Fear and greed – two of the strongest human emotions. Financial markets tend to be very susceptible to theseemotions and herd behavior. Due to high volatility, the cryptocurrency market feels their impact much more than traditional ones.

Index of fear and greed(Crypto Fear & Greed Index) – Thisan index that determines the mood of market players. Scale “fear” should be considered as an opportunity to buy at the bottom, while the “greed” scale signals that the market is overbought and, therefore, an imminent correction.

To determine the current mood of the market and the formation of the scale of fear and greed, a number of key factors are used:

- The current indicator of bitcoin volatility forms about 25% of the information for the index.

- Total trading volume on the cryptocurrency market, purchase volume and sales volume – also 25%.

- Mood on social networks – 25%.To assess sentiment, an analysis of the content of Twitter posts, as well as their number and popularity, is used. For example, if many users write that the price of Bitcoin will fall soon, this demonstrates fear in the market.

- Survey results (about 3 thousand people are questioned per month) form about 15%

- Bitcoin market share – 10% of information for index formation.

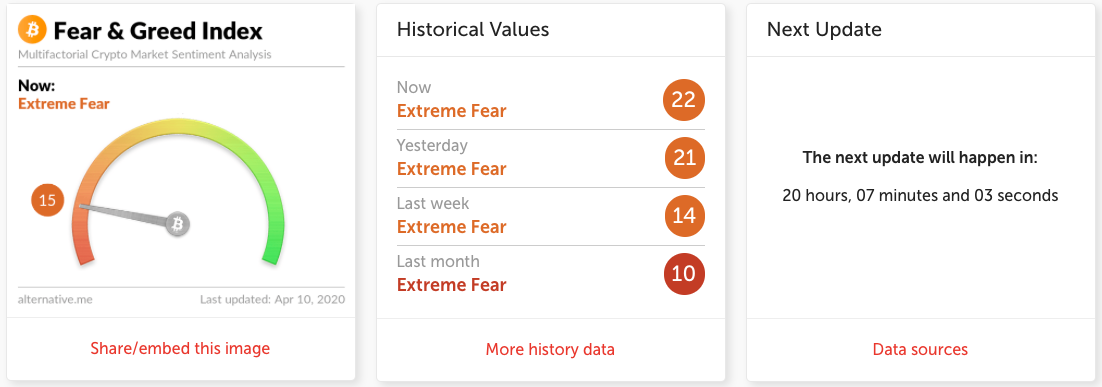

The fear and greed index shows the current mood in the value from 0 to 100 points.

- An index value of 0 to 20 points represents extreme fear. Such an assessment indicates a good buying opportunity.

- An index value of 20 to 50 points represents fear.

- The index value of 50 to 60 points reflects neutral market sentiment.

- An index value of 60 to 80 points represents greed.

- An index value of 80 to 100 points represents extreme greed, that is, market overheating. Such an assessment indicates the possibility of an early correction.

How to decipher the index of greed and fear

The fear and greed index is a fairly popular tool among traders. However, not everyone considers this index to be indicative.

If the scale shows “fear”, then the market is falling. This moment is most suitable forbuy bitcoin at a low price.

If the scale shows "greed", this should be considered a warning of an overly bullish market and an imminent price correction. This is the best time tosell bitcoin at the highest price.

Traders get very greedy when pricesrise and panic button is easily pressed when prices fall. These sentiments usually increase pressure and create excessive market movements. Since the cryptocurrency market is very prone to sentiment, this index can be a useful tool for making money on cryptocurrency.

How to track greed and fear index

You can independently monitor the mood in the market on the Alternative portal. The index is updated once a day.

Subscribe to ForkNews news in telegram – t.me/fork_news