The ETH rate to Bitcoin rose slightly amid a 10% fall in the price of BTC.

Last weekend the price of Bitcoin reachednew all-time high ~$61k.However, the same cannot be said for Ether, and the market as a whole does not seem to have shown much strength to continue the trend. As a result, the price of BTC fell by ~10% on Monday.

On this pullback, the ETH rate against the dollar also dropped.However, the ETH / BTC pair actually rebounded. This could be the case when altcoins are trying to stabilize towards BTC while bitcoin is giving back its weekend heights. Quite an interesting question: Could this be a prelude to a potential massive ether rally later this year? Let's try to refer to the graphs.

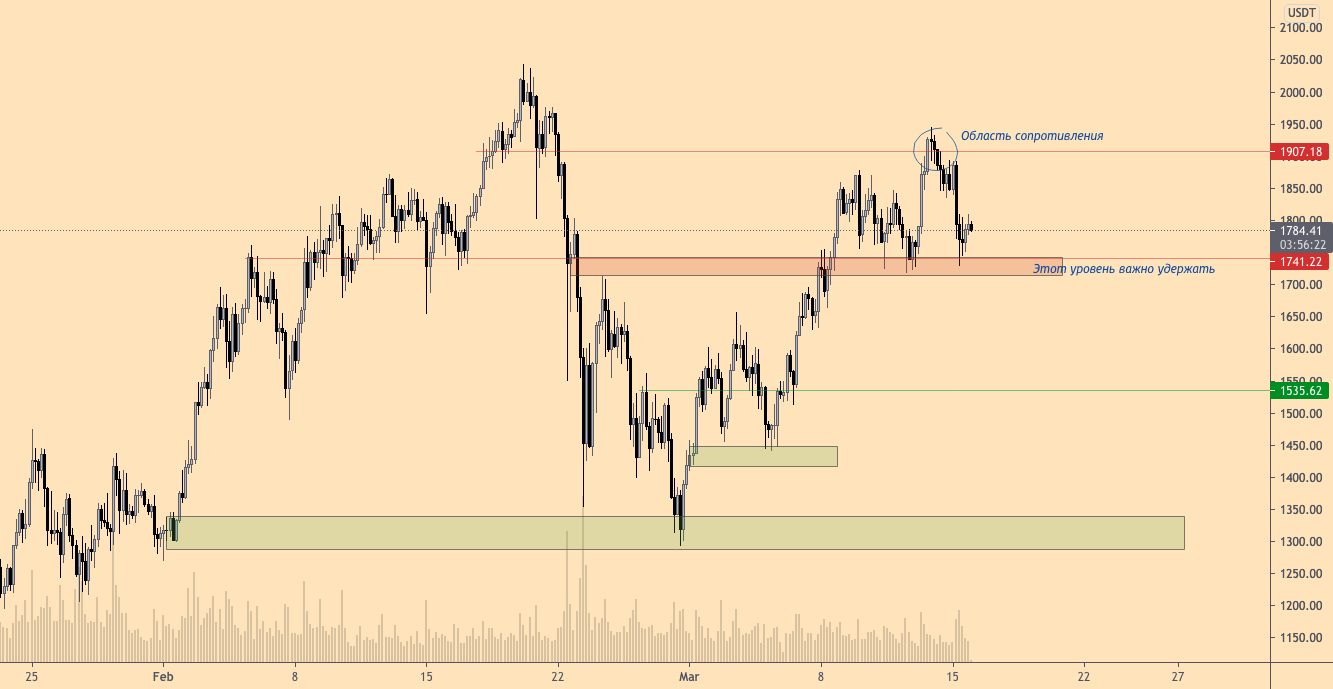

ETH Can't Get Over $ 1900

ETH/USDT, 4-hour chart. :TradingView

On Saturday, March 13, the broadcast could not overcomethe level of $ 1900, which is, in fact, the last obstacle before the important psychological barrier of $ 2000. The entire crypto market is waiting for a clear breakthrough of ETH above $ 2000 and it looks like it will have to wait a little longer.

From the very bottom at the level of $ 1300, ether is very confidentdrew one resistance after another into support. The last such flip of support to resistance occurred at the $ 1,740 level and served as the basis for a rally to $ 1,900.

However, ETH quickly rolled back to$ 1740. Such a drop is a sign of weakness, in part because repeated testing of key support levels increases the risk of further correction.

In other words, if the ether does not hold the $ 1740 level, then the market can expect another wave of sales to $ 1500.

ETH / BTC rate is holding firm

ETH/BTC, 1-day chart. :TradingView

Fortunately for the bulls, the ETH / BTC pair duringBitcoin's Monday correction was doing quite well, finding support in the 0.029-0.031 area. But if this level is lost, then the next support will be in the area of ₿0.025–0.0275. This level is critical to maintaining the current bullish market cycle.

Meanwhile, the chart shows that altcoins are not growing steadily and consistently. They often undergo heavy corrections and the ETH / BTC pair has already been in a correction since early February.

Nevertheless, the very construction of a bullish trend in terms of the sequential formation of large lows and large highs is still in force.

ETH/BTC, 3-day chart. :TradingView

The ETH / BTC chart still looks bullish. Larger lows have been consistently forming since the summer of 2019, setting the stage for an overall uptrend.

Such uptrends have periodsconsolidation. But as long as the structure of the big lows persists, the overall bullish trend remains in place. Therefore, it is important to follow the previously mentioned price levels, and first of all, the area за0.025–0.0275.

Strong impulse movement for ether, more likelyin all, it will happen closer to the release date of Ethereum 2.0, which, according to the developers, should be a solution to some of the problems with scaling and high transaction costs. Until then, fear - uncertainty - doubts and all the negativity associated with the project is likely to persist.

However, traders should be aware that periods of recession and negative sentiment are usually better times to enter the market than periods of general recovery when the market is overheated.

Likely scenario for ETH price

ETH/USDT, 3-hour chart. :TradingView

An important support area for broadcast at the momentis in the region of $ 1700-1740. As long as this zone holds, tests of resistance levels higher can be expected. But the decisive resistance that needs to be broken is the $ 1830-1860 level.

However, in the short term, such a breakthroughunlikely, especially given the change in market sentiment over the past few days. If the $ 1830-1860 resistance is tested and confirmed, then ETH could undergo another corrective move towards $ 1500.

The next big impulse wave mayoccur after the completion of this period of consolidation and contraction. And this impulse wave should push the price of ETH well above $ 2,000. But in this game, it is very important not to lose patience, and investors must understand that the development of events takes time - both in terms of fundamentals and in terms of the price trend.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>