At the Democratic National Convention in August 2020, Congresswoman Alexandria Ocasio-Cortez described"A movement that recognizes the exorbitant brutality of an economy that fosters soaring inequality, where a small circle of people grows wealthy at the expense of the long-term stability of many."

</p>What the current economic system isfavored by the few at the expense of the many, has become increasingly recognized by both major American parties in recent years. While there is heated debate over the proper solution, at least almost everyone agrees that there is a problem. Fortunately or unfortunately, there is no political solution to the essentially economic problem. Unfortunately - because politicians of all ideologies will promise wealth, further dividing the people in a hopeless search for a non-existent political solution. At the same time, the absence of a political solution is fortunate, because history shows that trying to reconcile ideological opponents is a futile undertaking.

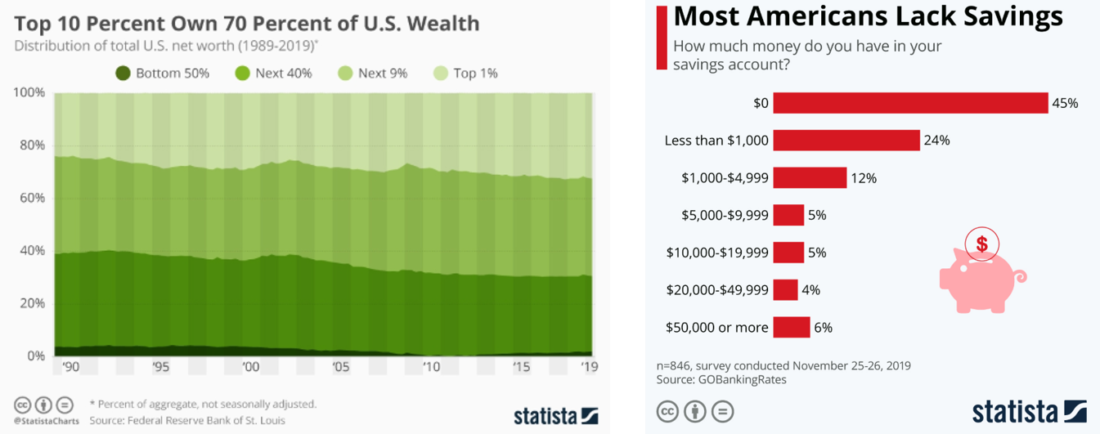

Graphs that clearly show the inequitable distribution of wealth among US residents. 45% of Americans have no financial cushion at all. : Statista

The breakdown of the economic structure is obvious.Wealth inequality is growing all the time, becoming dangerous and causing economic instability everywhere. Stock market prices and the average cost of housing in the United States are once again hitting historical records, while millions of Americans are losing their jobs and half of the public has little to no savings. Economic equations don't work. This reality is hard to deny; it affects many, and it is relevant to the whole world. Politicians simply cannot help. The fundamental problem with the current economic structure lies not in politics, but in the currencies that coordinate economic activity(dollar, euro, yen, peso, bolivar, etc.)... The weak point must be sought in the very foundation. No politician can solve the problems caused by structural flaws inherent in modern money. If the foundation is repaired, then solutions for higher-order problems will follow, but before that, any efforts will be in vain.

Weekly US Unemployment Claims Claims in 2020. : Fortune

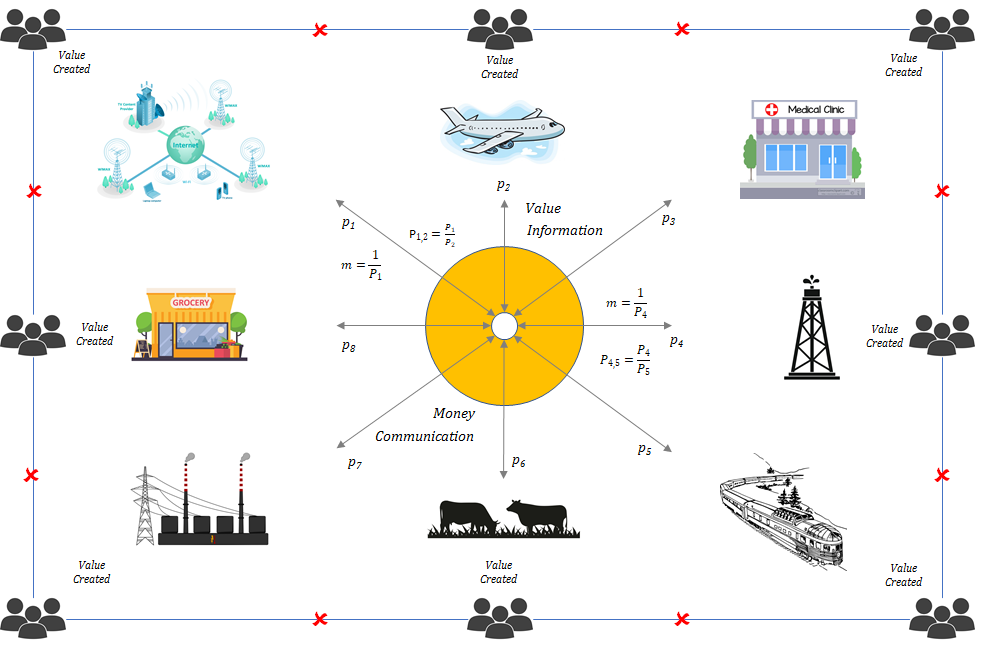

Currency is the foundation of the economy because itcoordinates all economic activities. If an economy is not functioning properly, it is more accurate to say that the underlying currency is not effectively coordinating economic activity: the currency is the input and the economy is the output. In short, the fly in the ointment here is money. While many are focused on how to solve the problem of huge wealth inequality, few see that the main source of injustice is the tool used to coordinate the entire system. It's not just that the economy isn't working for many, it's that the dollar(euro, yen, etc.)as the main mechanism coordinatingeconomic resources are untenable for everyone. Economic imbalance and rising inequality are the new normal, even if it is unnatural. In fact, this is generally economic nonsense. Balance is critical to the functioning of any economy, and in the normal course of business the economy naturally corrects imbalances. If the economy is unable to do this and allows imbalances to persist, this indicates a breakdown in the economic structure. But the enormous and growing economic imbalance that exists today was not an inevitable and inevitable consequence of free-market capitalism. This is mainly the result of central banks' monetary policies allowing economic imbalances to persist in ways that would not otherwise be possible.

Monetary policy of central banks –it is an external force that causes significant economic distortions and extreme levels of inequality. There is no injustice in the very existence of economic inequality. Unequal outcomes are in fact natural and entirely consistent with economic equilibrium. On the other hand, the inequality caused and exacerbated by an unsuitable monetary system is unnatural in a free market economy and therefore truly unfair. It has an external cause. The greatest responsibility for persistent economic imbalance lies with the structural failure of the fiat monetary system(dollar, etc.)... Huge, exorbitant wealth inequality- a consequence of this imbalance. All other distorting economic actions and measures exist at higher levels than the problems caused by money manipulation. This is where the root of all structural economic problems lies, and until that is corrected, the world will be increasingly fragile. The current monetary system centralizes and concentrates wealth, and this is a consequence of persistent and worsening economic imbalances. Such a system works in the short term for some, but fails in the long term for everyone, because the end result of monetary manipulation and ever-growing economic imbalances is instability. The ability of the currency to coordinate economic activity gradually deteriorates and eventually completely collapses. And everyone pays this inevitable price.

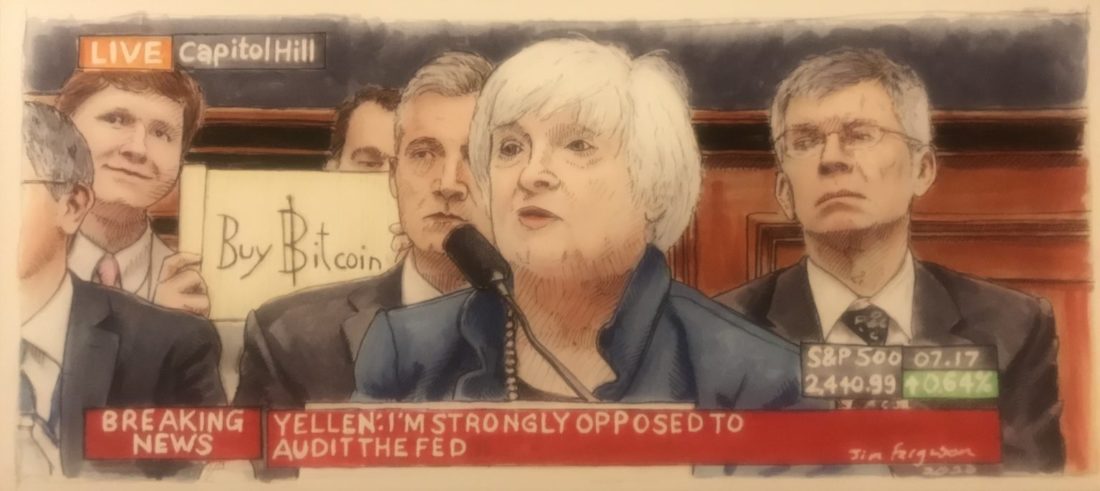

Janet Yellen is an American economist and head of the US Federal Reserve from February 3, 2014 to February 3, 2018.

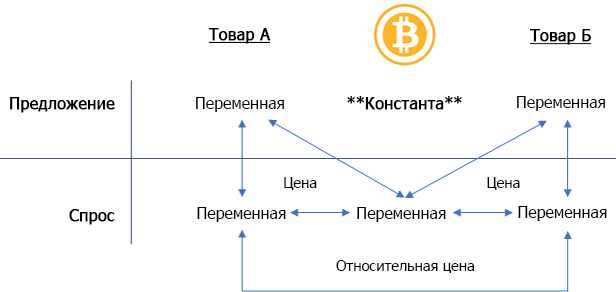

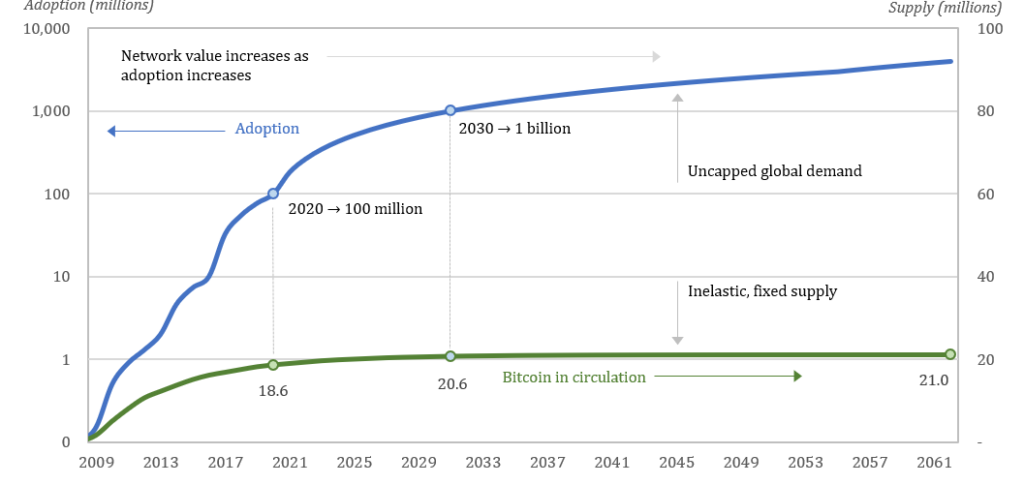

Bitcoin is the exact opposite. It is the only currency that works for everyone, now and in the future. He naturally corrects imbalances wherever they arise and as soon as they arise, because his proposal cannot be manipulated. Its supply is fixed and will never exceed 21 million coins. As adoption grows, more and more people own bitcoin, and each of them owns a smaller and smaller share of the unchanging, fixed supply. Currency ownership naturally becomes more distributed and less focused over time, which provides a basis for better balance. Bitcoin levels the playing field for everyone and ensures that the monetary system itself cannot become a source of extreme injustice. This is achieved by protecting certain inalienable rights. Each currency holder is guaranteed that no more units will be randomly created and that each unit is treated the same on the network. Bitcoin coordinates economic activity more efficiently because no outside force can distort or manipulate its price mechanism, which is a fatal flaw in the current monetary system. Fixed supply, equal protection, and true price signals provide the best balance. Bitcoin is fixing the economic foundation for everyone, so everything else will start fixing.

The role of money and the price system

For simplicity, money can be represented ascoordination function in the economy. Money acts as an intermediary in exchange. Take, hold, spend - it's simple. Money is an intermediate commodity used both to determine value and to exchange it. When the market converges on the general form of money, a price system arises that allows the subjective concept of value to be more objectively measured. Money is a pricing mechanism that results in a price system. The pricing system communicates information. It collects information about the preferences of participants in the economy and communicates them through local prices, measured in total money. Price changes reflect changes in preferences.

Prices are volatile because they are volatilepreferences. In an advanced economy, there are millions of goods, each with its own price, leading to billions of relative price signals. Relative price signals ultimately inform exchange rates between different combinations of commodities. Although the value of a particular commodity may remain static for some time, some prices in the economy are always changing, which is why the relative price signals are constantly changing. The economy is constantly seeking equilibrium through cumulative price level changes. Each participant in the economy reacts to those price signals that are most relevant to his personal preferences, which naturally change and are also dynamically influenced by changing prices. Through the pricing system, market participants learn what others value and what they themselves need to produce in order to satisfy their needs. When prices change, behavior changes and everyone adapts. The pricing system is the visible hand that allows you to achieve equilibrium and identify and correct imbalances. This is how long-term economic stability is achieved, because the price system communicates constantly changing information. It is the price fluctuation that is characteristic of undistorted markets that actively prevents the formation of large-scale and systemic imbalances.

Disadvantages of central banks

The foundation of the economy is upset becausethe money that coordinates economic activity is constantly manipulated. Most central banks, including the US Federal Reserve System (FRS), can create money arbitrarily and free of charge, and are also tasked with maintaining stable prices. This is a fatal combination for the functioning of any price mechanism, and therefore the economy. When the central bank seeks to maintain stable prices, it is effectively acting against the natural course of the economy, which seeks equilibrium and adapts to changing preferences through the price system. Even worse, the central bank achieves this stability by manipulating the money supply, which distorts the price mechanism on which the economy rests. With each attempt to achieve stable prices, the central bank actively contributes to maintaining the imbalance and communicates bad information to the participants in the economy through false price signals, which, in turn, further increases the imbalance. Imagine this happens every time the economy tries to find equilibrium. While the imbalance persists, those who benefit from it constantly cash in on others.

Even worse, it actively discourages those whois at the lower end of the economic spectrum, making more contributions and receiving a larger share of economic resources. Artificially inflated asset prices create an uneven playing field for those who do not own assets, and false signals contribute to poor economic decisions, disproportionately harming those at the bottom of the economic spectrum and least of all can afford mistakes and disruptions. False and distorted economic signals caused by the manipulation of the money supply are counterproductive for everyone in the long term, but beneficial in the short term to those who benefit from the imbalance.

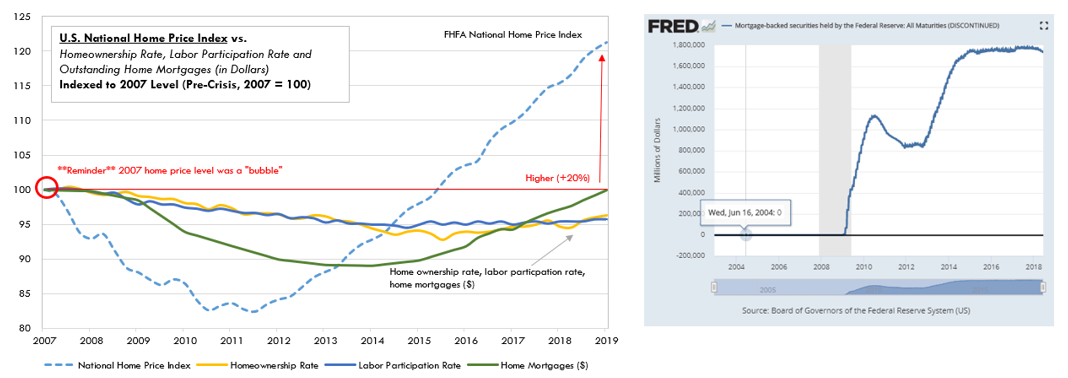

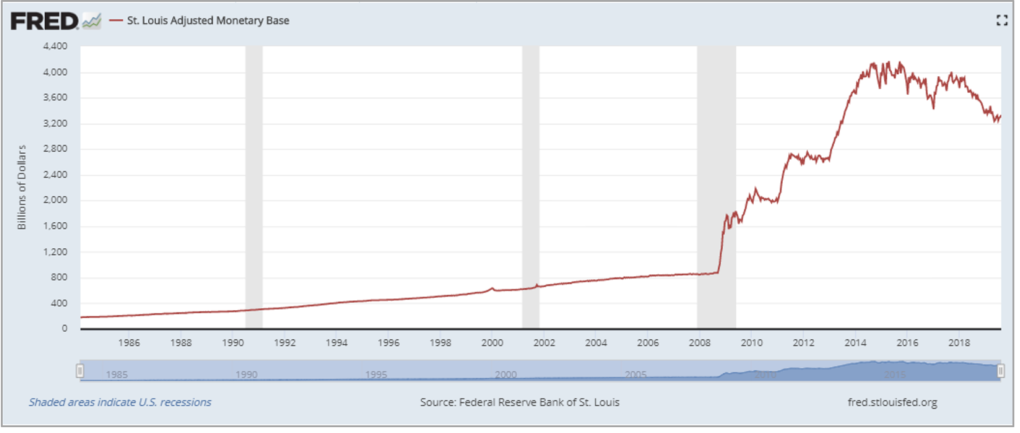

For example, when during the 2008 financial crisisThe value of real estate was falling, the price mechanism of the economy reported an imbalance. Collectively, market participants reported an increase in demand for money and a decline in demand for real estate. At that particular moment, the actual amount of money and the available supply of real estate did not change quickly. Economic preferences and relative price signals were changing. But instead of allowing the economy to balance and correct the imbalance, the Fed increased the supply of dollars in an attempt to "stabilize" the dollar value of real estate. In fact, it created $ 1.7 trillion and used that new dollars to buy mortgage-backed securities to directly support property values. Those who owned real estate (such as residential) or were in the business of building (or financing) real estate have disproportionately benefited at the expense of others. Because of this, the existing imbalance has only increased, as it always happens when it is artificially maintained.

Following the 2008 housing crisis, the Fed continuedrepurchase approximately $ 1.8 trillion of loan-backed securities, which led to a sharp increase in house prices, despite the fact that the share of ownership and labor force participation remained below 2007 levels What could have gone wrong? : Fed Board of Governors

The Fed not only manipulated the pricereal estate, but distorted all price signals in the economy, significantly increasing the money supply. For the market to correct the imbalance, prices would have to change. The Fed chose the opposite solution. She devalued money(increasing their offer), so the property value(and other goods)has changed only minimally.Instead of eliminating the imbalance, the Fed's actions allowed it to persist and even increase. If one truly understands the fundamental role that money and the price mechanism play in coordinating economic activity, it becomes clear as day that every time the Fed intervenes to stabilize prices, imbalances are precisely what persist. Stability achieved through manipulation simply suppresses volatility. An unnatural rigidity in prices arises, while price fluctuations are a desired state and a natural consequence of the market communicating changing preferences. When an imbalance that could have been corrected is artificially allowed to persist for a long time, it creates greater volatility in the long term and critically impairs the ability of money to coordinate economic activity, which is its main function. Every time the market is not allowed to correct the imbalance, it only further benefits some at the expense of others.

Instead of a billion set pricespeople who actually make up the economy, a few people unilaterally change the whole game by pressing only a few buttons on the computer screen. This distorts the entire value chain in the pricing mechanism.

Photo: Fed Chairman Jerome Powell (left) and Bank of England Governor Mark Carney at the Jackson Hole Economic Symposium in 2019. : DAVID PAUL MORRIS / BLOOMBERG NEWS

By manipulating price levels, the Fed does not just preventoccasionally occur small natural fires, which leads to large-scale problems in the future. The Fed sets the fire on its own, quietly escapes at night through an emergency exit, and then returns through the front door to put out the fire with gasoline, while she is hailed as a hero. Price changes, even if they are particularly volatile, are not a fire to be put out. Artificially preventing price changes, or maintaining price stability, is the real cause of the fire. The Fed takes over the entire value chain of the pricing mechanism. Price changes are actually desirable, but the central bank counteracts this by manipulating the money supply. The formation of an imbalance in the economy is natural, but the creation of a centralized mechanism that prevents its elimination is unnatural and dangerous. It also creates long-term economic instability, distorting price signals and increasing wealth inequality for decades, constantly playing into the hands of those on the right side of the imbalance. So long-term instability and persistent economic imbalances are predictable consequences of central banks' drive to maintain stable prices, coupled with their ability to print money.

“In fact, in the case under discussion, those sameThe measures that prevailing "macroeconomic" theory recommended as a remedy for unemployment - namely, increasing aggregate demand - have become the cause of a systemic misallocation of resources that makes future mass unemployment inevitable. The constant injection of additional amounts of money into different points of the economy, where it creates a temporary demand that will inevitably disappear when the growth of the quantity of money stops or slows down, together with the expectation of an indefinite rise in prices, attracts labor and other resources that can only last as long as the growth the amount of money continues at the same pace - or even accelerates at a certain pace. Such a policy creates not so much a level of employment that could not be achieved by other means, but rather a distribution of employment that cannot be maintained indefinitely and which, after a while, can only be maintained at a rate of inflation that will quickly lead to the disruption of all economic activity. A flawed theoretical view has led us to the dangerous position of being unable to prevent the return of significant unemployment; not because—as this view is sometimes misrepresented—this unemployment is deliberately created to combat inflation, but because it is a foregone conclusion as the sad but inevitable consequence of the misguided policies of the past, as soon as inflation stops accelerating,” - Friedrich Hayek “The Illusion of Knowledge »

</p>

Most mainstream economics professorswould readily agree that price fixing or quotas on certain economic goods naturally cause economic inefficiency and imbalances. However, those same pundits vehemently defend central bank monetary policy without realizing the fundamental inconsistency. Economic manipulation is economic manipulation. The immobility of the price or quantity of an economic good, caused by external forces, leads to imbalance, while volatility contributes to equilibrium. This is very logical and consistent. Why is this not understood when applied to money? When central banks manipulate interest rates by manipulating the money supply, an imbalance occurs, just like when the Venezuelan government arbitrarily sets the price per gallon of gasoline below market value. Ironically, the manipulation of the money supply is economically more destructive because it distorts all prices in the economy and the relative price signals are not adjusted commensurately. When the Fed is chasing stable prices, it actively sends false price signals to the economy, maintaining imbalances in supply and demand patterns. Price stability means price manipulation, so it is quite predictable that when the price of money is manipulated in order to achieve stability according to one definition or another, it causes far worse economic distortions than manipulation of any single market.

"We must view the price system asa mechanism for transmitting information if we want to understand its real function - a function that, of course, it does not perform so perfectly when prices rise inelastically. (However, even when quoted prices become sufficiently inelastic, the forces operating through changes in prices continue to operate to a large extent through changes in other terms of the contract). What's most remarkable about this system is how it exploits the knowledge economy, or how little individual participants need to know to take the right actions. Only the most essential information is transmitted in an abbreviated form, through a kind of symbol, and only to those whom it affects. And it is not just a metaphor to describe the price system as a mechanism for registering changes, or a telecommunications system that allows individual producers to monitor the movements of just a few indicators, just as an engineer monitors the hands of several dials in order to adapt his activities to the changes about which they are aware. , probably know no more than what is reflected in price changes,” - Friedrich Hayek, “The Use of Knowledge in Society.”

Consequences of maintaining an imbalance

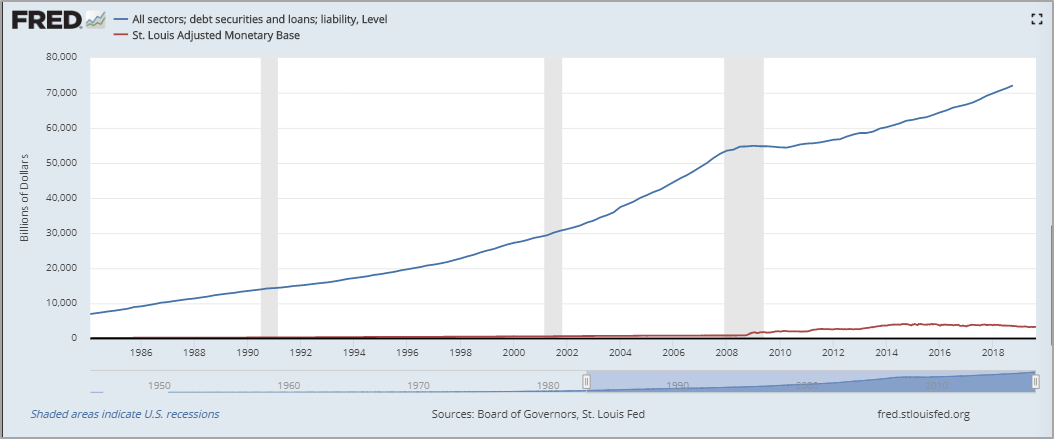

The consequences of maintaining an imbalance are bestare observed in the credit system, because it is in it that the Fed directly intervenes and, therefore, here the distortions and imbalances are greatest. When the economy slows and price levels begin to move contrary to the Fed's preferred rate, the central bank increases the supply of dollars in the financial system by purchasing debt instruments(typically US Treasury bonds)and crediting newly created dollars to accountssellers. Initially, the credit system was only a tool of monetary policy, a mechanism through which the Fed pursued price stability. Increase the supply of dollars by purchasing credit instruments, reduce interest rates through the same mechanism, stimulate economic expansion through cheap credit - and stabilize general price levels. That was the theory and that was the intention. However, this pattern predictably led to the emergence and persistence of an imbalance in the credit system itself. And now the tail is wagging the dog. Today, the entire American credit system is valued at $77.9 trillion, while only $4.5 trillion actually exists in the banking system.For every dollar there is approximately $ 17 of debt.Again, such an imbalance can occurpreserved only thanks to the actions of the Federal Reserve. Every time the credit system tries to contract, the Fed creates more dollars to maintain the size of the credit system and help it continue to grow. Because the credit system is now several orders of magnitude larger than the monetary base, economic activity today is largely coordinated by the distribution and expansion of credit rather than by the monetary base itself. As a consequence, the credit system has an implicit effect on prices given its size relative to the monetary base. Because of its desire to maintain stable prices, the Fed also seeks to maintain the size of the credit system, and to do this it needs to manipulate asset prices. It became a vicious circle. The Fed used the credit system as a tool to stabilize prices, but now it needs to maintain the size of the credit system to keep prices stable.

The US national debt has grown from $ 1.7 trillion in 1971 to $ 78 trillion in 2020. This would not have happened if it had not been for the Fed's manipulation of the money supply. : Fred

This vicious circle was only possible thanks tounilateral control of the Fed over the money supply. In 1971, US President Nixon formally put an end to the convertibility of dollars into gold, and then in 1976 the US government finally decoupled the value of the dollar from gold. While the start was the creation of the Fed in 1913, and the Roosevelt presidential decree banning private ownership of gold in 1933 set the stage, it was the complete withdrawal from gold as an anchor of money in the 1970s that removed obstacles to true centralization of the money supply and made possible a strong monetary inflation. When the last obstacles were removed, the Fed was able to actively manage the economy through the money supply, which is actually carried out through the credit system. The direct consequence was an expansion of the money supply and the credit system that would not have been possible otherwise, which made possible a permanent increase in imbalances and created long-term economic distortions.

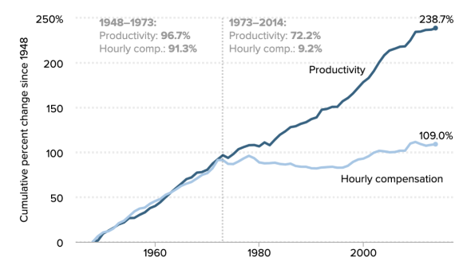

The gap between the productivity and pay of the average U.S. worker from 1948 to 2014

When there is an imbalance in the credit system(i.e. too much debt)The Fed is providing more dollars tomake existing debt levels manageable. Rather than writing off bad loans and reducing existing debt levels, the imbalance is being actively maintained. This is the real reason why the banking sector and the credit system got so big. This would not have been possible had the Fed not been printing money to artificially maintain unbearable debt levels in the interests of "price stability." In essence, every time the banking sector should contract, the Fed takes active steps to prevent it. Reminds of madness, but this became possible because the credit system is the main vehicle for the central bank's monetary policy. The Fed needs to support the credit system, because through it it tries to "manage" the economy. The Fed considers asset price manipulation to support debt levels less destructive than debt restructuring and debt relief. According to the FRS, it is practically the same thing, only with less destabilization. In reality, one is economic manipulation of the worst kind, and the other is a natural and organic restoration of economic equilibrium. The Fed chooses the first option - short-term stability leading to long-term instability and distortion.

While it should be obvious that price manipulationassets are beneficial to those who have these assets (the rich), and is a regressive tax for those who have no assets (the poor), the Fed still strives for price stability. For those at the lower end of the economic spectrum, cash naturally represents most, if not all, of their savings. On the other hand, those at the high end of the economic spectrum usually have both cash and interests in businesses, real estate, and financial assets such as stocks and bonds. Again, take the 2008 financial crisis. There was an imbalance in both the real estate and financial markets. Prices in these markets have reached unhealthy levels. When prices began to adjust to correct the imbalance, the Fed intervened to “stabilize” asset prices. Imagine that you just joined the economy, no savings, or you couldn't afford to buy a home and most likely didn't own stocks or bonds. Everyone who owned the assets was saved at the expense of others, all for the sake of price stability.

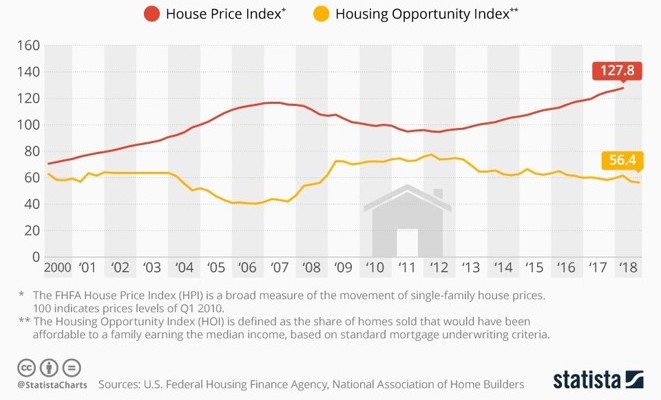

When the supply of dollars increases tosupport asset prices, each dollar naturally begins to be worth less. The dollar wages of those at the bottom of the economic spectrum depreciate while asset prices rise due to manipulation. Price inflation for most consumer goods follows. It's like being hit from both sides. Every day you can buy less and less for your salary, and it becomes noticeably more difficult to accumulate savings to purchase assets. Initially, the consequences are balanced: those at the top benefit, and those at the bottom suffer. But in the end, everyone loses because the result will be economic instability. Consider that the more expensive housing is, the less affordable it is, and then realize that the Fed is actively manipulating housing prices. Also realize that US home prices are currently at an all-time high.(above the 2007 bubble levels)while half of the country has no savings. This is possible only where there is manipulation, and it hits those who have no savings.

Housing affordability chart in the United States since Q1 2000. Rising housing prices have consistently reduced affordability. : Statista

The economists who are in charge of all of this, and those who benefit the most from it, will say every time that it is necessary; history is written by the winners, but all this is throwing dust in the eyes.

“Of course it was a crazy experiment, but the Fedthere was no other choice. Imagine how many people on the lower end of the spectrum would be out of work if it weren't for the Fed's actions. Without work, the poor would be much worse off, and they would not be able to afford housing. "

At least that's the common, predictable excuse. Of course, the Fed's recent actions in response to the pandemic were justified in the same spirit.(printing $ 3 trillion). Despite its apparent logic, the defense of price manipulation lacks fundamental economic arguments. It turns into a vicious circle, starting with economic imbalance(generated by decades of the same distorting monetary policy)... Think of the arsonist who is hailed asthe hero fighting the fire. You cannot get out of the hole if you dig in the same direction. At a fundamental level, price manipulation makes it possible to maintain imbalances that would otherwise have been corrected. It disproportionately rewards those who have had a hand in and benefit most from the very existence of the imbalance. Those who took unreasonable risks receive help instead of punishment, and the imbalance persists. Benefits from incentive manipulation are allowed to persist, which would not have been possible in the absence of policy decisions from the Fed.

An economic structure without manipulation

Although there is no perfect balance,the economy strives for it by trial and error, which leads to price fluctuations. Each individual responds to constantly changing price signals. People evaluate what kind of business to create, what skills to acquire and what job to look for, which depends on the personal interests and abilities of each. An imbalance can naturally occur in an economy when people speculate and invest too much in certain segments based on imperfect expectations of consumer preferences. This is trial and error. Nobody knows the future; people use price signals to make the best decisions possible. A business or individual produces a product for X and tries to sell it for Y, and if there is not enough demand for such an activity to be profitable, the market informs the manufacturer about it. Perhaps next time you will be more fortunate: create the same one cheaper or create something else that is of great value or is appreciated by a large number of people. Whoever takes a risk, and to disentangle the consequences. It all comes down to an endless game, the goal of which is to reconcile your ideas and skills with the preferences of other market participants.

“Prices and profits are all that mostmanufacturers to serve the needs of strangers. These are search tools, like a spyglass, expanding the field of vision of a soldier, hunter or sailor. ”- Friedrich Hayek

Money is a tool used tocoordinating resources and testing the market by trial and error. They are the life-giving blood of the economy, as they are the basis of the price system. With their help, information is transmitted to all participants. The better the money, the more reliable the pricing system. And the more reliable the price system, the better the equilibrium in the economy. Naturally, the participants in the economy who provide the greatest value to the largest number of people receive the most money in reward, but money would have little value for the producer if others did not produce goods that he himself values. Without equilibrium, the system would not be viable. To buy a product or service from someone, you first need to make money. Receiving money by voluntarily providing services that others value is much better for everyone than if the money were obtained in some other way. This is the only way to achieve a harmonious repeatable cycle instead of something short-lived, where some win at the expense of others. What is the use of a client who ran out of money or did not have it at all? In a balanced economy, every manufacturer is a customer, and vice versa.

“Give a man a fish and he will be full for one day. Give him a fishing rod and he will be fed all his life. "

You don't need to be religious to understand thiswisdom. When there are more people who produce goods and services, and when everyone is motivated to produce something that other participants in the economy value, everyone benefits from it. Everyone is interested in both providing something of value to others, and in the fact that others also provide him with something of value in return. But this is not just a naive or hopeful economic view of the world. There are clear advantages for trade and specialization in this and, ultimately, more choice for all, which organically dictates the division of labor. Money coordinates the division of labor, and the form of money with the most reliable price mechanism will consistently bring the most value with the most choice and balance. The least distorted pricing mechanism provides the clearest signals of what others value, and therefore the greatest assurance that the information being conveyed is true. A distortion-free cash and pricing system ensures that imbalances are corrected, allowing balance to be restored and harmonious relationships discovered through a constant process of trial and error.

An economic structure with manipulation and distortion

The Fed's monetary policy is activehinders restructuring and the economy's search for equilibrium. Trying to maintain stable prices when an imbalance exists is tantamount to maintaining false price signals. Productive assets remain in the hands of a small circle of people, and the world is constantly in a state of imbalance. The money that goes to those at the bottom of the spectrum eventually goes back to those in control of productive assets because the structural imbalance is not corrected. Fed intervention prevents the natural healing process. The economic structure is incapable of organically supporting the money turnover, because there is no balance, the skills and preferences of market participants do not coincide. When the Fed pours money into a frustrated economy, it’s like giving a man a fish and saturating him for one day, when false signals prevent him from learning to fish. The presence of an imbalance signals that the composition of the economy does not meet the needs of market participants. Or, rather, that the lion's share of the wealth would not come from the assets and individuals that are now, if the economy were allowed to restructure.

The Fed's economic structure gives rise toinjustice, preventing the restoration of balance. This is what the market tries to do every time the Fed intervenes to maintain its illusion. It is possible that the Fed believes this is helping. The Fed's economic theory is based on the fact that active money supply management is a positive driving force. It's in her DNA. The Fed believes it is not manipulating market signals, but smoothing them out. For Fed governors, the question is not whether the money supply needs to be manipulated, but to what extent and when to do it. Can we expect the Fed to be honest about its actions? It's like giving yourself a grade for an exam — objectivity is impossible here. Certain false assumptions are ingrained in the minds of Fed governors, which precludes objectivity. They look everywhere, but not in the mirror, for answers, and they apply the same policy over and over again, each time expecting a different result.

“Inequality has been growing for more than fourdecades, so it is not related to monetary policy. There are many theories about its causes. One of them says that globalization and technology require an increase in the level of skills, abilities and knowledge, which American education did not cope with during this period. ”- Jerome Powell, Federal Reserve Chairman (June 2020)

So Fed Chairman Powell recently responded tothe question of whether the Fed's policies are conducive to rising wealth inequality. Note that he did not argue why central bank policies do not create imbalances and inequalities. Rather, it is a general statement followed by a "this is not us" justification. Don't believe the myths that globalization and technology contribute to wealth inequality. There is nothing about technology, innovation and globalization that causes permanent economic imbalances or ever-increasing wealth inequality. For an innovation to be valuable, it must, by definition, solve problems for a range of people. But it won't be valuable if these people don't have the money for it. So the value in this sense has two sides. It depends on economic equilibrium. To believe in the tales that technology and globalization are causing economic imbalances, one must deliberately turn a blind eye to the impact of centralization of the money supply, which, in turn, has made central banks the epicenter and life-giving blood of the economy, and because of which the imbalance has been able to last for decades. actively persist as a consequence of political decisions. There may be many theories, but the manipulation of all price signals in the economy is the starting point of economic imbalance and injustice, a fundamental structural flaw that creates unequal conditions, exacerbating all other influencing factors.

If A, then B; if not A, then not B

: Unsplash

Money is the cornerstone of economicsystems. Understanding the fundamental and fundamental role of money in the economy establishes a logical relationship between the systemic economic problems of imbalance and artificial manipulation of the money supply. There are other factors, of course. The manipulation of economic activity is carried out not only through the money supply. Tax policy, government spending and the regulatory apparatus all contribute. But focusing on it is like trying to fix windows on the 100th floor, with the bottom 10 floors being held together by one brick. This is the relationship between the fundamental problems of the monetary system (foundation) and all other economic problems (higher levels). The main problem that Bitcoin solves relates specifically to the foundation. With a little humility, it can be admitted that there is no magic bullet that quickly resolves the structural problem of increasing wealth inequality and economic imbalance. No one will improve the situation with any plan or law. The central government cannot solve the imbalance it has created. Just the opposite. The only real hope is to fix the foundation first so that everyone can do what they want again without the need for conscious control. And then equilibrium will follow.

“But to those who shout about “conscious management” -and whoever cannot believe that anything developed without design (and even without understanding) should solve problems that we cannot solve consciously - should remember: the problem is precisely how to use resources beyond what one can control mind, and therefore how to get rid of the need for conscious control and how to provide incentives that will motivate people to do desired actions without anyone telling them what to do,” Hayek, “The Use of Knowledge in Society.”

With a fixed supply of 21 million,Guaranteed on a decentralized basis and not controlled by anyone, Bitcoin completely eliminated the possibility of manipulating the monetary function. What do you do when naughty children cannot share a toy and play together? Take away the toy and put the children in a corner. This is roughly the relationship between Bitcoin and central banks. No one person (or institution) can be trusted to control the money supply, so the only practical solution is to remove such temptation altogether. The only constant about Bitcoin is its fixed supply: there will only be 21 million coins, and no one can change that. Everything about Bitcoin may change, but its constant supply will increasingly become the benchmark against which all other activity will be measured. This guarantees a level playing field and represents a source of truth missing from the current economic structure. Since supply cannot be manipulated, price signals cannot be manipulated. Undistorted price signals convey better information. But better information and a level playing field should not be confused with price stability or the problem of volatility. If Bitcoin costs $12,000 today and $10,000 tomorrow, then this is an undistorted transfer of information.

“Variability is information.Where there is no volatility, there is no information... There is no freedom without noise—and no stability without volatility,” Nassim Taleb and Mark Blythe, Foreign Affairs, May/June 2011 issue.

Fixed supply ensures that any change in price is caused solely by changes in demand and not by artificial and unpredictable changes in the money supply(i.e. the economy learns about changed preferences). This removes a factor from the equation that is significantlyinfluencing prices today and distorting information about preferences. Imagine that you are absolutely sure that all price changes are dictated by changes in consumer preferences, and not by an increase or decrease in the money supply. It's the difference between being able to consistently rely on true economic price signals and playing "Who's out of chairs when the music stops" when you know that the "music" is playing? someone else controls. The same principle is true today and will be true in the future. Everyone can be confident that changes in the Bitcoin price system will always be true and will not be caused by unpredictable changes in supply.

This is the fundamental difference between the currentmonetary structure and Bitcoin is a game changer. False price signals versus true ones. False price signals are like taking an exam thinking you have a cheat sheet with the right answers, when in the end it turns out that you are not. Everyone thinks they are reacting to true price signals without realizing that the information transmitted would be radically different if the money were not manipulated. Every time there is a shock in the system, everyone gets a hint that the price signals conveyed bad information, but then the Fed intervenes to stabilize prices and everyone calms down and thinks again that they can rely on the same bad signals. The main reason why shocks are possible at all is that this process has occurred every time the economy has tried to find equilibrium over the past fifty years. Bad signals try to correct, but outside forces support and exacerbate them. With a fixed money supply, this injustice is permanently eliminated. It is no longer possible to maintain the imbalance. As long as Bitcoin exists, the money will not be able to spread bad price signals. There is a difference between right, wrong and true. True price signals simply ensure that the information transmitted reflects the aggregate preferences of the participants in the economy. In this sense, there is no right or wrong; the main point is that the information can reasonably be relied upon as accurate and undistorted. There is no need to believe or doubt the truth of Bitcoin's price signals, because it guarantees its fixed supply.

Also no longer need to try to playrigged game because this game is coming to an end. The days of monetary injustice will be a thing of the past as soon as Bitcoin spreads around the world. The balance of power will again shift in favor of those who actually create something of value, as determined by the true price signals reported by those who hold the currency. Putting taxes and regulation aside for a moment, if someone wants to buy bitcoins, they must provide something of value in return, and the cryptocurrency will act as a measure of that value. Of the 21 million in circulation, there are already about 18.5 million bitcoins. These 18.5 million bitcoins are owned by different people and organizations. If you want to purchase a certain amount of coins, you need to provide their holders with something of value. And even for those bitcoins that are not yet in circulation, you also need to provide something of value. This is not the case in the current monetary system. Dollars can be earned by providing other participants in the economy with something of value, but the Fed may also decide to give away more money. And this happens quite often. More than 80% of all dollars in existence today are created and distributed by the Fed after 2008 (source), without providing value to other participants in the economy. Which system seems fairer: balanced and conducive to the ordering of incentives in the economy over decades and generations?

As people become involved inBitcoin, the currency will be transferred from those who have it to those who do not. Since the total nominal amount of bitcoins is constant, everyone wins in the economic system. To join the economy, you need to provide some of the network participants with something of value. Value does not flow out of the system, and inefficiency does not penetrate it through the creation of money. Whether new participants join the network or the exchange takes place internally, value is always transferred, and even the transfer itself creates value. Remember that the value function of money is to coordinate economic activity. Money creation, on the other hand, does not add anything of value, but only distorts the ability of the money to function properly. The nominal amount of money does not matter. Their ability to accurately convey information to a wide range of economic participants is important.

Bitcoin supply / demand graph. : Medium

That is why people demand money, and sinceeventually, the rate of change in supply will be zero, each participant with the help of Bitcoin can better understand their own productivity in relation to the productivity and preferences of others, without any distortion due to the changing money supply. Each person (on average) can make better decisions by pursuing their own goals, while by definition providing something of value to others to achieve those goals. A fixed amount of currency plus more people who value it equals a larger distribution of currency. Because of the fixed supply, there may be no more than 21 million bitcoins in savings, and paradoxically, this change in the motivational structure will encourage more people to save. As there is an incentive to save (fixed supply), more people will do it. And as more people save in fixed-supply currencies, more people will keep smaller amounts and this will create more stability. While centralized control over the money supply and the ability to maintain imbalances lead to a concentration of wealth, a fixed money supply naturally promotes greater decentralization and distribution of currency, leading to greater equilibrium.

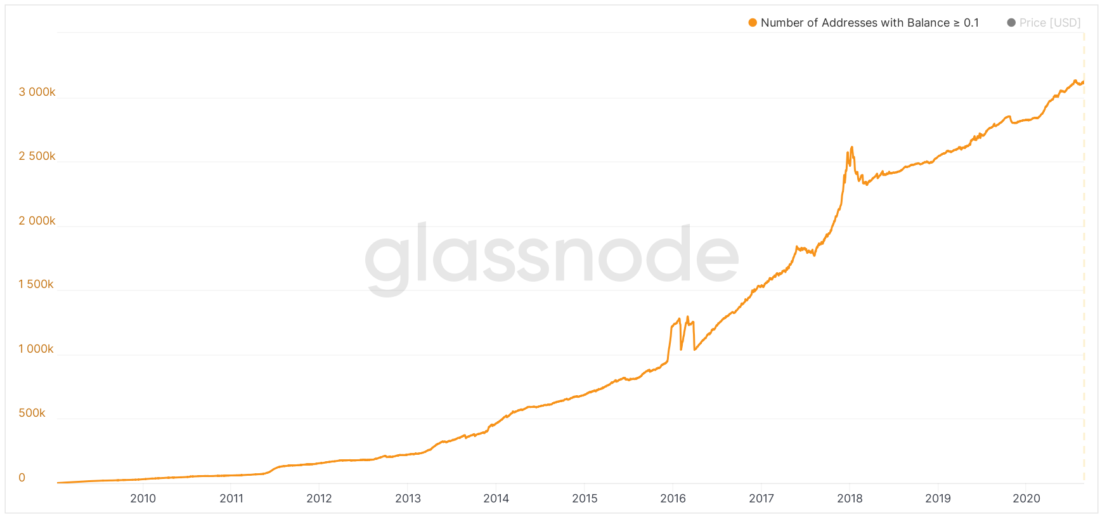

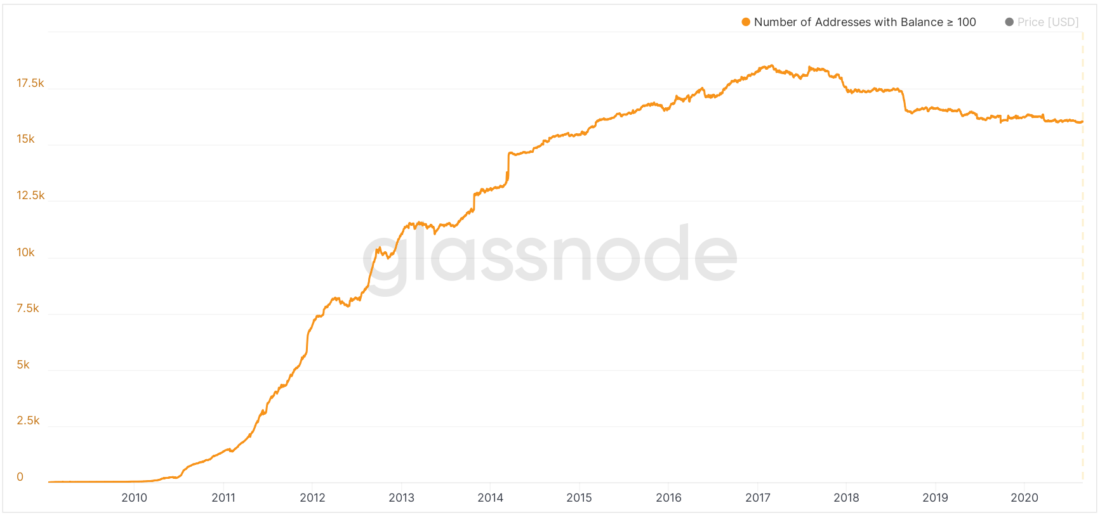

Schedule of dollar supply over the past 40 years. : FRED

Centralized money supply managementallows distribution to concentrate as new units of currency are created and imbalances are maintained, while a decentralized governance model that provides a fixed supply ensures that currency distribution becomes larger over time. The very structure of the currency determines the opposite effect, which can be observed in real data. Savings in smaller amounts in bitcoins are becoming more and more, and savings in large amounts are becoming less and less. As the currency and the economic system grows, the currency becomes more distributed. Instead of being concentrated, the currency is distributed among a large number of people, and the nominal amount held by each of them decreases, and the purchasing power increases. The more people demand the currency, the higher its value. But the final offer is fixed. When the growth in demand naturally outstrips the ever-slowing increase in supply, there will be only one primary way to get hold of bitcoins: by giving existing currency holders something of value. The currency is gradually shifting from relatively few early holders to a wider user base. Everyone wins. The usefulness of the network grows as more participants voluntarily join and the distribution of currency becomes less and less focused, which provides greater equilibrium and reduces the systemic risks that arise when there are several very large holders.

The number of Bitcoin addresses that hold more than 0.1 BTC. : Glassnode

The number of Bitcoin addresses whose balance exceeds 100 BTC. : Glassnode

When cash incentives streamlineindividual and collective interests, balance and common benefit become default values. Bitcoin is available to everyone and anyone who chooses to use it gets the same protection. Anyone who creates something of value and exchanges it for bitcoins can be sure that the fruits of his activity will not be depreciated in the future just because someone in some distant country creates new monetary units. Also, everyone can be sure of undistorted price signals. In Bitcoin, rich and poor alike receive these guarantees. This does not guarantee that someone will value the currency more or less, but it removes the possibility of arbitrary depreciation of labor and productivity converted into money, which distorts economic activity and creates false price signals. If you put this opportunity next to the certainty of the worst outcome, the choice becomes obvious. Compared to the current economic structure, where the richest understand the consequences of active monetary depreciation better and are better positioned to defend against and take advantage of them, those at the lower end of the economic spectrum may benefit more from equalization. But it’s not about the rich and the poor. When money is not created arbitrarily and there is more equilibrium in the economy through the transmission of better information, everyone wins.

No it won't: (link: https://t.co/sxx8pRiW3e) https://t.co/1fmw3ohQbV…

The idea that an individual can have the immutable right to own a fixed percentage of all the world's money indefinitely, on the other hand, feels very oligarchic.

— vitalik.eth (@VitalikButerin) August 17, 2018

"The idea that anyone can have the immutable right to own a fixed share of all the money in the world indefinitely seems very oligarchic."

In this tweet from 2018 Ethereum creator Vitalik Buterin beautifully and ironically described the benefits of owning a fixed supply currency that cannot be manipulated, effectively arguing for the opposite point of view. He simultaneously presented the argument used by central bankers to justify their actions and how the holder of the fixed-supply currency would benefit. Although Buterin considers the immutable right to indefinitely own a fixed share of all the money in the world to be oligarchic, what if this right can be extended to the poorest people on the planet? What if it applied equally to everyone on Earth? And this is the advantage of Bitcoin. If you live in one of the poorest countries in the Western Hemisphere, such as Nicaragua, and decide to exchange your value for bitcoins, you will receive the immutable right to permanently own a fixed share of all the money in the world. Only you can decide when, how and to whom to transfer it in the future in exchange for something valuable. The poorest Nicaraguans suddenly find themselves in the same conditions as New York billionaires like Paul Tudor Jones. In the Bitcoin network, everyone is equal. Everyone has the same rights by default. This is not possible in the old financial system. It is much more oligarchic to arbitrarily devalue other people's savings by increasing the money supply and at the same time determining who to "reward" with new money. This is nothing compared to allowing those who earn money honestly by providing something of value to others to determine how to dispose of it in exchange for something of value that will be provided to them in the future.

The idea that Bitcoin can solve today'sthe problems of rich and poor alike baffle many. Most consider the first cryptocurrency to be a speculative asset, and many, looking at its volatility, feel that it is not suitable for those who do not have the savings that they can afford to lose. Alas, this view is completely wrong and has no economic basis. Of course, it is easy, for example, when looking at the economic disaster in Venezuela, where the vast majority of people find it difficult to meet the most basic needs, to believe that reliable access to food, water, energy and healthcare is more important than "buying" bitcoins. More difficult to ignore, however, is that the economic collapse was caused by the depreciation of the money that previously coordinated economic activity, and that the only long-term solution to restore everything is to use a form of money that better serves as a coordinating function. Reliable access to food, water, energy and healthcare is impossible without money coordinating resources. Rebuilding the economy with new money takes the first step, and if it's hard to imagine, it doesn't change the fact that it's the only way out. The first step provokes the second, the third, and so on. Whether it's Venezuela, some other country suffering from a rapidly deteriorating economy, or some poor region of the developed world, the need for assistance is urgent, but there is no quick solution. Bitcoin cannot remove a socialist dictator, eliminate kleptocracy, abolish harmful tax policies or social programs, and magically make the poor rich, or vice versa. However, it can solve the problems of those who are willing to use it, regardless of wealth or economic status.

There's no reason why the best form of money shouldperform some function for some but not for others, regardless of wealth, income level, or any other factors. The vicious circle needs to be broken, but the starting point for uplifting an individual or society is to find a way to produce more value than is consumed or demanded by others. The best way to achieve this goal is to use money to exchange value and coordinate economic activity. Bitcoin is not a tool for the rich that will become useful to the poor once enough rich people own it. This is nonsense. On the contrary, this is the best way to level the playing field, even if the path is more difficult for some than for others. The demand for money is almost universal, and over time, everyone who uses the form of money with the strongest fundamentals and the truest price signals will benefit. Then like the dollar(and other fiat currencies)benefits few in the short term and no one in the long term, Bitcoin benefits everyone, now and in the future, because it fixes the economic fundamentals for everyone.

</p>"Whether in Rome, Constantinople, Florence orVenice, history shows that a solid monetary standard is a prerequisite for human prosperity, without which society stands on the brink of barbarism and destruction,” Seyfedin Ammous “A Brief History of Money”