Bitcoin has fallen by 70% from its historical high, expecting further tightening of the Fed’s monetary policy andrecessions in the United States led to the emergence of a number ofanti-records. So, the world's first exchange-traded investment fund (ETF), launched in Canada, was faced with the withdrawal of half of the investments in just a day. The fund's assets decreased from 47.8 thousand BTC to 23.3 thousand BTC.

Image Source:glassnode.com

Realized loss is the difference between the purchase price and the subsequent sale price of a coin along the chain. They also reached an all-time high of $2.4 billion per day and $7.3 billion over three days.

Image Source:glassnode.com

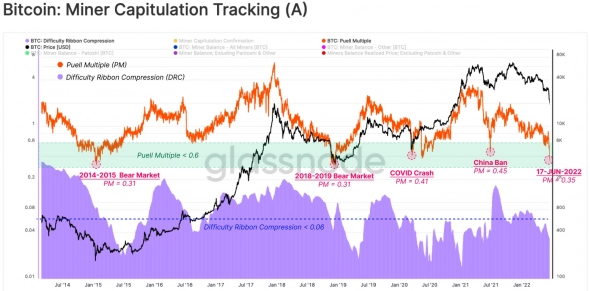

Miners have been in severe pain in recent yearsexpanding production capabilities by attracting foreign investment. Now their current combined income is 65% lower than the annual average (Puell's ratio). The situation was worse only at the end of 2018, when the fall of Bitcoin reached 85%.

Image Source:glassnode.com

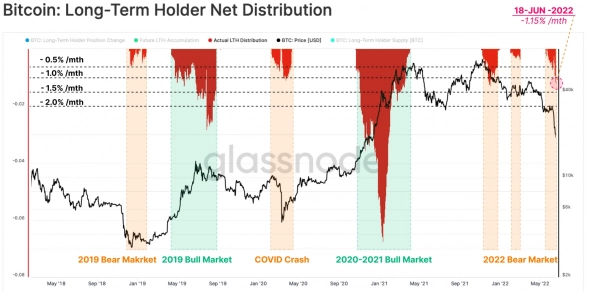

Under the pressure of negative trends, the cohortlong-term holders (LTH) has reduced its total holdings by 1.3% or 178 thousand BTC over the past week. The rate of parting with coins exceeds the rates of 2018-19, but is negligible compared to the sell-offs arranged during bull runs. Despite unrealized losses, LTH remains largely with Bitcoin.

Image Source:glassnode.com

The main panic is observed in the DeFi sector, whereunbalanced decisions of a number of projects lead to such phenomena as the complete ruin of investors, the freezing of client funds or the rewriting of a smart contract to sell off the assets of a key investor.

Due to the remortgaging of coins, the presencesynthetic cryptocurrencies (like stETH) and love for excess margin trading, the cryptocurrency market is experiencing so much volatility and outflow at the moment.

Image Source: Cryptocurrency ExchangeStormGain

On the other hand, in the absence of all theseelements, the growth of capitalization and the overall investment attractiveness would not be so significant. It remains to be hoped that in the next bull cycle, investors will be more cautious and investment products more balanced.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)