“All money is in the possession of the people who make up the market economy. Transfer of money out of controlone actor under the control of another in time occurs instantly and constantly ”, - Ludwig von Mises, Human activity.

</p>I am writing this study of the idea that the whole21 million bitcoins already exist for two reasons. The first is to celebrate the appearance of the 600,000th bitcoin block that unlocked the 18 millionth bitcoin, and the second is to make it even more famous as a cool guy who has fun hanging out at parties. The following statement may sound like a semantic or even esoteric argument, but Bitcoin is a completely different phenomenon that requires a careful assessment of our assumptions and formulations that we use to describe it. Having more clearly defined what Bitcoin is and how it functions, we will be able to more accurately describe the process of its monetization, which will ultimately allow HODLERS to disseminate this information among their friends and family members who have not yet been involved in the mystery of Bitcoin. We live for and are witnesses to the greatest event in the history of the economy - the rapid monetization of a scarce, non-politicized and global currency. Providing our communities with an early competitive advantage can have positive long-term consequences, of course, provided that Bitcoin survives.

Distorted names have already become ubiquitousa phenomenon in Bitcoin, for example, concepts such as wallets, addresses, and mining. Bitcoin wallet is more like a keychain or a factory for the generation and coordination of public and private keys. Bitcoin addresses are not really the places we want users to visit more than once, unlike physical addresses or email addresses. Mining - in the same way, is also an incorrect term. I believe that this is where most of the confusion arises when evaluating Bitcoin, and that is where most of the fears, uncertainties and doubts surrounding Bitcoin focus time and energy, because concepts are easily distorted, which is extremely confusing for beginners.

There are several questions and assumptions thatwe need to consider in order to understand whether the entire 21 million bitcoins actually already exist. Is it possible for a computer program to deal with Bitcoin stroll? What input is needed to complete transactions in bitcoins? Why do people prefer one transaction method to another? When did the total number of bitcoins of 21 million units exist? What is the difference between an available and inaccessible offer?

First, we need to understand what isunique in the offer of bitcoins in comparison with the offer of another “hard currency”. Let's start by comparing Bitcoin with another monetary product - gold.

Bitcoin offer versus gold offer

Perhaps it will be true for us to say that,Based on what we currently understand about physical processes and elements, most of the gold reserves (AU) in the Universe already exist, and over time, nature through nuclear fusion produces some additional reserve.

The fundamental difference between the offer of goldand the offer of bitcoins ultimately boils down to what people can know about the offer. Due to the expansion of the Universe and the existence of a universal limit of the speed of light, people are not able to estimate the total gold reserves, since the location of all its deposits is unknown, and most likely, most of the reserves are very, very far away.

On the other hand, we have an extremely strongsocial and technical consensus regarding the total supply of Bitcoin, as well as the exact location of the currently locked supply. In fact, we have more information about the bitcoins contained in blocks that have not yet been created than about the current unlocked quantity stored on the blockchain. We know exactly how many bitcoins will be broadcast as a derivative of the coinbase transaction of the detected blocks, but we have no way of knowing whether a person currently owning, say, a million bitcoins is going to broadcast the transaction at any particular moment in order to convert all your bitcoins into another currency.

New Bitcoin units become available atset delivery schedule, which is automatically adjusted by adjusting the mining difficulty every 2016 blocks in order to maintain the schedule. This allows us to know with an extremely high degree of certainty where the 3 million Bitcoins currently locked up are located (by block numbers), and with slightly less, but still extremely high accuracy, when they will be available for private spending. key (on average every 10 minutes). Difficulty throttling is a feature of Bitcoin that uses individual incentives to ensure its growth is sustained. By leveling complexity across network size, it negates people's efforts to create more supply and instead uses those efforts to make the network more secure.

Theoretically, we could find out whereall the gold on Earth, but we have no way to determine exactly when we can get to it, how much it will cost to extract, or how much gold exists outside the Earth. Thus, we can make the assumption that if gold ever becomes valuable enough, we can and will find a way to find it for later use, either by mining on the planet or outside the planet, or by using nuclear fusion to create more of it. This is the nature of supply and demand. If the demand for a product or service becomes high enough, it increases the incentive for people to make every possible effort and produce more of the product or service.

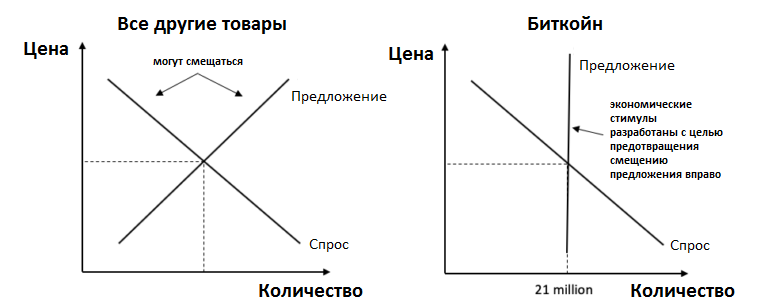

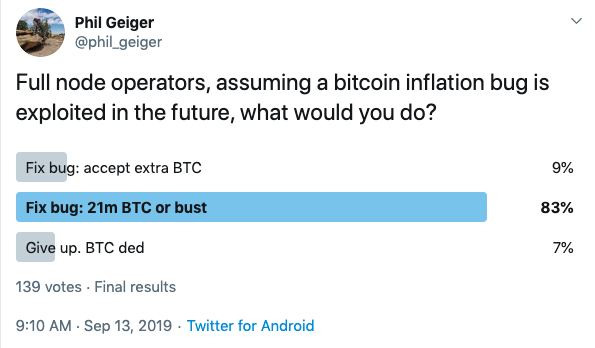

The Bitcoin network itself is itsthe maximum possible amount of 21 million units. Bitcoin's supply is a vertical line in the supply and demand model, which means that it is completely inelastic. This restriction is recorded in the code that is used by all full node operators, and, more importantly, we all also agree with this restriction when we buy our first bitcoin - it has an almost unanimous social consensus. In the history of Bitcoin, several technical errors have already been discovered that could lead to inflation, and one of these vulnerabilities was even exploited by cybercriminals, but in the end the network recognized the transactions they generated as an invalid minority hard fork and continued to follow a socially understandable delivery schedule. while node operators needed to update the software. It is reasonable to expect that in the future we will see even more such errors in the software, and the Bitcoin network will again have to rely on social consensus. Fortunately, all network incentives have been developed taking into account the social and technical maintenance of this limit of 21 million units.

@phil_geiger:Full node operators, assuming Bitcoin's inflation bug is exploited in the future, what will be your actions? a) Fix the bug: I will accept «extra» BTC — 9%; b) Fix the bug: only 21 million BTC or collapse — 83%; c) Give up: Bitcoin is dead — 7%;

Owners of complete nodes are pretty much reprimandedfor this limit of 21 million units. The result of this survey would be the emergence of a competitor to Bitcoin - a minority coin (a minority coin), which would obviously be called “Bitcoin inflation”.

In the case of gold, however, there is notechnical or social consensus for managing the proposal. There is only the chemical element AU, and there is no way with a reasonable degree of accuracy to find out when and how it will be mined and available for human use. For gold, we can use forecasting models based on its current reserves to measure future supply. We cannot know how much gold exists in the Universe, except for the fact that additional gold reserves are very difficult to mine here on Earth. We can simulate how fast gold reserves will increase, assuming that demand remains relatively stable.

Then what is bitcoin mining?

In Bitcoin, it is allowed to conduct transactions with one oftwo ways. The first way is that just the majority knows and loves - private key authentication. If a person has a private key associated with an address on the blockchain that has bitcoins, he can transfer funds by openly broadcasting a signature from the private key, including a fee to encourage the network to buy electricity and process this transaction. In order to get an address with bitcoins in the first place, someone somewhere had to spend productive energy in order to earn these bitcoins.

The second way people canto carry out operations with bitcoins, is to sell electricity to the network in the form of SHA-256 hashes - just what we colloquially (and incorrectly) call “mining”.

By converting the cheapestpower into the maximum possible number of SHA-256 hashes, these bitcoiners streamline and offer raw transaction packets, finding a block hash satisfying the requirements of the SHA-256 at the current level of complexity. If their ASICs can find a solution earlier than the others, and the blocks they offer are checked by full nodes in accordance with the rules, the miners can forward the blockbase transaction of the block, often called miner reward, and the block transaction fee to any convenient address for them.

Do miners create new Bitcoin units in this scenario, or simply make transactions with already issued bitcoins and transaction fees, consuming electricity in the form of SHA-256 hashes?

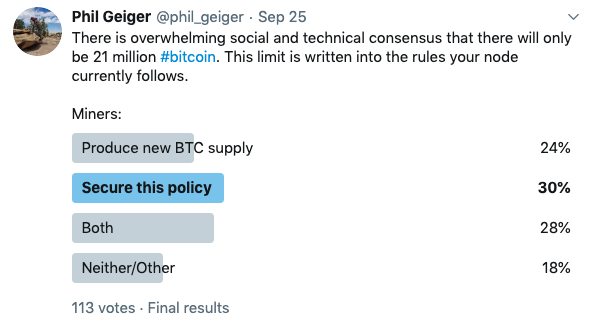

@phil_geiger:There is a stunning social and technical consensus on the 21 million Bitcoin supply limit. This restriction is written into the rules that your node follows at that time. Miners, what would you choose? a) Set a new limit on the number of bitcoins — 24%; b) Continue to follow existing rules — thirty%; c) Both options — 28%; d) None of the proposed/Another option — 18%;

On this issue, opinions are pretty strongdivided - 52% believe that miners create new bitcoins in one form or another, and 48% believe that with these actions the offer of bitcoins does not increase. There is a very big chance that this survey was poorly worded ...

This is a subtle, but very important difference, onmy opinion allows us to authoritatively assert that there can only be 21 million bitcoins and no more satoshi. The question (in part) is an individual decision that each operator of a full node and a HODLER must take. The owners of the nodes individually cannot determine what is or is not Bitcoin, they can only check whether Bitcoin is Bitcoin, and individually they are either in agreement with others or out of general consensus. However, when we reach block number 630,000 at the next halving, will your full node accept 12.5 bitcoins or only 6.25?

My node will reject any future block,who will try to conduct any coinbase transaction that falls outside the Bitcoin emission schedule specified in the code, which my node follows, because such a transaction will be unacceptable in accordance with the social and technical consensus that I accepted for execution. Through a distributed network of independent individuals making such decisions on a personal level, the market ultimately determines what is real Bitcoin, and today the market has objectively set a limit on the number of bitcoins of 21 million units.

If in the middle of the forest there is one computer and performs hashing operations, does anyone care?

Convert electricity to hashes withusing the SHA-256 algorithm (or any other hashing algorithm) is inherently unproductive activity, unless it serves something of value. Turning electricity into hashes for the Bitcoin network is productive and profitable, as Bitcoin holders value the use of electricity to protect the network, as long as the “miners” comply with the consensus rules for scammers and full node operators.

For those people who are interested in sellinghashed electricity into the Bitcoin network, in order to be able to carry out coinbase transactions and transaction fees (mining), there are only a few immutable rules. The most important rule is that there are only 21 million Bitcoins. The next rule is that the coinbase transaction size started at 50 bitcoins in 2009 and decreases every 210,000 blocks until all 21 million bitcoins have been «manifested» for use with private keys in 2140. After this point, hashed electricity will only be able to perform transactions with “transaction fees” paid by users broadcasting transactions initiated using private keys.

Fortunately for the miners, the regulation of complexityaccording to the plan, it always guarantees that it will be profitable for someone to sell networks of effectively hashed electricity. If a particular miner does not make a profit in the long run, he must decide either to close his business (and, possibly, sell his equipment on the secondary market), or find a cheaper source of electricity. If a sufficient number of miners do not make a profit and close their mining farms, which leads to a drop in the network hash rate and to the discovery of new blocks on average longer than 10 minutes, the complexity adjustment is recalibrated to a new lower hashrate to ensure that the average supply schedule is maintained. As a result of this, the Bitcoin network is configured to always pay the market price for electricity converted to hashes, depending on the cost of the network. If a miner does not make a profit by selling electricity to Bitcoin networks, it simply means that it is being replaced by other, more efficient miners.

Taking into account these absolutely rigid networkthe rules, savvy “miners” quickly realize that if they can bring their electricity costs closer to zero, perhaps by generating their own electricity cheaply and choosing whether to sell it for other purposes or as hashes for the Bitcoin network, they will be able to forever efficiently sell hashed electricity for a profit.

This is the value of a currency, not the number of units.

“It should be noted that the level of aggregatemonetary reserves and the value of the monetary unit are issues of complete indifference to the utility derived from the use of money. Society always uses the maximum utility that can be obtained from the use of money. Half of the money at the disposal of the community would bring the same usefulness as the whole volume, even if the change in the value of the monetary unit would not be proportional to the change in the volume of money ”, - Ludwig von Mises, Theory of money and credit

After Satoshi (Nakamoto Satoshi) foundthe genesis block, and Hal Finney and friends agreed to participate in the network in accordance with the rules set out in the code and, more importantly, with social consensus, all 21 million bitcoins instantly arose at the time of the Big Bang. At the initial stage, each user who converted electricity into hashes for conducting early coinbase transactions received not only access via private key to a large number (at that time of no value) of bitcoins, but also an understanding of the rules by which future HOLDERS and “miners” will be able to complete transactions with a blocked Bitcoin offer, providing electricity in the form of hashes in order to compete with others for transaction blocks and find their solution.

So we can look atcostlocked bitcoins from a slightly different angle - as if they were already distributed and held equally by every participant in the network. Thiscostpaid by HODLers to "miners" asrewards for providing the network with hashed electricity at a market rate measured by the value of the network it was used to secure. In 2009, the Bitcoin network was very low cost and only available to a few people, so the electricity cost to transact the 50 bitcoins that make up a coinbase transaction was very low. Today, to earn the opportunity to make a transaction with 12.5 bitcoins, you need to spend about 100 exahashes of electricity per second.

Anyone who joins the network at anyquality, it should be borne in mind that approximately 14% (3 million out of 21 million) of the value they purchase as of October 2019 is held by all network participants in equal shares, only so that people can use them in their transactions, Provide valid PoW (proof of work) to host and secure transactions. All this happened in accordance with the established supply schedule from the very first day of Bitcoin's existence, and nothing has changed in terms of economic incentives for the sale of electricity to the network in the future. Thus, the constructively laid-down regulation of complexity ensures that it is always profitable for the most efficient energy producers to sell their cheapest electricity to the Bitcoin network.

It has been argued that computers andsoftware can store and conduct private key transactions. I claim that we have almost 11 years of empirical evidence that the network itself is engaged in the storage and execution of transactions with bitcoins, but instead of using private key signatures, it uses hashed electricity.

It's not about the number of bitcoins that areat the disposal of one side or another. Value has the value of the entire network, and the value of the network can only increase from the understanding that all its monetary characteristics are reliable. There are only 21 million bitcoins.

All or nothing

Bitcoin's innovation lies in its absolutea deficit that is accessible in unrecognized boundaries in a neutral and non-permitting manner. This innovation is shockingly destructive for all aspects of human interaction, and it is this innovation that leads to an increase in the cost of the network over time. Bitcoin is its limit of 21 million. In no case should his proposal exceed 21 million units, because this would contradict what we currently know and understand about how the Bitcoin network works, and would leave the digital deficit problem without a solution.

Bitcoin was able to achieve absolute deficitdue to its network architecture, which is designed to increase decentralization over time and actively resist the desire of a person to produce more goods in high demand. An increase in decentralization over time actually leads to crowdsourcing of the decision on the total final offer of bitcoins for the entire network of participants, based on the simple assumption that a decentralized network of private individuals will not choose to devalue their own currency, at a time when no participant has access to opportunities seigniorage.

As a result, the prudent operator is completenode, miner and HODLer can act on the assumption that the limit of 21 million units is not negotiable. The knowledge of this deficit violation is gradually and organically leaking out through the free market and through the HODLER OF LAST HOPE network, but this whole experiment depends on a ossified foundation of 21 million with clear, neutral and unchanging rules on how people can make transactions.

Since we have voluntarily chosen this network, wewe can say that all 21 million bitcoins already exist today, as the rules followed by the consensus of the network dictate the need to comply with the delivery schedule. The only difference between an available / inaccessible offer is who or what currently costs the coinbase bitcoin price, and how people must compete in order to make transactions either with bitcoins tracked by blockchain or bitcoins tracked by block number, behind PoW and complexity adjustment.

Digital scarcity is a rather strange idea. The Bitcoin tracked by the blockchain is ultimately just the units, zeros and mathematical functions supported by economic incentives. The same applies to coins from coinbase transactions. The schedule is written in the software that we use, and there can be no such scenario in which the upcoming block contains a different numerical value of coinbase coins, because in this case the social and technical consensus would not consider this as Bitcoin.

Bitcoin is the crossroads between code and social consensus. Either the entire 21 million units already exist, or none of them exist. There is no third.

</p>