The bank's chief investment strategist, Michael Hartnett, suggested that the rise in the value of BTC is a consequence of speculativemania, and recalled that price increases of hundreds of percent preceded many crises in recent decades.

Bitcoin is "the worst of all bubbles," saidMichael Hartnett, chief investment strategist at Bank of America. Since the beginning of autumn, the cryptocurrency rate has risen by 250%, to the current $ 35.4 thousand, at the moment reaching $ 42 thousand. The expert warned that such an increase may be the result of speculative mania, reports Bitcoin.com.

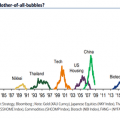

Hartnett compared Bitcoin price dynamics withpast market bubbles. For example, with the events in the gold market in the late 1970s, when the precious metal rose in price by 400%. Hartnett also recalled the bubble in the Japanese stock market in the late 1980s and the dot-com market in the late 1990s, as well as the rise in prices in the US mortgage market that sparked the 2008 financial crisis. The expert stressed that in all cases, the collapse was preceded by an increase of hundreds of percent.

Early January David Rosenberg, PresidentRosenberg Research and a former chief economist at investment bank Merrill Lynch warned that "the biggest bubble" has formed in the bitcoin market. He is confident that the rapid growth that BTC has shown in recent months is "abnormal." But the collapse will not happen as long as the price of the cryptocurrency is supported by low interest rates, the expert suggested.

</p></p>