The explosion of decentralized finance (DeFi) is caused by the greed of investors, on top of whichprocessabsolutely not controlled in any way. This statement was made by the creator of the Yield.finance YFI project André Cronier at the Smart Contract Summit 2020. Recall that YFI has become a real sensation this year: the cryptocurrency has risen in price 1000 times in just a month and a half and now costs much more than Bitcoin.

Native Yield token.finance under the ticker YFI has indeed become a major hit this summer. Today the coin is valued at $ 34,000, while as early as July 18 it cost just $ 34. The peak of the rate was recorded on August 31 - it was $ 38,000.

The YFI cryptocurrency chart for a month and a half looks like this:

Tokens of many projects follow a similar path -although not on such a scale. It is this prospect of earning money that attracts people to the niche. Still, it’s unlikely that anywhere else you can invest 100 dollars and get 100 thousand after 45 days.

DeFi is out of control

Cronje noted that the main reason for the hypeWhat surrounds DeFi at the moment is the fear of many investors of missing out on big profits. To buy tokens, all they need is a couple of “success stories” about how much new cryptocurrencies have risen in price in a short period of time.

driven primarily by the greed of investors. They want to make money on the crazy growth of coin rates and therefore are investing in more and more projects. If at least one of them shoots like YFI, the investment idea can clearly be considered successful.

According to André, contain the rise in popularityprojects are not allowed. However, when the situation gradually returns to normal, truly valuable projects like Compound, Synthetix or Chainlink will still remain.

Co-founder of the Aave project Stani Kuleshov expressed another interesting thought. Here is his remark, as quoted by Decrypt.

«I am afraid of the rapid growth of DeFi protocols.It seems as if they are trying to accumulate all the wealth. They turn into banks - those institutions that the sphere of decentralized finance is designed to fight.

Let us remind you that DeFi is financial instruments based onbased on blockchain, which are an alternative to traditional banking services on a decentralized basis. With DeFi, you can issue loans, borrow coins, earn money on deposits from different platforms, participate in decentralized lotteries, and much more.

Also DeFi-platforms, including allowconduct trade transactions without any intermediaries like centralized crypto exchanges. The most popular of these is Uniswap, which makes it possible to exchange ether for any ERC-20 token.

Innovations in the field of decentralized finance will form the basis for the future of financial relations on a more global scale, says Synthetix founder Kane Warwick. Here is his comment.

«We are all at the beginning stagetransforming traditional financial systems into their decentralized counterparts. Everyone who is now involved in this process will receive a huge reward for their time and capital invested.

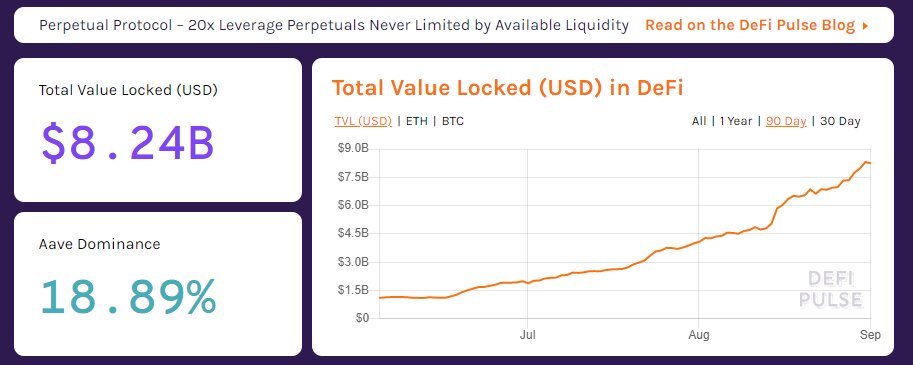

DeFi operates on the basis of smart contracts, andоценить размах роста сферы можно по объему средств, оперируемых этими самыми смарт-контрактами. По данным платформы DeFi Pulse, величина уже превысила отметку в 8.2 миллиарда долларов. Она растет огромными темпами: ещё в начале августа в DeFi было заблокировано чуть больше 3.5 миллиарда долларов.

The experts' comments are really relevant. The growth of the decentralized finance niche turned out to be truly unexpected and fast. As a result of this, a huge number of people started using decentralized exchanges and becoming familiar with other components of DeFi. And most of them are probably driven by the desire to make money, which is more than justified in the current situation.

Over time, the hysteria around the industry will becomedecline, because the niche will not be so new, and new projects will be launched less often - and bring not so much. In the meantime, we will have to endure and get used to the idea that now for a transfer in the Ethereum (ETH) blockchain or other tokens we may be asked for about $ 10.

5

/

5

(

1

voice

)