5

/

5

(

1

vote

)

In September, cryptocurrency exchange Binance introduced itsBTC / USDT platform for trading futures contracts - Binance Futures.

On this platform, Binance offers perpetualfutures on the BTC / USDT pair, which serves as an additional product for the BTC / USDT pair on the Binance spot exchange. According to the exchange, BTC / USDT futures are only the first of many new products that will be presented on this platform in the future.

In the futures market, stock prices are not “set instantly” (in contrast to the traditional spot market). Instead, two counterparties will enter into a contracted transaction with a future date.

It is important to emphasize that there are differencesbetween Binance perpetual futures contracts (as well as other platforms that offer this product) and the traditional futures market. The key difference between a perpetual futures contract and a traditional one is reflected in the name: it has no expiration date, which allows the trader to keep the position open for any time.

Today is the main futures market, ChicagoThe Mercantile Exchange Group (CME Group) provides traditional futures contracts (including Bitcoin), but, as Binance notes, “modern exchanges are moving towards a perpetual contract model.”

There are several key concepts that traders should know in a perpetual contract:

- Mark Price.To avoid market manipulation andTo ensure that the perpetual contract matches the spot price, Binance uses the mark price to calculate unrealized profits and losses for all traders. The main component of the market price is the index, which is a basket of prices of a number of spot exchanges weighted by their relative volume (Binance, Huobi, OKEx, Bittrex, HitBTC, Bitfinex).

- Initial and maintenance margin.Traders should be careful about the levelsinitial (acts as collateral when opening a position) and maintenance (minimum allowable amount to maintain an open position) margin. Particular attention should be paid to the maintenance margin, where automatic liquidation may occur. It is highly recommended that traders close their positions above the maintenance margin to avoid higher auto-liquidation fees.

- Financing (Funding).Payments between all longs and shorts in the perpetual futures market. The Funding Rate determines which party is the payer and the recipient every 8 hours.

- Risk.Unlike the spot market, futures allowtraders place large orders without their full collateral (use leverage). This is what is called “margin trading”. One thing to always remember is that the price of Bitcoin can rise and fall quickly as it is a highly volatile asset, so leverage can quickly multiply your profits, but it also increases your risks and potential losses.

How to start trading on Binance Futures?

First of all, you need an account on Binance -The registration process on this exchange is quite simple and should not cause difficulties. Trading on Binance Futures is possible without verification of the main Binance account.

Before proceeding with real cryptocurrency trading, traders can practice on a test version of the platform - https://testnet.binancefuture.com/en/futures/BTCUSDT.

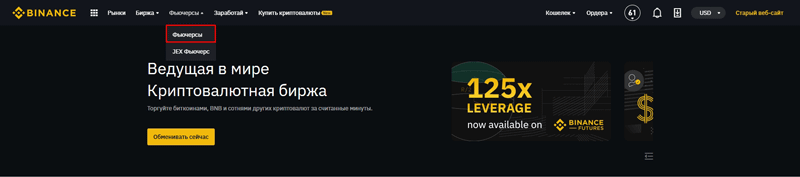

After making a deposit on the exchange you needtransfer them to a separate futures wallet. To do this, you need to go to the official website of the Binance exchange https://www.binance.com/ and go to the futures platform - there is a Futures button in the upper navigation menu. Click on it and select the “Futures” option.

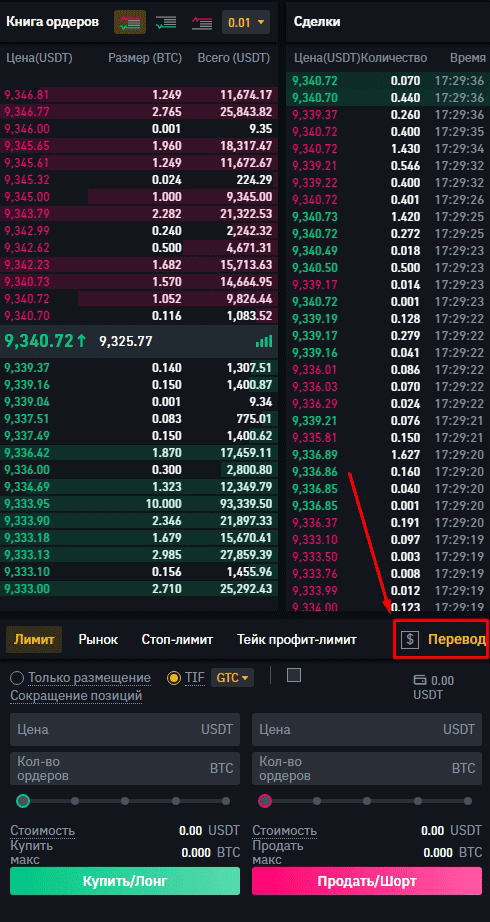

At the bottom right, under the order book, there is a separatemenu with the "Open Account" button. By clicking on this button you confirm the creation of a futures account. After that, you will see a menu of orders for opening long and short positions. To start trading futures, you need to transfer USDT to your futures account.

This is pretty simple. To do this, you need to name the button "Translation". A new window will ask you how much USDT you want to transfer. Just enter the amount and click the "Confirm Transfer" button. Transfer occurs automatically and without commission; To change the direction of the transfer, you just need to click the corresponding button between the wallets.

Leverage at Binance Futures

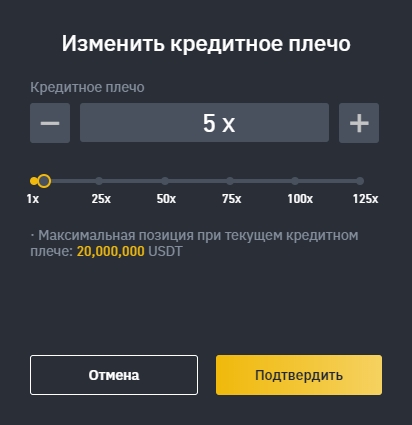

Binance allows traders to open positions with leverage up to 125x.

In the upper left corner next to the BTC / USDT symbol there is a button for setting the shoulder. By clicking on it, you will see the following menu:

Everything is pretty simple here. The slider can be used to set any shoulder from 1x to 125x.

There are four types of orders that you can place on the platform:

- limit(the most popular type of orders, which is a buy/sell at a price specified by the trader),

- market(the simplest type of orders, which is an instant buy/sell at the best market price),

- stop limit(a type of limit order that is used to exit a position upon reaching a certain stop price),

- take profit limit(the opposite of a stop limit, used to exit a position with a profit at a certain price).

If you want to close your position, you havetwo options. Market closes instantly — you close at the best available market price. In contrast, closing by limit allows you to specify the price at which you want to close the position.

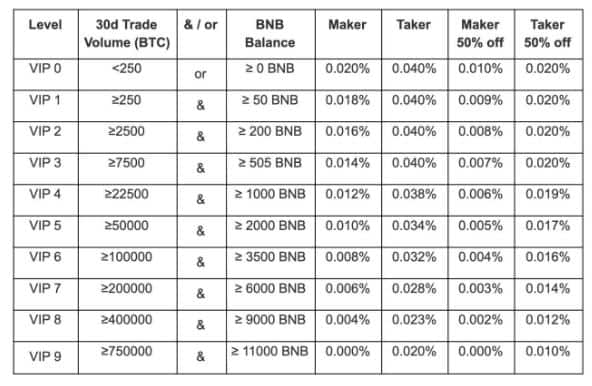

You should also pay attention to the commission of Binance Futures.

Read also our material: Margin trading in cryptocurrency on the Binance exchange.

</p>