For four months, Bitcoin has fluctuated around $40,000, which is why market participants are increasingly givingdiametrically opposed assessments of the future trend.

Image Source: Cryptocurrency ExchangeStormGain

Arguments for growthBitcoin advocate:reduction in supply on cryptocurrency exchanges due to the outflow of coins to cold wallets; return of whales to shopping; accumulation of coins by long-term holders (LTH), despite the floating loss.

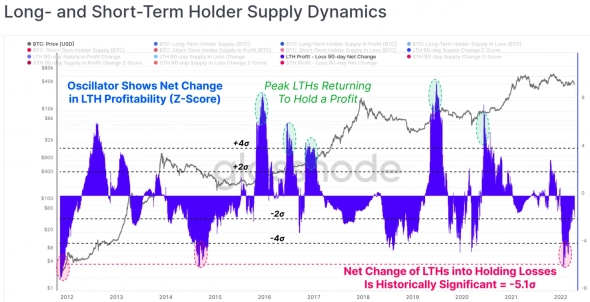

According to Glassnode, short-term holders(less than a 155-day period), most of them have already spent coins, fixing losses. Thus, this group has ceased to exert significant pressure on the price, and it has stabilized.

15% of long-term holders are also inloss, but continue to hold coins in anticipation of future growth. Moreover, the significant volume of LTH coins added between August and November now shows a loss that is usually seen at the end of a major bearish cycle.

Image Source:glassnode.com

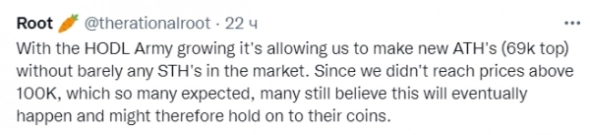

A number of analysts believe that strong hodal sentiment and the absence of speculators (STH) will allow Bitcoin not only to withstand the financial storm, but also to significantly increase in price up to $100,000.

Image Source:twitter.com /therational root

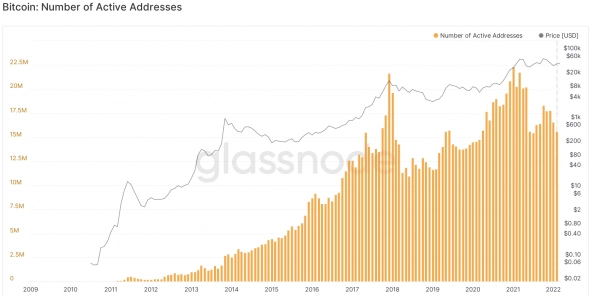

Arguments for reductionBitcoin: a drop in network activity and a decrease in interest from investors. Thus, the number of active addresses decreased to 15.6 million, which is a third less than the maximum of January 2021.

Image Source:glassnode.com

As for investors, most of themexit high-risk assets due to a new cycle of tightening monetary policy by the Fed. We previously disclosed to what extent Bitcoin depends on the interest of institutional investors.

The other day the head of the St. Louis Fed and FOMC member JamesBullard announced a possible increase in the key rate immediately by 0.75% at the May meeting (under favorable conditions, the regulator adjusts the value by 0.25%). The US dollar has already rallied to this remark against most currencies.

Output

Bitcoin is hard to grow in a contractionmarket, despite the enthusiasm of whales and long-term holders. However, he has another trump card against the dollar - resistance to inflation. Only because of the growth of the latter, the Fed is forced to hastily raise the key rate. If the cryptocurrency manages to survive the first shocks from the outflow of institutional investors without loss, Bitcoin will again be remembered as a store of value.

What do you think will happen to the price in the coming months? Let us know about it in the comments!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)