Aave developers invited the community to launch a multi-collateral protocol native to the DeFi ecosystemGHO stablecoin pegged to the US dollar.

«As a decentralized stablecoin on the networkEthereum, GHO will be created by users. As with all borrowing in the Aave protocol, collateral must be provided (at a certain ratio) in order to be able to mint GHO,” the team explained.

GHO will be backed by a «diversified set of crypto assets» supported by the protocol. Users will continue to receive interest on pledged tokens.

All decisions regarding the GHO, including interest rates, collateral levels, etc., will be made by the DAO, the team noted.

«If approved, the implementation of GHO will make"making stablecoin borrowing on the Aave protocol more competitive, will provide more user options, and generate additional revenue for the Aave DAO by directing 100% of interest payments on GHO loans to the DAO's treasury," the statement said.

The developers also offered to provide a discount on the issuance of a stablecoin to holders of the AAVE token in staking. In their opinion, this stimulates the growth of stkAAVE volumes, which will increase the security of the protocol.

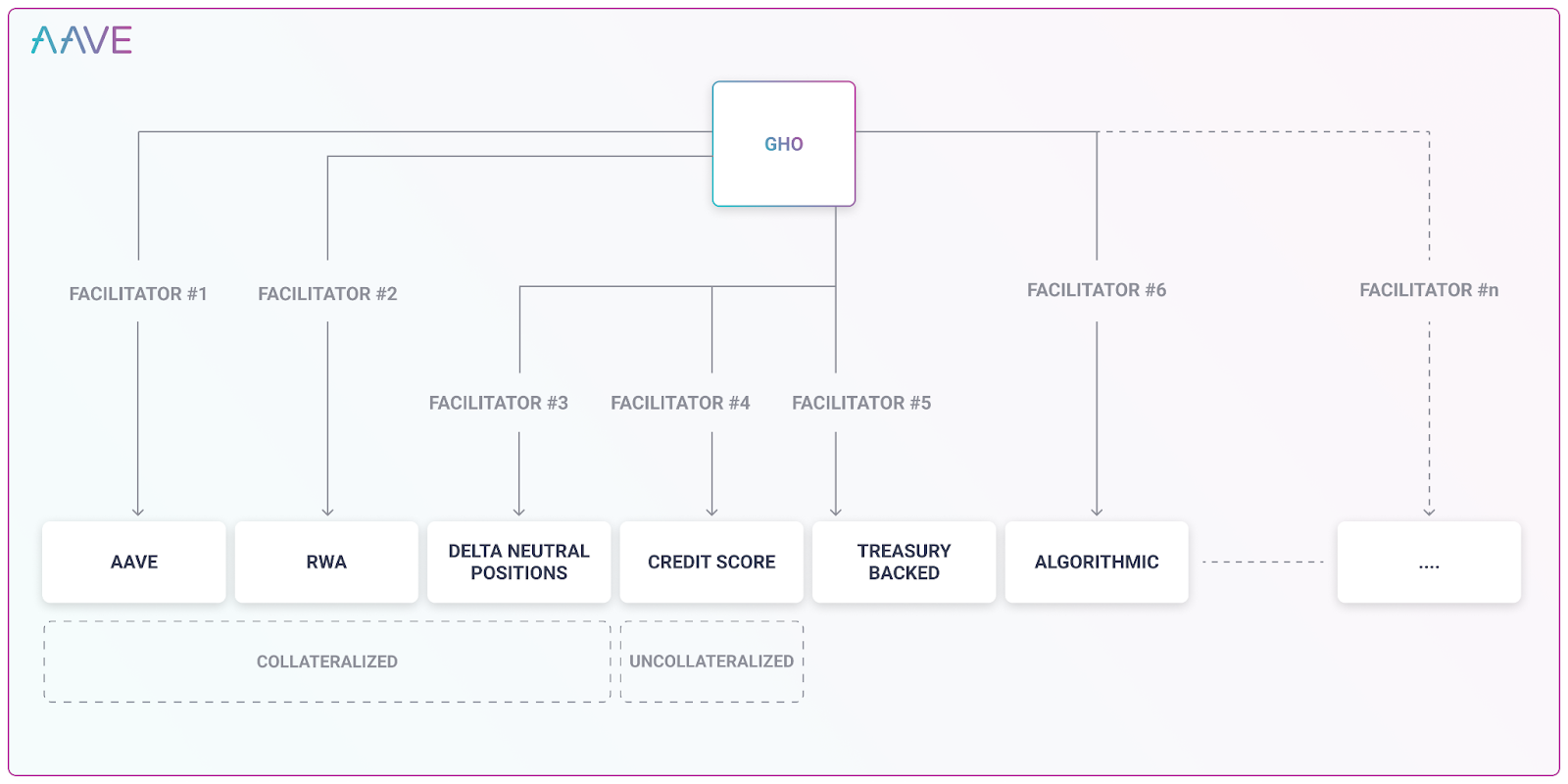

It is expected that the release and combustion of GHO will be controlled by community-approved «assistants» (Facilitator) with an established emission limit.

Data: Aave Governance.

«The use of stablecoins will onlygrow as crypto assets further integrate with a user base that is currently less committed to digital assets. Decentralized “stable coins” provide a censorship-resistant fiat-denominated currency on the blockchain,” the Aave team emphasized.

If approved by the community, the stablecoin proposal will be audited by OpenZeppelin and PeckShield. Deployment of GHO in the protocol and other networks will require a new vote.

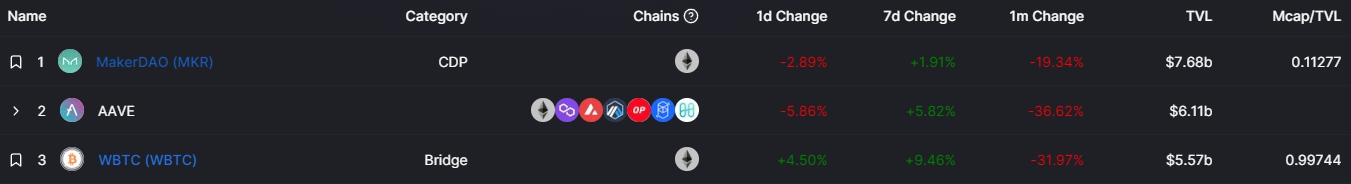

According to DeFi Llama, Aave is in second placeby TVL among DeFi protocols with a figure of $6.11 billion. The project is second only to MakerDAO ($7.68 billion), which manages the most popular decentralized stablecoin DAI with a capitalization of almost $6.5 billion (CoinGecko).

Data: DeFi Llama.

Recall that in July, the MakerDAO platform disconnected Aave from the direct deposit module, depriving protocol users of the opportunity to borrow DAI through it.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.