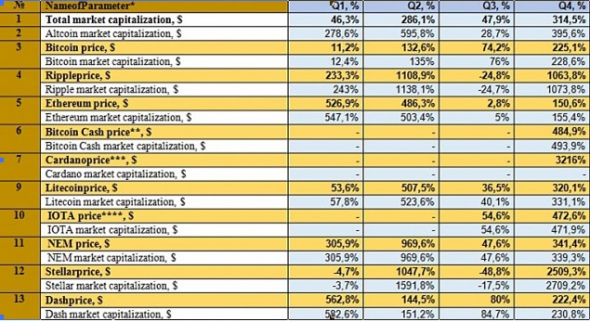

You can't miss such an important topic asgrowth potential of cryptocurrencies in the world. Now we are expecting a target of $50,000 for Bitcoin and, for example, $5 for Stellar. Investing in cryptocurrencies causes fear for many, due to the fact that they have never tried this direction. Most people associate crypto with programmers-miners who “mine something.” In fact, this is the same tool as all the others, the same amount of purchases as in stocks, and the transaction itself with all money transfers can be carried out without leaving home in 15-20 minutes. You don’t even need to open Bitcoin wallets. Everything is much simpler. Let's look at the results of such investments in 2017 using the example of 10 cryptocurrencies from the highest rating.

Ripple immediately catches your eye - 35160% inyear. This means that investments have increased by 351 times. Let's multiply the 100 thousandth investment by the growth of Ripple and get 35,100,000 rubles. And the rest of the results are quite decent. At the same time, the Russian market, excluding Sberbank, mostly stood still, currencies slid all year. Was Buffett able to earn 35 thousand percent on “rat poison squared”? Of course no. Berkshire's 65 billion profit with a capitalization of 488 billion is 13%. His investments brought in 153 times less than Bitcoin and 2,704 times less than Ripple. Of course, investors like Buffett and Gates are not happy, since a worldwide revolution of capital is taking place and money is leaving without their participation in private hands. On the other hand, Buffett owns large international companies and does not care whether he receives dividends in dollars or bitcoins or other cryptocurrencies. That is, changing part of the money will not lead to the collapse of share capital.

There is also decentralization of the exchanges themselves, which can lead to full independence.At the same time, there is recognition and drop-off regulators who consider technology effective.Banks and exchanges on Wall Street are ready to launch deals with cryptocurrencies.None of them wants to let the profits down any more.That is, in fact, the money was distributed to random people, but after a few yearsThey will be consolidated by the rich and successful.A typical example is a Norwegian student who wrote an abstracton the subject of bitcoin and invested 24 dollars, it is about 1400 rubles.At the time of sale, when he ran to look for the password in translation to our money received 80 million rubles.That is, he gave the crypt, and in a year could get 800 million.Capital flow in action!

Do cryptocurrencies have potential?To do this, let's take the average value of all the money in the world economy in dollar terms - 100 trillion dollars. The calculations are not new, so there may be more of them now. It turns out that the share of cryptocurrencies is less than 1%. This share can easily be increased to 10 or 20%. Why are we comparing the secured money of the world and unsecured cryptocurrencies? To determine how many benefits can be obtained with this money. Therefore, if suddenly the total capitalization exceeds all the money in the world, then it will be a bubble, since there will be no global goods for exchange. It turns out that the growth of both Bitcoin and other cryptocurrencies is limited to a certain extent. And it will not be possible to receive 600 times the same income as Ripple in 2017.

Cryptocurrencies can grow quite well.But at the same time, 100% of the world’s money will not be achieved, since this is absurd at such an early stage and the area of recognition of these technologies by states is at the starting conditions. Even 20% is a bit much, but 10% is quite doable. At the moment, you need to make money on the movement, but remember about money management. Use this ratio in your personal finances as well. Investments in cryptocurrencies do not exceed 10% of the account. And, of course, no futures, Forex pairs or leverage. I’m not talking about the cost of overnight rates on Forex, which reach 500% per annum. Real cryptocurrencies have a wallet number and can be stored without fees for as long as you like. I am often asked the question of how to buy other cryptocurrencies (altcoins) conveniently and at minimal cost.

And what is the difference between them?The difference is that Bitcoin is growing by a factor of 10, while some cryptocurrencies have shown growth of 600 times. That is, by investing 50 thousand rubles in a promising cryptocurrency, you could get 30 million rubles in one year. Agree, it is much more interesting for investors with small capital. You can earn a decent amount of money and risk less. At the same time, purchasing such cryptocurrencies does not require much time. I’m laying out point by point ways to buy altcoins. And also how you can save money.

1.So, the first thing I did was compare prices between the exchange and the exchanger. Let's take Stellar as an example. The coincap website presents the capitalization of all cryptocurrencies. You can change the sample from dollars to rubles and see that Stellar costs 22.22 rubles. In exchange offices, such cryptocurrency costs 38-45 rubles. That is, twice as expensive. It turns out that cryptocurrency needs to be bought exclusively on the exchange. The first point has been dealt with. You also need to buy real cryptocurrency, that is, one that can be stored for free for as long as you like without overnight fees. Let me remind you that the commission of Forex offices for this reaches 500% per annum. This means Bitcoin increased by 500%, the commission was paid 500%. The result is zero. This is the best case scenario. And you will get the opportunity not to pay all these commissions. What you need to do from the first point is nothing.

2.You cannot buy altcoins on the exchange for fiat (rubles or dollars), you can buy for bitcoins or parts of bitcoin (satoshi). This means that you will first have to buy bitcoins from exchangers. But the exchanger asks for your Bitcoin wallet number, so the first thing you need to do is register on the exchange. I chose the most convenient exchange, Binance, the tags are in Russian, registering an account is the simplest, enter the requested data and confirm your email. The advantage is that it does not ask for any passport data, any photographs or other additional data. Today it is the largest and most reliable cryptocurrency exchange. After registration, select Asset - Balance. Enter the letters BTC, then select the Deposit tag. We see the address of our Bitcoin wallet. And we copy it.

3.Now that we have the Bitcoin wallet address, we can go to the exchanger. There are many exchangers; when I sent a request for the first time, I was horrified because the exchanger offered to send money to the card to a private person. It turns out that these exchangers are still at the formation stage and someone processes payments from their website and sends bitcoins to your wallet in a semi-automatic mode. Next, we make an application for an exchange, choose where you are transferring from and what you want to receive (bitcoin) and transfer money, click on the exchanger’s website Sent. On average, transferring bitcoins via a crypto exchange takes from a few minutes to 20 minutes, plus the payment itself takes a couple or three confirmations along the way. One of the most profitable and reliable exchangers that I personally use is 60 cek referral link: https://60cek.org/?rid=15192952675780 Photo identification and identification of documents on this exchanger is not required. It is advisable to register on it immediately.

I call it "Cryptotet."

4.Now that the bitcoins have arrived in your wallet in Binance, you can also go to Asset - Balance, select the cryptocurrency of interest from the ones offered and buy it in Trade mode for your bitcoins. That is, the mechanism itself is simple; there is nothing complicated about buying real altcoins. This is 15 minutes without leaving home.

I hope the instructions were useful to you. Trade carefully; testing is best done on a small amount.

Let's move on to the list of cryptocurrencies (altcoins) for purchase.

1.The first part should consist of two main cryptocurrencies Bitcoin and Ethereum (ETH).The share of these major cryptocurrencies should reach 30-40% of all investments.

2.The second part is the top 10 cryptocurrencies from the site Coincap.io about 30%

3. The third part is the top 11-20 cryptocurrencies.

At the same time, it is not necessary to buy dollar crystals (for example, Tether USDT), as these cryptocurrencies do not grow, although they do not fall.

Let's move on to the list of cryptocurrencies recommended for purchase in 2020.

2020 is the emergence of new unusual cryptocurrencies and an increase in the potential of some later ones due to their development.

1. BTC is still relevant with a target of 50,000 USD. The first cryptocurrency will continue to grow.

2.BNB the development of the cryptocurrency market will primarily affect the development of the best cryptocurrency exchange.

3.WRX (WazirX) Indian crypto-exchange built into the Binance platform.And bought Binance, and therefore bought Binance, and thereforeThe population is very large and growing, the rupees will beMove through this system.

4.ETH waiting for the stage of significant acceleration.Many improvements of the second most important cryptocurrency will leadto disclose the cost.