Article Reading Time:

2 minutes.

The collapse of the cryptocurrency market and massive liquidation of positions have sparked rumors that Singapore-based cryptocurrency hedge fund Three Arrows Capital is on the verge of bankruptcy.

According to analysts, Three Arrows Capital(3AC) could fail in a bear market. Unnamed sources told The Block that the total liquidation amount was about $400 million. An Onchain Wizard analyst noted that another $300 million could be liquidated on Aave and Compound if the market continues to fall.

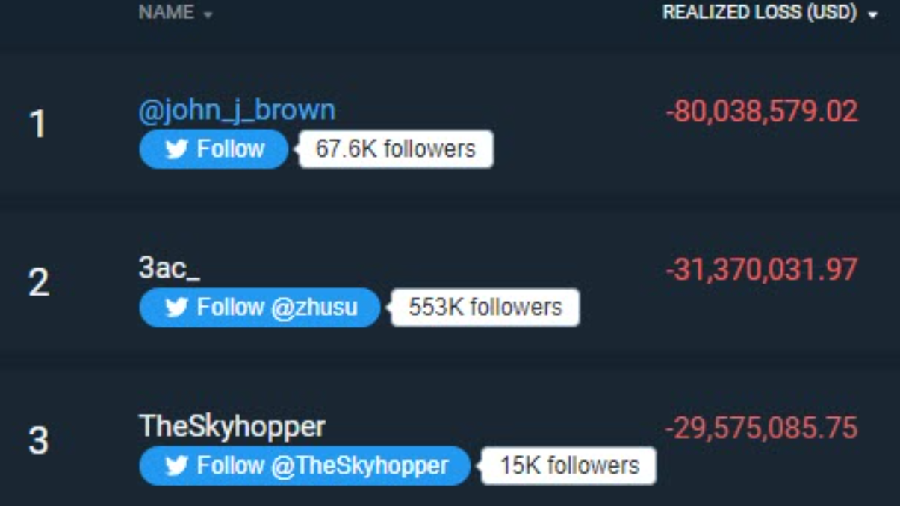

Investor and cryptocurrency trader underpseudonymous Moon cited data on Twitter that Three Arrows Capital took 2nd place in the leaderboard on Bitfinex for realized losses in May 2022 with -$31 million.

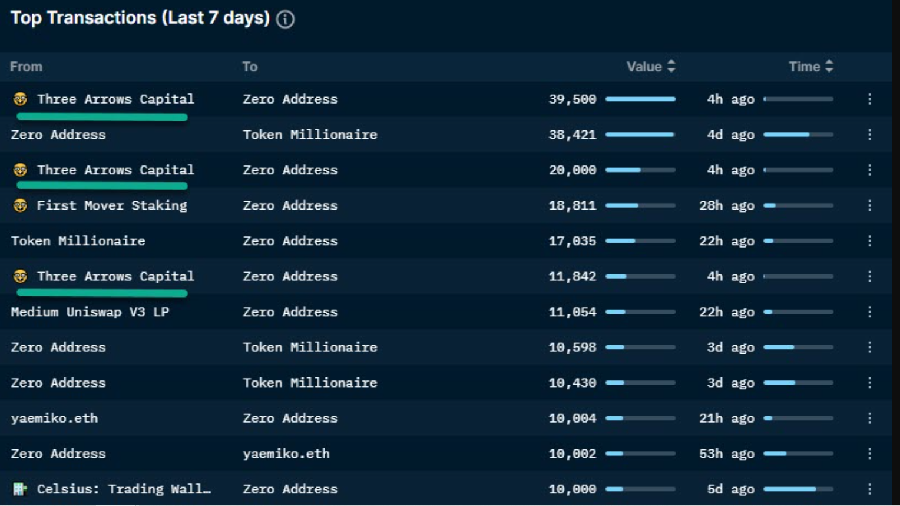

According to the AppZerion service, June 14 3ACsold Lido Staked ETH (stETH) for at least $40 million, making it the largest seller of the ETH 2.0 staking token. Moon confirmed AppZerion's observations. In his analysis of the situation surrounding Three Arrows Capital, Moon noted:

</p>"People think Celsius is the biggest dumperstETH, but it's actually 3AC. They are dumping on every account and seed round address and it is like paying off the debts and outstanding loans that they have.”

Co-founder of Three Arrows Capital Zhu SuSu), в ответ на слухи о том, что компания борется с неплатежеспособностью, ограничился сообщением в Twitter: «Мы находимся в процессе общения с соответствующими сторонами и полностью погрузились в решение данного вопроса».

Let us recall that in April, Three Arrows Capital moved its headquarters to Dubai and created a fund aimed at attracting capital from external investors in the UAE.