Summing up the results of the past week, we recall the recovery of the price of Bitcoin and the continuation of the legal sagaCraig Wright, the transformation of the Libra project, the closure of the YouTube channel of the famous trader and analyst Ton Weiss and other notable events.

Bitcoin price

Starting the week with quotes above $ 7000, bitcoinimmediately on Monday, April 13, dropped below this psychologically important mark. Only on Thursday, the leading cryptocurrency took it again and is now trading in the range of $ 7100-7300.

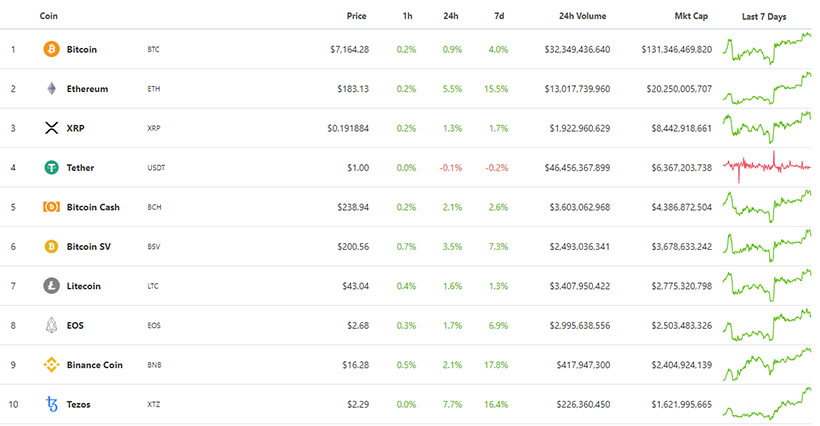

Source: CoinGecko

According to the results of the week, the market is in greenzone, and the largest growth among the leading cryptocurrencies showed Ethereum (ETH) - 15.5%, Tezos (XTZ) - 16.4%, and the BNance token of the Binance exchange added 17.8%.

As a result, market capitalization rose above $ 200 million. At the time of writing, it is $ 207.9 million with a share of bitcoin of 63.2%, ETH - 9.75%.

However, according to lead analyst RoboForexDmitry Gurkovsky, before the further growth of bitcoin can expect another drop to $ 4000. Bitsgap platform analyst Dmitry Perepelkin also believes that now the leading cryptocurrency is not ready for stable growth.

Transformation of the Libra Project

The Libra digital coin project from the social network Facebook abandoned the original concept of a «stable global digital currency».

According to the updated white paper, now LibraThe Association plans to develop several stablecoins, each of which will be tied to various fiat currencies - the US dollar, euro, British pound and Singapore dollar.

At the same time, representatives of the organization still insist that the project will be launched this year.

A possible transformation of the digital currency project from Facebook became known in March, but the social network denied this.

The value of the transferred assets in blockchain and Ethereum networks has reached parity

Amid explosive growth of stablecoins, the volume of daily value transfer in the blockchains of the two leading cryptocurrencies has reached parity, according to Messari.

According to the firm’s analysts, stablecoins made the majority of the contribution to the outstripping growth rate for Ethereum in recent months.

They noted that in the first quarter of this year alone, the capitalization of stable coins increased by $2.4 billion, and for the entire last year - by $2.6 billion.

At the same time, three of the four most popular stablecoins - USDT, TrueUSD and USD Coin - are mainly issued on Ethereum.

As a result, stable coin transactions now account for about 80% of the daily value transfer in the Ethereum network.

In addition, this week, the total value of the decentralized finance market, which is dominated by Ethereum, recovered from the March fall and again exceeded $ 1 billion.

Continued Forensic Epic Craig Wright

The scandalous Australian entrepreneur, the self-proclaimed inventor of Bitcoin, Craig Wright this week turned out to be a defendant in several news related to court cases.

As part of the ongoing proceedings with the familyThe late business partner David Kleiman, the court set Wright on a deadline of April 17, before which he is obliged to provide documents confirming information about his ownership of 1.1 million BTC owned by the creator of bitcoin Satoshi Nakamoto.

Clement's relatives claim half of theseassets for which Wright previously notified the court. In fact, the papers turned out to be a list of bitcoin addresses supposedly belonging to him. In February, Wright refused to submit documents to the court about companies associated with him, as requested by the lawyers of the Kleiman family.

In March, Judge Bruce Reinhart ruledobliging Wright to provide the required more than 11 thousand documents, however, his lawyers obtained another hearing. His results were disappointing for the Australian.

Earlier, Wright filed claims for the defense of honor andmerits against a number of well-known representatives of the crypto community who doubted that he was Satoshi and even openly called a fraudster. This week it became known that the entrepreneur withdrew the lawsuits against Blockstream CEO Adam Beck and Ethereum co-founder Vitalik Buterin. Moreover, in the case of Back, this happened in January, and Wright fully paid for his legal expenses.

Prototype Secure Intranet Bitcoin Storage

Bitcoin Core developer Brian Bishop introducedprototype code of the online storage, with which you can put bitcoins in a specific place on the blockchain and restore them in case of security problems.

Unlike a cold wallet that losesits value, when the secret key is compromised, Bishop’s proposal suggests using a mechanism to return unspent amounts.

The concept was first outlined in 2016, but only now is close to implementation, since Bishop has yet to resolve a number of issues.

Against this background, one of the oldest bitcoin startupsannounced the closure - after 6 years of work, Purse decided to stop working. The startup allowed getting a discount of up to 5% on Amazon, offering gift cards when paying with bitcoins and BCH.

YouTube is back on the cryptocurrency warpath

On April 16, video hosting YouTube deleted the channel of cryptocurrency trader and analyst Ton Weiss, marking it as «Harmful and dangerous content».

Moreover, this happened only an hour after the initial warning and half an hour after his complaint.

A few hours later, the YouTube team restored Weiss’s channel, and he expressed gratitude for the “timely resolution” of the problem.

However, these are not the first problems with YouTube for cryptocurrency-related channel authors. The beginning was laid in December last year, when video hosting removed the content of at least 11 of them.

Regulation

The refrain of the week in the field of regulation of the cryptocurrency industry was “tightening.”

Financial Stability Board Advisorybody at the G20, stated the need to eliminate «blind spots» in the legal regulations of various countries due to the risks that stablecoins pose to financial stability. The regulator made ten recommendations, noting that stablecoins should be subject to the same rules as other initiatives with a similar degree of risk, regardless of the technology used.

In the USA, they are concerned about countering cyberattacksNorth Korea. To this end, the Ministry of National Security, the State Department, the Ministry of Finance and the FBI have developed measures to tighten mechanisms to combat money laundering using cryptocurrencies.

South African authorities plan to introduce stricter measurescontrol over the cryptocurrency industry, compared to the existing ones. According to the document submitted by the Intergovernmental Working Group on Fintech (IFWG), cryptocurrencies will not receive legal tender status in the country and will be accordingly regulated in the framework of “sandboxes”.

Supervision of the crypto industry in South Africa is expected to be carried out in accordance with the recommendations of the Financial Action Task Force on Money Laundering (FATF).

The regulator was guided by the same rulesGibraltar is one of the few cryptocurrency-friendly jurisdictions. The Overseas Territory Department of Digital and Financial Services in the coming months is determined to introduce standards to counter the manipulation of the digital asset market and the FATF recommendations.

The head of the department stressed that they approach the regulation of cryptocurrencies as a sphere of financial services. The industry is subject to the same supervision regime as banks and financial companies.

In the Netherlands, tighter regulation leadscryptocurrency business is crashing, industry participants say. The entry into force of the fifth EU Anti-Money Laundering Directive (AMLD5) in early January put local bitcoin companies at a disadvantage in relation to other players in the financial sector.

However, industry representatives believe that the Ministry of Finance is misinterpreting the rules of the directive, setting higher requirements.

Our YouTube

Under the heading “Explain the crypt” a representativeCurrency.com explained the cryptocurrency exchange that they were tokenizing in 2020, whether a separate exchange was needed for this segment, and how it worked.

One of the speakers held on April 11 ForkLogLive of the large-scale online conference “Digital Middle Ages” spoke about the need for digital sovereignty and blockchain technologies to protect personal data.