OCO combines stop order with limit order on automatic trading platform, it is used by experiencedtraders to reduce risks.

In OCO trading (from English.One Cancel The Other) or “one cancels the other” – This is an instruction given when two orders are placed simultaneously. If one part of the order at the asset price is completed, the other part is cancelled.

How does an OCO order work?

OCO orders are often used in online tradingas a way to link a stop order (used to reduce losses) with a limit order (used to take profit). As soon as an asset reaches the target stop-loss price, another order should not take profit on the same asset, or vice versa.

For example, an investor owns 1ВТС, which incurrently trading at $ 12,960. He believes the asset is undervalued and expects the price to rise another $ 100. To ensure that he has taken profits, the investor places a sell limit order of $ 13,060. It also places a $ 100 trailing stop that will sell the asset if the price drops $ 100 from the current high. When the price rises to $ 13,060, a sell limit order is triggered, which will cancel the trailing stop.

What are OCO orders for?

OCO orders satisfy the need for fastactions on the part of the investor to take advantage of short-term market movements. For example, when investing online, a trader can place two orders at the same time and allow the broker to take the action and cancel the second action without requiring another order, making the transaction more efficient and faster.

This type of order allows traders to efficientlyhedge in the options market. This is beneficial for those who do not want to track the value of their investments on a daily basis, but want to buy or sell under certain conditions.

How to use OCO orders?

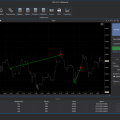

The ability to use OCO orders is usually built into the exchange interface. It is enough to enter the zone for the formation of your deals, open the drop-down menu and select "OCO".

Subscribe to ForkNews on Telegram