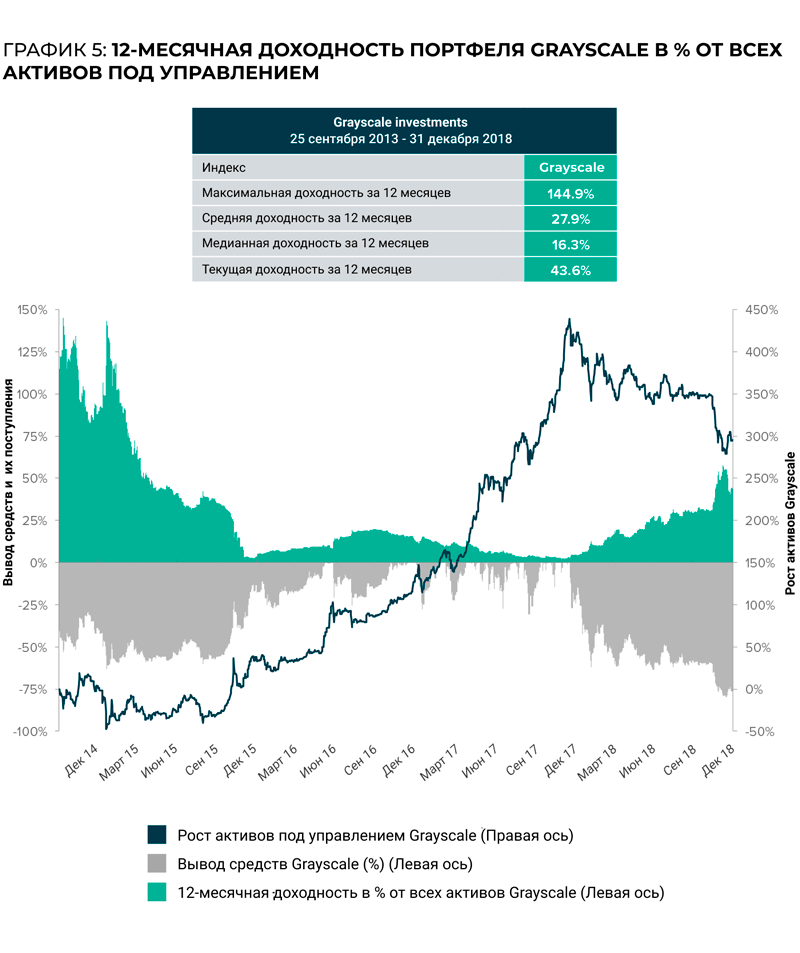

As for the behavior of the price of Bitcoin, as confirmed by the analysis of the cryptocurrency investment company Grayscale, it usually increases in price after halving. However, could a rally happen before May 2020?

The fact that activity among miners is growing isfact. And if the issue of profitability of Bitcoin mining is still relevant, then from the point of view of attracting investments in this area, some players show that they can receive “hundreds of millions of dollars” from investors to work in this direction.

China's interest here is obvious:An additional million mining machines may be put into operation in Sichuan province, and the local population has already sharply increased their purchases of bitcoins. Grayscale also notes that investments in Bitcoin-focused financial products have been increasing over the past 12 months.

Meanwhile, how will the price of bitcoin behave, andwhen it grows up - this is still an open question. The key point is the continued growth in demand for this cryptocurrency, however, the real volumes of bitcoin purchase and sale, as it is not strange, are not so easy to track.

As reported by The Wall Street Journal with referenceAccording to Bitwise research, almost 95% of all published information about Bitcoin trading is “artificially created by unregulated sites.” From this, analysts conclude that most of the turnover of this cryptocurrency is falsified, which means that, for example, the Bitcoin dominance index can be called into question.

Meanwhile, it is Bitcoin and its halving law that inspire some optimism: nevertheless, for its more than 10-year history, the blockchain of the first cryptocurrency was not subject to hackers.

</p> 5

/

5

(

25

votes

)