In 2021, banks will begin to integrate cryptocurrency into their system and create custodial wallets forstorage and use of digital currencies.

The boundaries between traditional finance and cryptocurrencies will blur

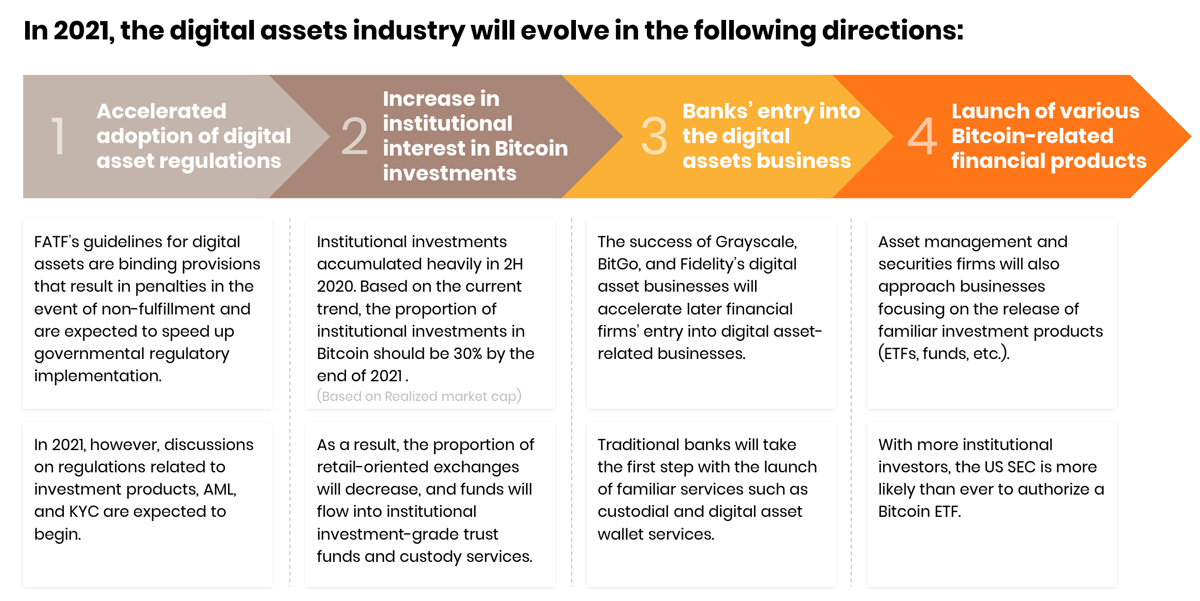

According to research by Xangle and Hanhwa,This year will see a convergence of the traditional finance market and the cryptocurrency sector. This will primarily manifest itself in the integration of digital currencies into the banking system.

According to Xangle analysts, already in 2021banks will start creating custodial wallets with cryptocurrency support in order to provide users with simultaneous access to both digital assets and fiat money.

To ensure the safety of datausers, as well as control the turnover of cryptocurrency in the world, banks and cryptocurrency companies will tighten requirements for users in terms of personal identification.

More and more cryptocurrency exchanges, exchangers andP2P platforms will require clients to complete the KYC (know your customer) procedure. Traditional banks will follow the same path, since it is through them that most of the money stolen in the world is laundered.

Also this year, blockchain companies willdevelop analytical services to track transactions by traditional banks to avoid cases of money laundering. According to CipherTrace research, the majority of banks operating in the world do not understand the nature of cryptocurrency transactions, and therefore cannot adequately analyze and block them.

Let us note that Ukraine is already following this path.Last year, the Ministry of Digital Development and Blockchain Crystal signed a Memorandum of Cooperation, within the framework of which they will work on the creation and implementation of analytical tools that will allow them to monitor and block suspicious transactions.

Institutional investors will invest in bitcoin

Researchers believe that in 2021 majorCorporate and institutional investors will invest in Bitcoin. Microstrategy, Grayscale and Tesla have set an example that other corporations will follow. Note that not everyone shares this point of view. For example, JP Morgan does not believe in the Bitcoin craze due to its volatility.

The activity of institutional investors will leadto the fact that the US Securities Commission (SEC) will most likely meet halfway and give permission to register the first Bitcoin ETFs in America. We note that in 2020, the SEC denied financial firm Wilshire Phoenix from launching a Bitcoin exchange-traded fund (ETF), citing fraud and market manipulation concerns.

At the moment, large institutional andCorporate investors can only invest in cryptocurrencies through trusts, which are created by companies like Grayscale. Last year, the organization launched more than a dozen trusts that allow investing in Bitcoin, Ethereum, Litecoin, Chainlink and a number of DeFi tokens.

Xangle analysts predict that institutional investment in cryptocurrencies will increase by 30% in 2021, pushing the price of bitcoin up to new highs.

Where is it more profitable to buy bitcoin? TOP-5 crypto-exchanges

For a safe and convenient purchase of cryptocurrency, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that supportDeposit and withdrawal of funds inrubles, hryvnias, dollars and euros.

The most reliable platforms with the largest cash turnover have been for several yearsthe largest cryptocurrency exchange in the world is Binance.Binance is the most popular crypto exchange in the CIS, as it hasmaximum trading volumes and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site evaluation |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | OKEx | https://okex.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

| 5 | Yobit | https://yobit.net | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)