Bitcoin is rising again. The cryptocurrency is approaching $16,000, reminiscent of the late 2017 rally.Nearly zero interest rates makespeculative instruments like bitcoin are very attractive. Narrating BTC as an inflation hedge is also helping bulls right now as the Fed and ECB pump money into the financial system. But Bitcoin is far from a real haven. Its price swings can be quite impressive in both directions. Therefore, to get anything out of it, investors must have an idea of its future direction. Given Bitcoin's lack of intrinsic value, Elliott Wave Analysis seems to be the most effective tool.

The graph above first appeared in our analysispremium as an alternative count on March 29. When Bitcoin was slightly above $6,000, he suggested that a rise to $16,000 in wave C was possible after a full 5-3 wave cycle in waves A and B. Wave A was a clear five-wave impulse labeled 1-2-3-4-5 , while wave B looked like a simple zigzag abc. Wave "a" in B was the leading diagonal. However, immediately after the March crash to $3,850, betting big on this count was a big risk. However, the Bulls persisted, and by July they made it clear that they were serious about the matter.

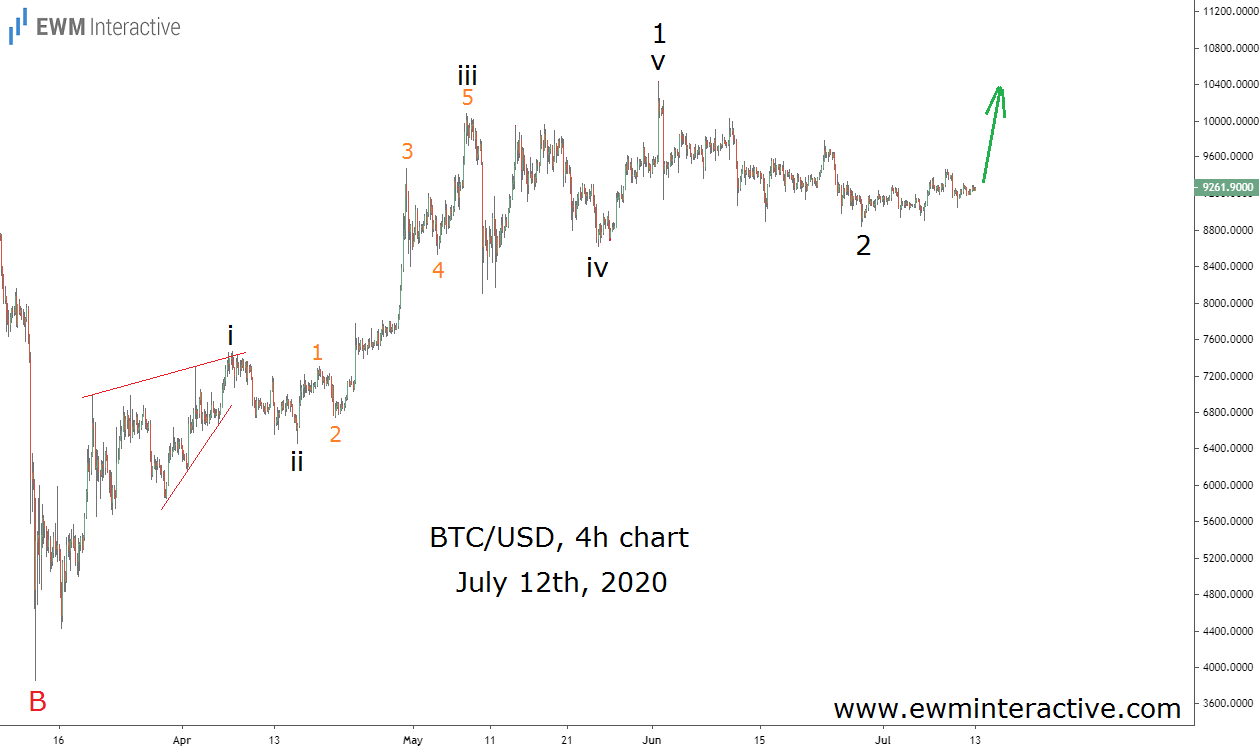

The chart above was sent to subscribers on July 12th.when BTCUSD hovered around $ 9300. It showed that the recovery from $ 3850 to $ 10,429 was the impulse denoted by i-ii-iii-iv-v in wave 1. This signaled that wave C is in progress and a drop to $ 8831 in late June is likely was wave 2. This meant that higher levels were to be expected in wave 3 in C. Indeed, bitcoin rallied to $ 12,473 in August, but fell back to $ 9825 a month later. So, on September 20, we sent out the next update to our subscribers.

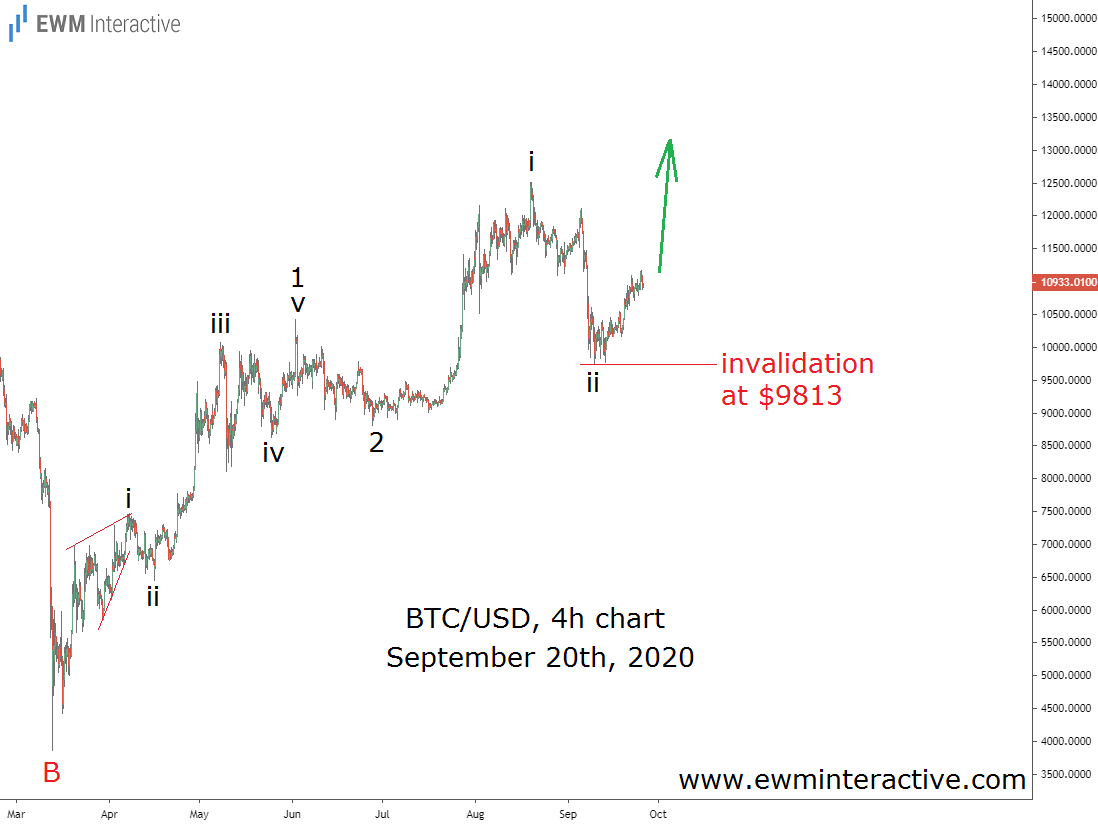

Even if the analysis is correct, traders cannotexpect price to move in a straight line towards its target. The Bitcoin price has proven this once again. Instead of moving sharply in wave 3, he decided to first make a noticeable correction in wave ii at 3. However, it did not go below the starting point of wave i, which kept the bullish outlook in effect. As BTCUSD was approaching $ 11,000, we defined $ 9813 as the invalidation level of this count. If there was a fall below this level, the bulls could no longer be trusted. The next graph shows how the situation developed.

The price remained in the range for a while, butit was not possible to break through $ 9813. Uncertainty surrounding a possible second blocking in Europe and the upcoming elections in the United States has added fuel to the fire of an optimistic thesis. As time went on, the number of buyers grew steadily. Bitcoin surged to $ 15,969 earlier today, almost hitting its original target set at the end of March. Meanwhile, COVID-19 continues to be the biggest challenge facing humanity today, and as of this writing, U.S. election results remain unresolved. One thing is for sure: uncertainty is the norm in life, not the exception. This is an illusion of confidence that occurs periodically for a while. So, as Bitcoin approaches a new all-time high, one question remains: is things different this time around?

translation from here

PySy. I think that this is more likely not A-B-C, but 1-2-3- ... (top graph)

Crypto Trading Guide: 5 Simple Strategies To Watch Out For New Opportunity

Trump vs. Biden: Find Out What The Stock Market Says About The Race To The White House (Free Webinar)

Trump vs Biden: who will win in November?Ask the stock market! This research from our friends at SI/EWI shows that the stock market is a stronger predictor of a president's reelection than the economy. Download your FREE copy at SSRN.com

Now the handbook for wave enthusiasts, “The Elliott Wave Principle,” can be found in free access here

And don’t forget to subscribe to my telegram channel and YouTube channel

Free Guide “How to Find High Potential Trading Opportunities Using Moving Averages”

If you find the article interesting, put pluses and add to favorites.