This is one of the most common questions that private clients come to us with today,related to the crypt. Let's try to talk about several possible options and their legal implications.

</p>There are many nuances and individual circumstances, so for the purposes of this article, we make the following assumptions:

- The owner of the cryptocurrency is a tax and currency resident of Russia;

- The cryptocurrency was purchased several years ago, while there is no proof of expenses in most cases;

- A person wants to convert a significant amount to make a big purchase: real estate investments, securities, startups, education of children in Russia or abroad.

You can read more about taxation of transactions with cryptocurrencies here. Check out this guide to learn more about the tax issues of digital nomads.

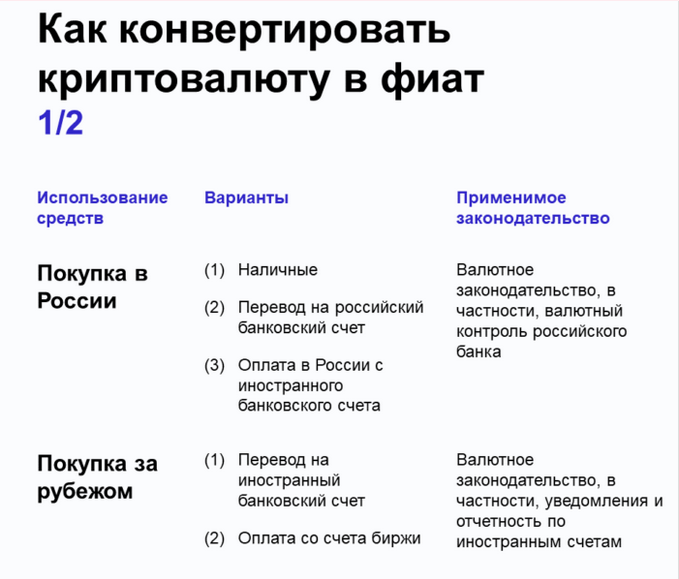

1. Where is the purchase planned

Communication with clients in this area becomesit is clear that people are considering converting a crypt precisely for the purpose of carrying out a specific transaction using fiat funds. In this case, the analysis is usually divided into two directions, depending on where the purchase is planned.

Ifthe purchase is planned in Russia, that is, the seller is a Russian legal entity,then you first need to convert cryptocurrency into fiat funds. Because from January 1, 2021, accepting cryptocurrencies in payment for goods, services and works is prohibited. Accordingly, no legal seller will sell anything for a crypt. Read more about conversion in the next chapter.

Ifpurchase is planned abroad, that is, there are two options:(1) you can pay with crypto immediately, if the seller is ready to accept it in payment, or (2) you still need to convert to fiat, but you can avoid depositing money into Russian accounts. More on this in Chapter 3 below.

Cryptocurrency Conversion Methods

2. Purchase in Russia

If you want to buy something in Russia, thenCryptocurrency must be: (1) converted into cash, (2) converted and deposited into accounts in Russian banks, (3) made a purchase with funds from a foreign bank, or (4) used as payment for the cryptocurrency itself. We will not consider the fourth option further, because it is illegal, although, of course, there are enough such transactions after January 1, 2021.

2.1 Conversion to cash

It's no secret that there are many crypto exchangers in Russia,which offer services for converting crypto into cash. Using this service, you receive cash, which you can then: (1) credit to a bank account, or (2) pay for the purchase directly.

It is worth recalling here that individuals canpay for your purchases in Russia in cash in favor of legal entities without restrictions. Cash settlements are limited only between legal entities - the maximum amount is 100 thousand rubles.

2.2 Conversion with the institution of funds to Russian accounts

In this scenario, you can open an account on a foreign cryptocurrency exchange, convert the crypt into cash, and make a transfer to an account with a Russian bank.

The main risk here is questions from the Russianbank. While Russian banks do not ask questions regarding small amounts, say, up to 100 thousand rubles, for transactions with larger amounts, one should expect inquiries from the bank's foreign exchange control department.

To confirm the legality of the operation, the bank infirst of all, it will request an agreement under which the funds come. In the case of foreign crypto exchanges, the only document is the Terms of Use. The Bank may ask to submit these terms and conditions translated into Russian.

In the worst case, the Russian bank will debit the funds from the transit account and send them back.

2.3 Conversion abroad and payment in Russia from a foreign account

In this case, it is assumed that the purchase inRussia will be paid directly from a foreign bank account. For example, a person has an account on a foreign crypto exchange linked to a foreign bank account. After converting the crypt on the exchange, the funds are withdrawn to an account in a foreign bank. Further, the purchase in Russia is paid from this account.

There are two nuances in the area of currency control.

First, one must remember the requirements of the Russianforeign exchange legislation, which obliges Russian currency residents to report on the opening of accounts with foreign banks and on the movement of funds through them.

Secondly, again everyone's favorite currencythe legislation establishes restrictions on operations of crediting funds to foreign bank accounts of Russian currency residents. It is important to make sure that a particular transaction will fall under one of the exceptions provided for in Art. 12 of the Federal Law No. 173-FZ "On Currency Regulation and Currency Control" dated December 10, 2003.

So, if a crypto exchange makes payments to its customers from its bank account located in a country that exchanges information with Russia, then there should be no problems.

Third, not every Russian seller willready to accept payment for goods or services from a foreign account. For example, if you want to send funds from a foreign bank account to the account of a Russian broker, then it is better to consult with the broker in advance how they relate to such transactions. I'm not even talking about the fact that no Russian university will accept payment for the education of children from a foreign bank.

Fourth, even if the seller agrees to accept payment from a foreign bank, it will still be necessary to provide a foreign exchange contract with a Russian bank.

There is one alternative here:transfer from your account in a foreign bank to your own account in a Russian bank and further payment within the perimeter of the Russian banking system. Such a transaction will also arouse curiosity on the part of the bank's foreign exchange control, but in general it is not illegal in itself. You just need to remember the requirements of Russian currency legislation in terms of notification and reporting on accounts in foreign financial institutions.

3. Buying abroad

Unlike Russia, other countries in the world do notprohibit payment for goods and services in the crypt. Therefore, for example, the purchase of real estate in the United States is quite possible to pay in a crypt, if the seller agrees to this. For a long time there have been brokers in New York who are ready to accept crypto for payment.

If a foreign seller, for his own reasons, does not want to accept crypt for payment (and there are most of them at the moment), then the question of converting the crypt into fiat still arises.

In general, foreign cryptocurrency exchanges are notobject to opening accounts for Russian tax residents. Therefore, converting crypto to fiat through a foreign exchange does not pose any particular problems. You only need to go through all the KYC / AML procedures, which, of course, requires some effort in terms of collecting and translating documents into English, but it is quite feasible. The larger the amount, the more documents must be provided, up to confirmation of the origin of funds from mining or trading.

Most of the major exchanges are ready to open accounts for Russian residents: Bitstamp, Kraken, Blockchain.com, and probably many others.

Once the crypt is converted to fiat, itis on the exchange account. These funds can be: (1) withdrawn to your own foreign bank account or (2) directly transferred to a third party. The second option is extremely rare, because usually exchanges only allow you to withdraw money to a bank account with the same name.

If a transfer is made to a foreign bankaccount, then, as mentioned above, one must remember the requirements of Russian legislation on currency control. In addition, the exchanges have their own internal rules for which banks they work with. For example, the American exchange Kraken will not withdraw funds to accounts in banks in New York due to the licensing requirements of the New York State BitLicense. Therefore, before registering an account on the exchange, it is worth clarifying which banks the exchange works with to withdraw funds.

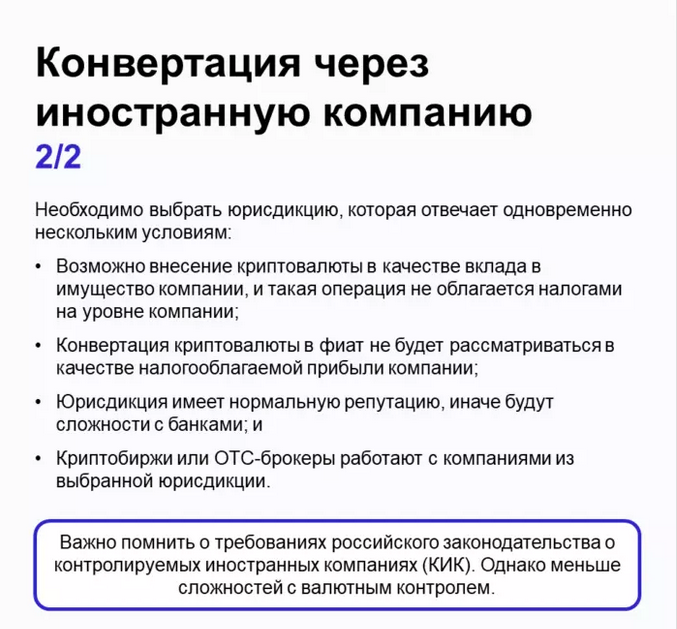

4. Conversion through investment in the capital of the new company

Above, we considered scenarios when an individual converts cryptocurrency on his own behalf and then makes some kind of purchase in Russia or abroad.

There is another more sophisticated scheme that can be suitable for converting larger amounts.

This scheme assumes the establishment of a physicalthe face of a new company in a foreign jurisdiction, making cryptocurrency as a contribution to property and further conversion with the withdrawal of fiat funds to the company's bank accounts. After that, the company has the right to dispose of these funds at its discretion, including making a return to the founder or purchasing real estate in another country.

To implement such a scheme, you must first of all choose a jurisdiction that meets several conditions simultaneously:

- It is possible to make cryptocurrency as a contribution to the company's property, and such an operation is not taxed at the company level;

- Converting cryptocurrency to fiat will not be treated as taxable profit for the company;

- The jurisdiction has a good reputation, otherwise the company will not be able to open a corporate bank account; and

- Crypto exchanges or OTC brokers work with companies from the selected jurisdiction.

You also need to have patience and documents to pass all KYC / AML checks in a bank, on an exchange, etc.

If you are waiting for me to name a dozen nowsuch jurisdictions, then I have to disappoint you. There are always many individual features in such schemes, so there is no one solution. However, jurisdictions such as Gibraltar, Malta and the BVI are usually on the list of options under consideration.

Complex conversion scheme

5. In conclusion

Before converting, it makes sense to decide exactly where the funds received will be directed. This can influence the choice of the scheme.

To convert large amounts of cryptocurrencies intofiat money will almost certainly have to use foreign infrastructure: exchanges, banks, legal entities. Therefore, one must remember the requirements of currency and tax legislation. To convert large amounts, it is worth considering the possibility of establishing a special legal entity.

If you find errors or wantcriticize, feel free to write in the comments. I hope this post will be useful to those who want to have a more or less comprehensive idea of the options.

</p>