In their daily lives, people everywhere face the tyranny of time pressure. In this article weexplore how humanity interacts forconfronting this immortal tyrant with the help of one of the most ancient social technologies - money - and why Bitcoin is bound to achieve worldwide monetary dominance.

Ancient tyrant

All human activity is inevitableoccurs within a certain time frame. As a universally recognized component of the human experience, time is nature's great paradox - it heals all wounds, but ultimately destroys everything that exists. Each of us feels the impartial passage of time. In a mercilessly egalitarian manner, time passes equally for all people - rich and poor, sick and healthy, young and old. The time flows we experience cannot be reproduced again, reversed, or even stopped. On an individual level, we are short of time for the simple reason that our life span is limited. Interpersonally, time pressure refers to the total amount of time we can collectively devote to serving one another. Whether we produce goods, provide services, or acquire knowledge, we only have a limited number of hours that we can devote to our efforts. In this sense, time shortage is an immortal tyrant that enslaves all of us mortals. And only through joint activity can we free ourselves from the limitations that lack of time imposes on us.

Society is a collection of collectivelyactions taken, in other words - a social structure, which, paradoxically, is formed under the influence of competition between its components - free people. Activities aimed at improving our interaction with nature, which in turn also improves the quality of our lives by saving time, necessarily include the use of natural resources. If one is looking to dig ditches faster, they will first need to craft a shovel, a tool that requires wood from a felled tree, refined metal ore, and expertly crafted screws to hold the (mind-blowing) device together. Because the Earth we share is physically limited, and its natural resources are by definition finite, we must compete with each other to earn our fair share. In an ideal imaginary world, as abundant in resources as our imagination will allow, ultimately only the limited time available will prevent us from producing what our soul desires, in whatever quantities we desire.

Existing in the conditions of widespread tyrannylack of time, animals naturally adhere to more energy-efficient means of satisfying their needs. The first law of thermodynamics, the "Law of conservation of energy-mass", is the unshakable principle of the universe, which living organisms (lazily and reasonably) follow to the last letter. Predators in the wild often calculate the expected profit when they decide whether the estimated energy used to pursue a particular victim matches the calorie content, of course, provided that the hunt is successful (most hunts have a low chance of success). Even herbivores, such as koala bears, try to move as little as possible in order to eat as many eucalyptus leaves in one go. Of course, these decisions (most likely) are not based on any mathematical knowledge, but rather on instinct.

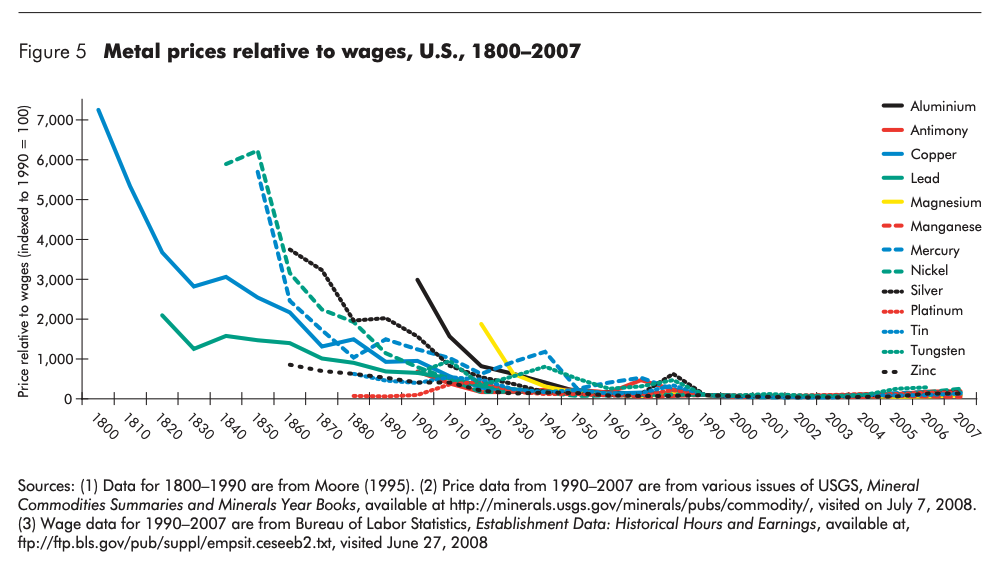

Similarly, we humans are driveninstinct of overcoming the pressure of lack of time, always found ways to discover and extract more and more natural resources when we “hunt” for the satisfaction of our needs. We literally “only barely scratched the surface”, because all our efforts did not lead us even half deep into the earth’s crust, its thinnest and most superficial layer. Over generations of trial and error, thanks to the accumulated collective experience in heuristics, written knowledge and methodologies, mankind has consistently saved its productive efforts, gradually using time more and more efficiently. The fruits of our labor are obvious: the price of all natural resources, in terms of the time required for their production, is steadily decreasing in the long run as technological advances constantly increase our productivity - the ability to achieve the greatest results with the least efforts. Metal prices over the past two centuries are confirmed by:

Metal prices relative to wages, US 1800 — 2007

Proof of the simple truth about constantlyof humanity's growing productivity is gold: since the annual influx of new supplies of this extremely rare metal remains stable, there is no point in treating other natural resources (which are less rare than gold) as scarce in any practical sense. Indeed, it is only lack of time that actually limits our creative productivity. From this perspective, time—both individually and collectively—is our most valuable and scarce resource. Each of us strives to extend our time on Earth and enjoy it to the fullest. As inhabitants of this planet, we strive to economize our actions and increase productivity to achieve the greatest possible results with the minimum use of time and effort. In fact, the goal of the global economy is to accelerate the growth of our collective productivity through innovation and trade, with the goal of eventually achieving energy efficiency - our only liberation from the constraints of time pressure.

We are connected by trade

Trading transactions (or inter-human exchange)bind us into economic networks that increase our productivity due to the inherent undoubted comparative advantages to us: the diversity of skills, experience and know-how that naturally arise among us. Trading allows us to focus on the development of our competitive advantages and become more and more qualified in our skills over time. This positive sum game is the basis of all economic activity. Working as a single ensemble, we become more productive than if we worked separately. This economic interdependence makes us collectively more productive and prosperous. Such a desire for functional interaction is usually called the "division of labor", and the main global goal of society is to create conditions conducive to its distribution.

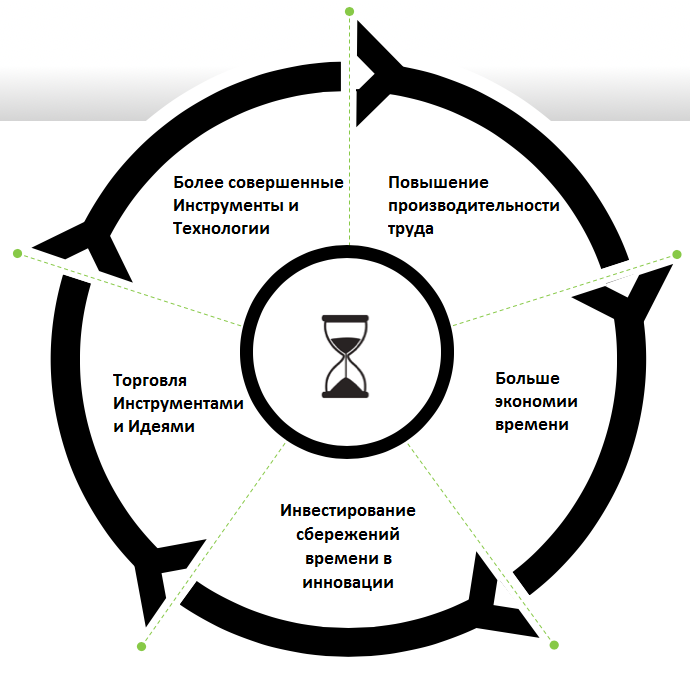

The division of labor provides each of usthe ability to focus on what we do best and increase our collective productivity: this means that it allows us to produce the same quantity in less time or more in the same time. Alternatively, we can use this newly acquired time saving to engage in innovative activities. Innovation includes the creation of tools and technologies that will help us do even more in less time (that is, dig with a shovel, not with our own hands). As new innovative tools and ideas are disseminated in society through trade, more and more time is saved, and this process becomes recursive, then transforms into a self-reinforcing “circle of virtue” that has no natural limits:

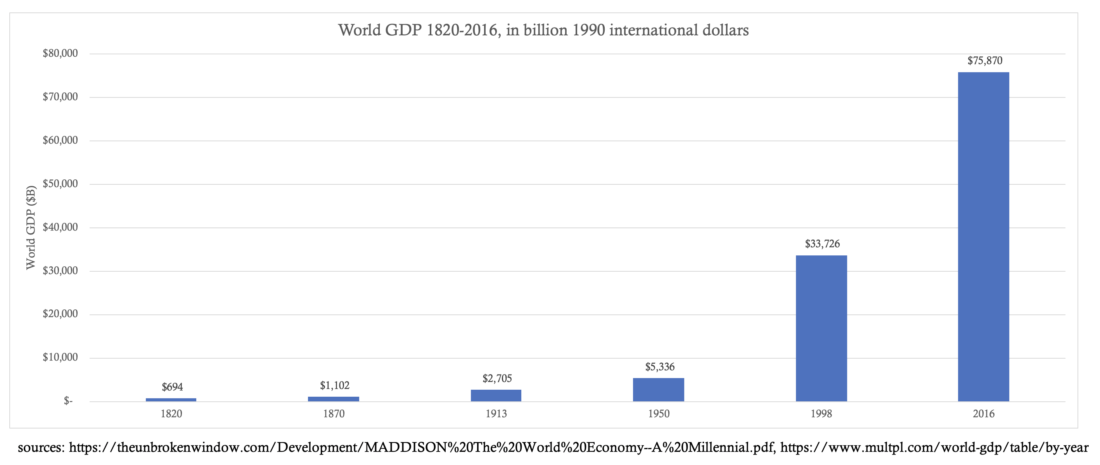

Through specialization, trade and implementationinnovation, society creates a wealth (literally) of saved time, which can be used productively or for leisure. By productively spending time savings, human communities create wealth - the accumulation of saved time in the form of capital. Anything that saves human effort—tools, knowledge, and even relationships—is considered capital because it enables us to satisfy our needs more quickly. Simply put, as we become more productive, we accumulate more capital—a form of frozen time savings. In this regard, we have come a long way over the past couple of centuries:

World GDP 1820-2016, in billions of international dollars 1990

Money — masterpiece of humanity

Money is the most popular (or easyexchangeable) capital in the economy; this is the most liquid measure of saving time - a kind of social chronometer. Money is the technology we use to measure and move the value of our time savings in time and space. The main function of money is to preserve value, which implies that they must (at least) maintain their own exchange value over time. Naturally, as our collective productivity grows, so does the value of money, and the prices expressed in them decrease. The secondary function of money is to act as an intermediary in the exchange, that is, they can be exchanged in the market for anything - for goods, services or knowledge. Money is in demand by everyone who seeks to find their way to satisfy personal needs (this includes everyone who is not fully economically independent). The tertiary function of money is a quantitative assessment of exchange relations, that is, they are used to express prices in the minds of all market participants. Think about how we think in dollars or in our local currency when deciding whether to buy or sell something in the market and at what price. Interestingly, this function of the “unit of account" of money is so deeply rooted in our mental mechanism that it actually changes our thinking and perception of the world.

In addition to these three functions, money technologies usually exhibit the following features:

- Limited: resistance to manipulation of the money supply and, thus, weakening the value of its monetary unit (difficulty in manufacturing)

- Divisibility: the convenience of accounting and conducting transactions at various scales (shared and mergeable units)

- Portability: ease of moving cost in space (high price-to-weight ratio)

- Durability: ease of movement of value over time (wear resistance)

- Recognition: ease of identification and verification of monetary value by other participants in the transaction (universally identifiable and verifiable)

Any product that is most immune tothe destructive action of time, displacement and greed, is naturally chosen as "money." Monetary technology, freely selected on the market, is called “hard money,” a haven for liquidity (time saved for exchange) that resists the devastating effects of time, the damage associated with moving in space, and the deliberate unlawful seizure of these vicious biped monkeys ( people). Due to these factors, monetary metals have historically outperformed other metals due to their durability and portability, making them ideal for storing values in time and space, respectively. With the advent of the minted coin, which standardized each monetary unit, such characteristic features of these metals as divisibility and recognition were significantly improved. Fundamentally important is the fact that the rarity of monetary metals is controlled by natural laws that are beyond human control, which makes their proposal (in most cases) resistant to manipulations driven by greed. Gold has become and remains the main global monetary metal precisely because of its exceptional relative scarcity. Historically, it has always been the best indicator of the absolute limited time resources.

Gold is the most difficult to mine monetarymetal, and almost every ounce of it ever mined, to this day remains a part of the existing gold reserve, since chemically it is a superstable element. Together, all these properties have made gold the best way to preserve value over time, since its offer is most resistant to changes and, therefore, most resistant to inflation. Providing satisfactory monetary characteristics (divisibility, portability, durability, recognition) combined with exceptional physical rarity, gold was naturally chosen as money in the free market (hard money). With (low) reproducibility and physical scarcity, most closely associated with absolute irreproducibility and lack of time, gold was the most reliable repository of values in history - this explains why freely acting people have been accumulating it for centuries. In more technical terms, the unsurpassed ratio of reserves to gold makes it more resilient to supply inflation (and, consequently, to lower monetary value) than all other monetary technologies (that existed before Bitcoin's invention).

Play time

To understand the rise of gold we mustimagine that people's actions in free markets are driven by game theory. In game theory terms, "game" — it is any situation in which people can win or lose, which is what happens in markets. "Strategy" — it's just a decision making process. Game theory applies to any field where people must decide whether to cooperate or compete. For example, if you and I are being chased by a bear, my decision to run or fight is not based on how fast I am, but rather on how fast I think you are. From a game theory perspective, all I need to do is be faster than you and not the bear to guarantee my survival. Such assessments of interpersonal dynamics are also closely related to economics and monetary evolution.

In the context of the relationship between monetary evolution andtime: free market participants prefer sound money to all other monetary technologies because its resistance to increases in supply most accurately reflects the immutability of the passage of time. No matter how long it took to produce gold, its supply resisted inflation more than any other monetary metal, causing people to join forces in using it as a highly reliable store of value. In game theory terms, gold production has become a "Nash Equilibrium", a game state in which everyone follows the same strategy because there is no advantage to be gained by switching to any other strategy. As long as people sought to maximize their freedom from time scarcity through the accumulation of capital, collectively producing more than they consumed, and achieving these goals through trade, gold remained the best intermediary of the scarcest economic resource - time.

The unity of time and money

Time is the only unchangeablean element in the reality around us. Its orientation is due to the ever-increasing entropy of the Universe - as defined by the 2nd law of thermodynamics. This "thermodynamic arrow of time", which points to an increasingly chaotic universe, is actually the only irreversible aspect of reality; any other natural process is symmetrical, which makes it impossible to recognize whether the event is moving forward or backward in time. Thus, this universally objective and unidirectional flow of time provides us with a perfect reference point for all indicators (six of the seven key metric values supported by the international system of units and measures are based on the time that light takes to get through the vacuum). In this case, gold, as the most difficult commodity to produce, regardless of how much time was allocated for its extraction, served as the best market equivalent for the objective purity of forever current time. It is usually said that time is money, but few people realize that the opposite is true - money is time.

In addition to relative irreproducibility, solidmoney exhibit other properties related to the natural course of time. Markets naturally adapt to hard money, which is as impersonal, irreversible, and unstoppable as the passage of time to which they are reliably anchored and which they are called to represent in the market. Since hard money arises naturally as a result of countless market interactions in which people seek to exchange their goods for stably more sought-after goods, they are inherently uncontrollable to any single person, nation or central bank. This makes hard money apolitical and impersonal. They cannot be used in the interests of any one group, giving it an advantage over others. In other words, hard money tends to be politically neutral, like time.

Hard money is also based on your owncapital, which means that the physical possession of gold as an asset, for example, is 100% of equity and 0% of debt (bearer asset). This makes payments in gold immune to cancellation, unlike those made with monopolistically imposed debt money called fiat currencies, which are subject to the whims of bureaucrats, at whose whim fiat currencies can be confiscated, subject to currency control or even deauthorized at any time and for any reason. Finally, hard money cannot be stopped, in the sense that if I toss you a gold coin, there is not a single authority on Earth that can block or devalue this transaction. Hard money, such as gold, is endowed with value by freely acting individuals who choose the best monetary technology available to them.

Sacred sovereignty

Bearer assets, such as gold,offer another significant advantage - each of their individual units is sovereign in itself. Sovereignty means freedom to act at one’s discretion. As Jean-Jacques Rousseau said: “Man is born free.,but everywherehein chains."The historical struggle has been the need for flexible coordination of human action on a large scale against the usurpation of individual sovereignty which is usually imposed by institutions created for this purpose. Paradoxically, as humanity mobilized on a large scale to overcome the natural tyranny of time scarcity, it created an artificial tyrant that consumes our individual sovereignty - the government and its apparatus of theft - the central bank. True sovereignty occurs at the individual level. It naturally reigns when our individual self-expression, whether verbal or financial, is not subject to the control and management of others. When a government censors your speech or a central bank devalues your dollar, it is a violation of your individual sovereignty. Don't let anyone stop you from speaking your mind or spending your time and money as you see fit. Each of us is our own supreme ruler:

The word "sovereign" comes from the Latin“from above” and “dominion, control.” Thus, “sovereign” means “one who is over the power or control of another.” Sovereign means — NOT a subject or slave. I repeat — NOT A SLAVE!

Gold is independent sovereignbearer asset, the trust in which and its value as money are determined by the combined sovereignty of numerous individuals acting in their own interests, exercising their right to free choice in the market. When a product gains value in a free market, this is the result of market participants finding it useful, making sacrifices for it, and thereby endowing it with part of their individual sovereignty. Since gold has gained dominance in the free market as a result of countless “voices” in the form of mercenary trading decisions by an impersonal mass of people throughout history, it can be considered a monetary materialization of popular sovereignty - the fundamental principle of Western civilization:

“We the people...” — opening words of the Constitution of the United States of America

Despite the fact that this is an ancient monetarytechnology, gold still forms the main monetary sovereign layer of the Earth, since it lies at the basis of all state sovereignty. Governments, in turn, use this power to monopolize the money market (through their minions from central banks) and to protect fiat currencies from direct monetary competition. Such isolation is the only way to survive debt money in parallel with hard money. Gold and other bearer assets are the ultimate debt collectors, as payments in them do not bear any associated liability. Modern central banks still carry out the final settlement exclusively in gold and actively participate in market fraud in order to suppress its price (see Gata.org) - which is additional evidence of the superiority of this ancient monetary metal.

Lair of thieves

Despite this abuse of sovereignty overgold on the part of the government for their own selfish purposes, the fiat currency is no longer tied to gold, which makes it highly reproducible at almost zero cost. Indeed, fiat currency is the mildest form of money in history; it can (and in almost all cases suffers) suffer from counterparty risks, such as censorship, deauthorization or hyperinflation. Hard money is tied to the reality of time in order to save time for its owners; fiat currency is a political tool that promotes an institutionalized system of time theft known as “expansionary monetary policy” implemented by central banks around the world.

And although today governments are usingLegislation obliges us to use fiat currencies, these rules are subject to enforcement only by coercion due to our vampirism - the pumping of sovereignty from gold reserves. Ironically, this stolen power is used to monopolize violence and suppress dissent. Thus, state sovereignty rests on the agglomerated sovereignty of the gold reserves that it owns, which, combined with the anticompetitive obstacles it erects (the law on means of payment, capital controls, capital gains taxes, etc.) the sphere of money, explains why gold was repeatedly confiscated from the population, and private ownership of gold was outlawed throughout history:

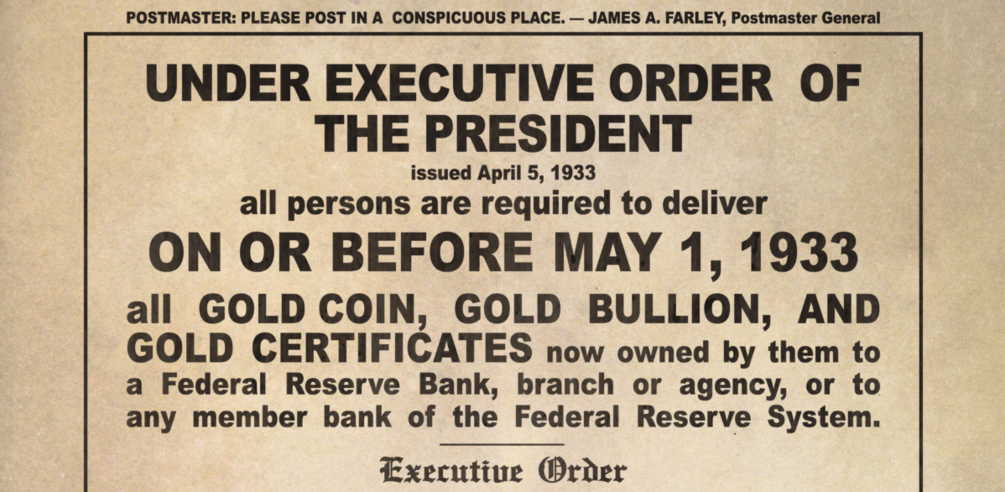

During the Great Depression on April 5, 1933US President Franklin Roosevelt issued Decree No. 6102 on the actual confiscation of gold bullion and coins from the public and organizations. All individuals and legal entities located in the United States (including foreign nationals and companies storing gold in the United States), with rare exceptions, were required to exchange gold for paper money by May 1, 1933.

There's only one reason for something like thispredatory actions: governments seeking greater power, one of the means of usurping the sovereignty of gold, the appropriation of that power, which itself originates from the actions of free people choosing monetary technology on the market — a tragedy that underlies all modern economies. As the axiom says: “he who has the gold makes the rules”:

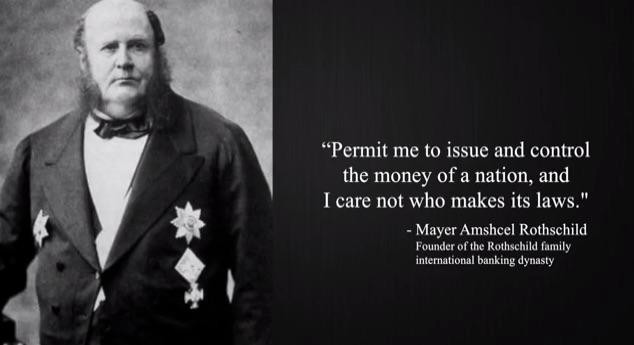

“Let me manage the country’s money, and I don’t care who makes the laws there.” — Mayer Amschel Rothschild, founder of the international banking dynasty of the Rothschilds

Main money

In this sense, gold is the main money,for the physical possession of it underlies the sovereignty of governments, which misappropriate it in order to impose on free men central bank monopolies on the production of money. Paradoxically, it was the actions of free people that gave rise to the sovereignty that governments and central banks now use against them. This «duopoly of monopolists» has repeatedly proclaimed that gold does not play any role, that it is just a simple object of value, an artifact that testifies to the culture or economy of a certain period of development, and that only it will lead the world economy to a bright future. Ignore such anti-gold propaganda, just watch their actions:

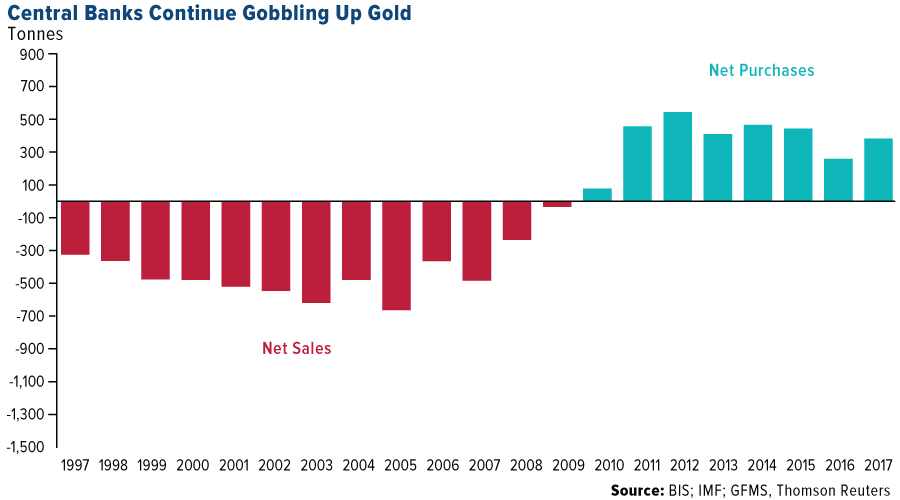

Central banks continue to grab gold. Red shows net sales, and green — net volume of purchases in tons. : BIS, IMF, GFMS, Thomson Reuters.

Although gold resisted manipulation withdeliveries in various ways, it is far from ideal. Through the London gold pool and other frauds (seriously, see Gata.org), central banks drove the gold market into a corner, which allowed them to secretly suppress its price and better isolate fiat currency (soft money) from direct competition with gold (hard money). Market manipulation like this is possible only because of our passivity. Giving our sovereignty to unaccountable institutions such as central banks, we give up conscious control over most aspects of our lives. Remember: central banks involved in “expansionary monetary policy” are actively stealing time from free people. As they increase the money supply, they redistribute claims on productive capital from the majority to the politically privileged few. This parasitism on the savings of society extends the working life of most citizens. Thus, monetary inflation is a direct violation of private property rights and individual sovereignty. It is worth repeating: human activity is the essence of sovereignty. It is our actions that instill in institutions this divine quality inherent in free people. Let us all be extremely vigilant when deciding which institutions should be empowered through our sacred sovereign energy:

“Institutional structures are legitimate to the extentbecause they expand the ability to freely explore and create based on inner need; otherwise they are not" — Noam Chomsky, On Anarchism.

Hard money renaissance

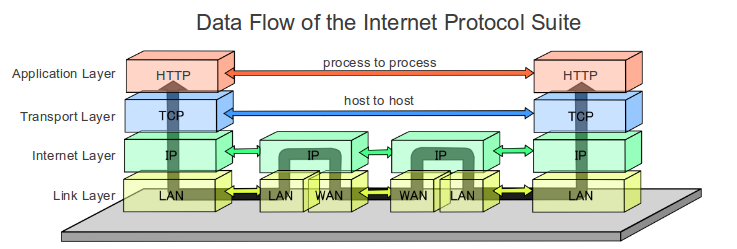

Amid this usurpation of our individualsovereignty by the government thanks to the advent of modern innovation called the Internet - a universal mechanism for the exchange of knowledge - we gain hope. The Internet has already democratized and excluded intermediaries from many aspects of our lives - from housing and transportation to the dissemination of information and commerce. In its composition, the Internet is a set of open source protocols (known as the TCP / IP protocol stack) designed to seamlessly move information around the world in an instant. Created in a free market, thanks to many years of cooperation and efforts to ensure standardization, the Internet is the greatest information network in history. Today, we all use this easily accessible library of human knowledge:

Internet Protocol Packet Data Stream

As Milton Friedman (MiltonFriedman) in 1999, about ten years before the invention of Bitcoin, the only thing the Internet lacked was a secure, confidential "electronic cash":

"The only thing missing, but soonwill appear, so it is reliable electronic money. The way in which it will be possible to transfer funds on the Internet from A to B, while A will not know B, and B will not know A. ”

Friedman's foresight turned out to be amazingaccurate. Entering the 21st century, we already had two key factors for the emergence of digital sound money: gold, the ancient and dominant layer of monetary sovereignty (representing the immutable money supply), and the Internet, the main engine of exchange (representing global interconnectedness or liquidity). By combining and developing the economic properties of both, Bitcoin is a significant monetary innovation that has succeeded in achieving divisibility, portability, durability and recognition of perfect information permeated by acute time constraints. Just as the Internet gives us the freedom to express and perceive ideas without any restrictions, Bitcoin gives us the freedom to express and receive value in the form of hard money that cannot be stopped. In this sense, Bitcoin — it is the latest evolutionary layer of the Internet protocol suite, a quantum leap beyond the monetary “Nash equilibrium” represented by gold.

Historically, gold has become more difficult to mine withthe passage of time due to chemistry, its physical rarity and game theory. Gold is the ancient anchor of the main economic reality of the shortage of time, for this reason it remains the main means of modernity. Time is the most objective measure for our intersubjective (opinion-based) assessments, since this is the only indisputable aspect of existence. In a solid money society, the price level naturally decreases over time, as our productivity increases in parallel with the division of labor. In other words, hard money begins to rise in price over time as human knowledge becomes more specialized. Thus, the increase in the value of hard money reflects how much humanity has freed itself from a shortage of time.

Liquidity of time and information

Then from a theoretical point of view, moneyrepresent both frozen time (as a means of storing time savings) and liquid time (as a means of exchanging time savings). We earn money by sacrificing our personal time, and we can exchange it for proportional sacrifices from others. Thus, anyone who gains control over the money supply and can manipulate it at their own discretion can steal time savings directly from users of their money through a shadow inflation tax. In order to shed light on the true nature of fiat currency in one line, let's call it as it is: a financial pyramid that is subject to unlimited supply inflation, which is built on gold. Since this is very important, it would be worthwhile to remind once again: inflation is the theft of personal time - injustice backed by legal sanctions.

"Inflation is probably the most significant factor inthat vicious circle in which state activity leads to the need for further strengthening of state control. For this reason, anyone who wants to stop the drift toward increased such controls must focus on monetary policy." — Friedrich August von Hayek, Constitution of Liberty.

Manipulation of cash reserves has othereffects. Money is the main information utility of the economy, a kind of touchstone for measuring the value of saving time (or spending it), which is expected to become possible due to economic benefits in the future. When money is manipulated, the objectivity of its measuring ability is in question. This violation of the informational utility of money is called a distortion of the price signal. Such manipulations make economic calculations less reliable and force entrepreneurs to borrow too much money, allocate capital inefficiently and, ultimately, reduce time savings, as capital is spent instead of increasing through reinvestment. Price signals provide a system of "telecommunications to market participants" and can be explained as follows:

Understanding Price Signals

Knowledge, because of its dynamic andof a changing nature, cannot be fully comprehended by one entity, because it is in a state of constant change and widely dispersed over many minds. Under the conditions of the free market economic system, prices record this distributed knowledge, turn it into impartial information and ensure its widespread dissemination. Price signals are the coordinating force of free market systems. Each decision maker can confidently rely on the prices of goods corresponding to the process of their production, since prices themselves are a generalization of all known market realities into a single valid variable. In turn, the decisions of each buyer to buy and sell additionally form prices that return this changed information to the market. Price signals for market participants are the same as light for the eyes.

To understand this, consider the 2010 earthquakeyear, which caused severe damage to the area in Chile, responsible for much of the world's copper production. This earthquake seriously damaged copper mines and export infrastructure, which immediately reduced the flow of new supplies to the global copper market and led to an increase in copper prices by 6.2%. This event will affect the business of any person in the world who is somehow related to the copper market, but they will not need any specific knowledge about the earthquake in Chile or the state of the market in order to make a decision on how to respond. All the necessary information required to make effective decisions is contained in the price of copper itself. Immediately, all firms that require copper are encouraged to reduce demand, suspend purchases, or search for substitutes. On the other side of the market, all copper-producing firms are interested in its production. With a natural change in prices, everyone in the world involved in the copper industry receives an incentive to act in such a way as to mitigate the negative effects of the earthquake. This is the power of a free market with accurate price signals.

Price signals are navigationaltools for entrepreneurs navigating the stormy seas of markets, and money — it is the medium through which these signals propagate. To put it another way: money is a system for measuring value (a time property), just as a ruler is a system for measuring length (a spatial property). The less elastic the money supply, the better they perform at this measurement task. If you measure a table with a ruler that you don't trust to be accurate, then you can't be sure whether you're measuring the table or the ruler itself; you can't differentiate between signal (actual length) and noise (changes in units). Historically, gold has outperformed the competition due to its relative inelasticity of supply, making it both the best store of value and transmitter of price signals. Clearly, Bitcoin is money with perfectly inelastic supply, the most uncompromising system of measuring value the world has ever known. In this sense, Bitcoin is like an unbreakable ruler—the ideal objective unit of measurement for the infinite variations of market values.

Therefore, the more reliable monetarythe proposal is consistent with an absolute lack of time, the better it conveys the time savings generated by our collective increase in productivity. Thus, both gold and Bitcoin have the same fundamental appeal: they more accurately reflect the impersonal, irreproducible, irreversible, irrepressible and absolutely deficient essence of the empirical component that money is intended to symbolize in the market - time.

Snap to time

When money is not associated with a shortage of time (likein the case of fiat currency), their “selfish interests” (English skin in the game, “skin in the game”) are jeopardized, and the economy they promote begins to suffer from distorted price signals, inefficient investments, economic crises and escalating fluctuations in economic activity (cycles of ups and downs). As with most systems, money requires their “selfish interests" to function properly - this means that money production must be expensive, otherwise those who can produce it cheaply will steal the value of the time savings stored in them (as central banks do).

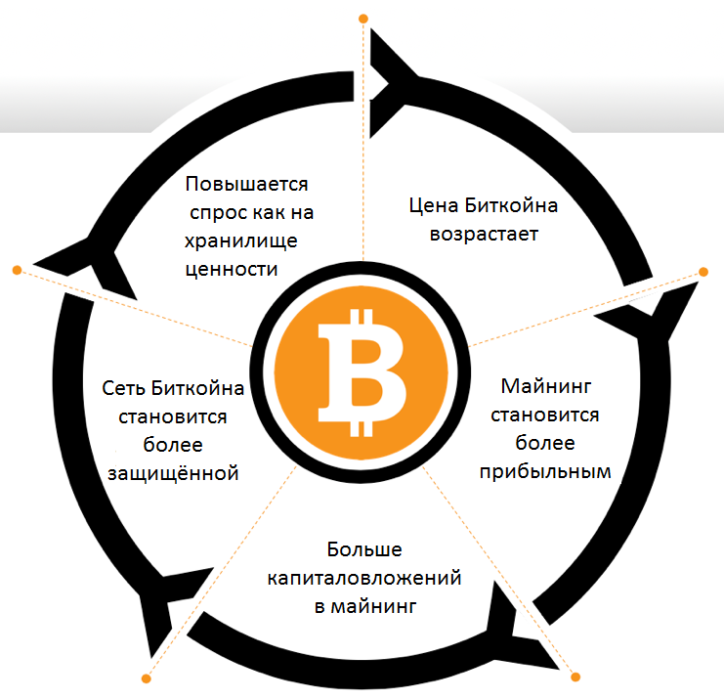

For gold, the costs associated with its mining,provide this critical feature of selfish interest. For Bitcoin, the ingenious combination of energy costs for proving work (selfish interest) and economic incentives (game theory) allowed him to express the deficit in digital form. In this sense, the Bitcoin blockchain is like a bridge between physical and digital reality - the first incarnation of a digital asset with a proven deficit. Bitcoin is an innovative combination of open source software and a behavioral economy, designed to create a money network that continuously reproduces itself:

From this point of view, the cost of mining is like gold,so Bitcoin is the “unjustified cost” that each of them represents - a measure of the time spent on production, which can be reimbursed due to the time of others. Filled with a digital deficit, Bitcoin retains the advantages offered by the physical nature of gold (independence, irreversible transactions, final settlements), while eliminating its disadvantages (ease of confiscation, costly security measures, high cost of settlements). Digitization also makes Bitcoin weightless, intangible and (potentially) perpetual money technology. As a completely depersonalized and sovereign money network, capable of taking over the functions that the market has tested from competitors over time, while resisting changes that adversely affect its users, Bitcoin could be the last evolution we have ever seen in global fixed assets. Gold is the “primary collateral” that underlies the entire financial complex of fiat currencies with a high level of leverage. Bitcoin is ready to become the basis for a completely new economic order.

Monetary perspectives

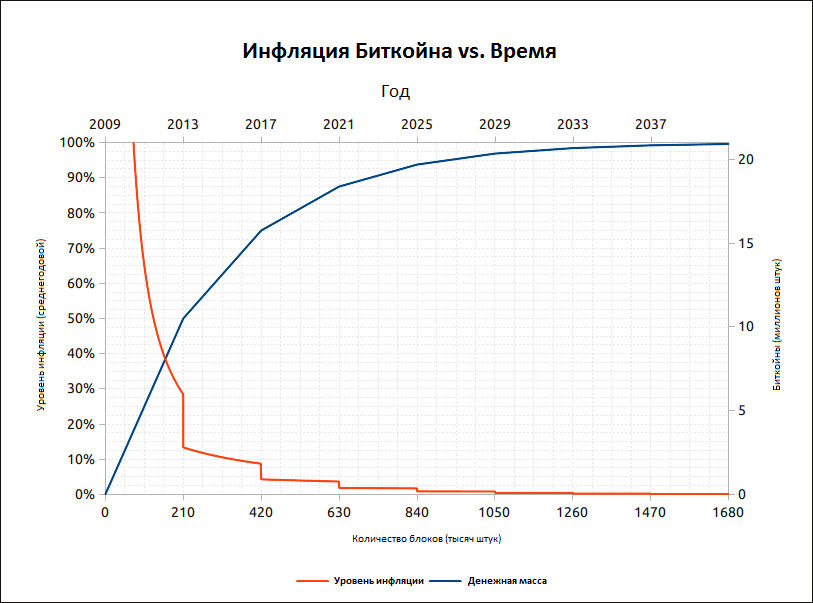

In the near future and for the first time in history in the worldthere will be money that is harder to produce than gold. A fixed final offer of 21 million units makes Bitcoin absolutely scarce - a property that has never been achieved by anything other than time itself. In the same way that Galileo’s invention of the telescope led to discoveries that reoriented our relationship with space, so did Bitcoin’s discovery of absolute scarcity — a stunning breakthrough that fits perfectly and will forever change humanity’s relationship over time. Soon, in accordance with its completely predictable release schedule, Bitcoin will turn into the most scarce liquid asset. At this stage, Bitcoin will become the monetary technology most closely associated with the absolutely scarce nature of time. After that, each block produced will (asymptotically) continue to improve this connection until the last Bitcoin is mined in the middle of the 22nd century:

The highest characteristics of divisibility, mobility,Bitcoin's longevity, recognition and deficit are constantly increasing the likelihood (through the Lindy effect) that it will continue to compete with gold and fiat currencies in its long climb to becoming global fixed-income money. Bitcoin, whose offer is more closely linked to the main economic reality of the lack of time, is slowly but surely undermining the role of gold as fixed money. The word "undermine" literally means "to dig under the fortifications to destroy them." In this sense, Satoshi developed Bitcoin to “dig deeper” than gold did into reality, and thereby undermine its role as main money, more accurately reflecting the fundamental nature of time. As a result, the value of fiat currencies will also decrease, as gold will fall from the first position.

Metaphor of Time

Time is an exceptional empirical element,whose power we all feel on ourselves. It is ruthlessly egalitarian; it flows equally for all. Time is our objective anchor in the world of continuously changing intersubjective evaluations. In an abstract sense, money is our metaphor for time. As a tool, they serve humanity best when their offer is as inelastic as the absolute lack of time. In this regard, gold does well; however, Bitcoin, being the first money with an absolutely scarce supply, is an ideal reflection of time.

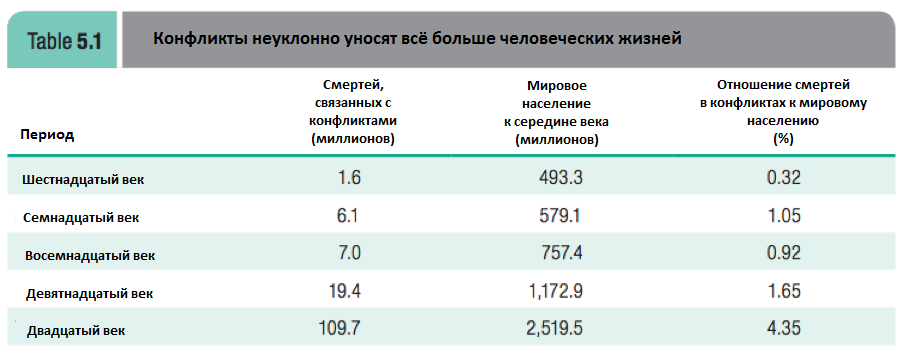

Money is the intermediary with which manyminds are united into a single whole; it is the coordination mechanism of human activity. Money matters because only through cooperation and innovation do we mortals strengthen our position in the fight against the immortal tyrant of time pressure. Perhaps someday Bitcoin will be considered the most efficient technology ever invented, Bitcoin is just a tool to save time; it preserves the value created from our time spent serving each other, reduces the time needed to establish trustful interactions, and it protects the time savings resulting from our joint efforts from expropriation. In addition, Bitcoin promises to reduce the amount of money, capital and lives wasted on wars. Bitcoin achieves this by breaking down laws and competing with monopolies on money production, which use taxation through inflation to secretly fund ongoing military operations. As Ron Paul said: “The fact that the centennial of a total war has simultaneously become the centennial of central banks is no coincidence”:

: Human Development Report 2005 Summary English

Bitcoin also promises to help generate morelarge time savings due to the deepening division of labor, which is a direct result of financial disintermediation, the benefits of which everyone gets. Finally, Bitcoin encourages us to stick to lower time preferences and think in the long run. Hard money encourages us to save and invest, and also holds back excessive debts and expenses, as it naturally rises in value over time as our collective productivity grows. Fiat currency just has the opposite effect: it pushes up our temporary preferences and destroys societies. As the multiple decline of ancient civilizations shows, monetary integrity and social cohesion are inextricably linked.

Breaking chains

Bitcoin belongs to a certain classextremely important innovations, such as antiseptics, electricity or the Internet, which either increase our life expectancy individually, or increase productivity and, therefore, collectively save time. These innovations expand our relationship with time in one or more ways: increase life expectancy, reduce time preferences or increase productivity. Bitcoin promises to contribute to all three aspects, becoming the best independent saving technology in history: reducing the number of victims and destroying capital from wars by financially starving governments, stimulating savings and investing in innovations, and accelerating the growth of our productivity by reducing artificial and arbitrary trading disagreement.

Bitcoin has the potential to turn a greatthe arc of human history back to the free market paradigm. Bitcoin does this in the financial market, but its underlying technology can one day be applied also to other markets such as stocks, bonds and real estate. In the future, Bitcoin promises to further free us from the grip of time pressure, eliminate the theft of time through inflation, revive individual sovereignty and, as a cumulative result, radically increase social scalability around the world. As Alfred North Whitehead said:

“This is a deeply erroneous truism repeatedin all the copybooks and all the outstanding people when they give speeches, as if we should develop in ourselves the habit of thinking about what we are doing. It's completely the opposite. Civilization moves forward by increasing the number of important actions that we are able to perform without thinking about them."

And while we still continue our endlesslack of time bickering, government-sanctioned monetary monopolies, remain a disaster for all of humanity. The activities of the central bank, this institution of monetary socialism and the systematic theft of time, throughout history have repeatedly harmed our individual sovereignty, time preferences and freedoms. We mortals must break the shackles of this oppressive institution and focus our energy on innovation against the lack of time - an immortal tyrant. In doing so, we will create a world in which our children are born, their children and all future generations capable of living a completely independent life - forever freed from the chains of state tyranny.

Robert Breedlove

October 2019

</p>