Crypto can reward a lot, but just as quickly punish

The phrase "bank run" evokesconjures up images of the Great Depression of the 1930s.However, this phrase now applies to the world of cryptocurrencies in 2021. This is from a June 17 article on coindesk.com: “The near-total collapse in the decentralized finance (DeFi) protocol's share token price was the 'world's first large-scale exodus from a crypto bank,' the people behind Iron Finance said in a blog post. dedicated to this. As a result of this [June 16], the cost of the protocol dropped from $2 billion to almost zero." It all started when “a series of large holders attempted to buy back their IRON tokens and sell their iron titanium (TITAN), the Iron Protocol token.” In other words, a lot of people were walking towards the exit at the same time. Of course, this has a parallel with a “bank run,” when crowds of depositors want to immediately withdraw their money from the bank.

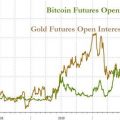

Thus, as on others, exclusivelyvolatile markets, cryptocurrencies can generate huge profits. but just as quickly - to punish. Indeed, our June Global Market Outlook showed this chart and reported:

The so-called altcoins, dash, litecoin and ethereumgrew up to 7, 10 and 12 May, respectively. Then they collapsed. Other indicators also turned on. Fund managers have never been as passionate about bitcoin as they were in the first few days of May, according to a monthly survey by Bank of America. A survey of 194 managers showed that bitcoin was the “busiest deal,” with 43% saying they were long in bitcoin.

Please be aware this timeline was published on May 28th, andyou probably know that cryptocurrency volatility has persisted since then. Now the question is: what's next for cryptocurrencies? Well, here's a comment from our June 11th Short Term Update that may surprise you: “Decentralized finance and cryptocurrencies may be the wave of the future, but the likelihood of bitcoin being the leader, or even being included, is slim. Investors began to view the current conditions as normal, but this is not at all the case. "

translation from here

A Survival Guide for a Gold Investor: 5 Principles to Help You Get Ahead of Price Turns

Crypto Trading Guide: 5 Simple Strategies To Watch Out For New Opportunity

Now the handbook for wave enthusiasts, “The Elliott Wave Principle,” can be found in free access here

And don’t forget to subscribe to my telegram channel and YouTube channel