Bitcoin market sentiment analysis tools can provide many opportunities. With the rightIn use, they can allow traders and investors to assess whether the prevailing moods on the cryptocurrency markets (and among their participants) are bullish or bearish.

Due to the fact that the market is currentlyfluctuates between bearish and bullish status, the time has come to take a look at three popular tools for analyzing sentiment in the bitcoin market.

Below we will look at how they work individually (and collectively), and explore how to use them to make smart trading decisions.

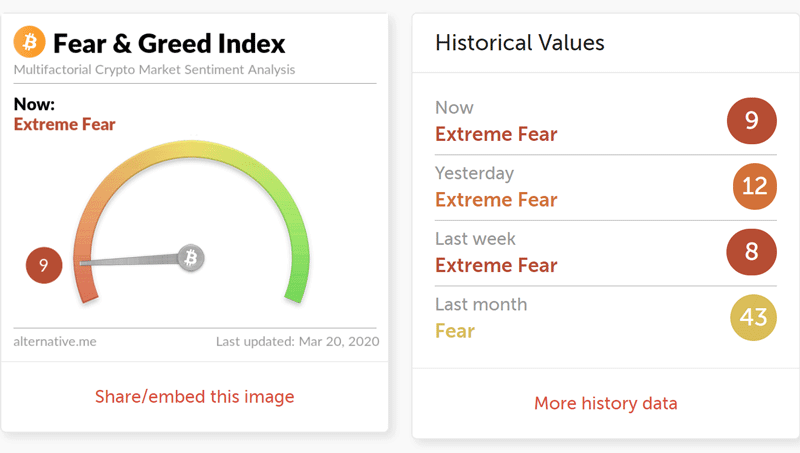

Index of fear and greed of cryptocurrencies

Crypto Fear & The Greed Index, or cryptocurrency fear and greed index, is perhaps the most popular sentiment indicator currently used in the Bitcoin market.

It was proposed by the Alternative.me team that created a solution very similar to CNN's fear and greed index.But instead of measuring the mood in the stock market, as it doesCNN tool, it measures the setting of crypto-investors.

The index of fear and greed of cryptocurrencies shows what investors feel in the present - courage or fright.The index uses a shot that moves from left to right and values from0 to 100. The lower the value, the more fearful they feelThe higher the value of the index, the more greedy they are.

Factors that determine the value of the index include volatility, market momentum and trading volume, as well as social media sentiment and bitcoin dominance.

How to use this index?

The index of fear and greed is very easy to understand anduse. If it shows investor anxiety, then this is probably a good time to buy. And when people begin to show signs of greed, you might consider selling your asset.

When the index of fear and greed falls below 20, fear prevails, and a value of 80+ can mean that smart investors are selling and market confidence is growing.

Bull and Bear Index

Bulls & Bears or index of bulls and bears,created by Augmento, is a social media sentiment indicator that shows the presence of bullish or bearish talk about Bitcoin (BTC) on platforms such as Twitter, Reddit and BitcoinTalk.

The index shows a value from 0 to 1. This value is calculated using a classifier that is trained in specific cryptojargon. This tool analyzes conversations in social networks and is sensitive to 93 different moods and topics.

How to use this index?

The bull and bear index is an indicator of the mood of social networks, the purpose of which is to assess the mood of investors by analyzing cryptocurrency references.

A low score close to zero indicates thatBitcoin investors behave like a bear, and a high indicator close to 1 shows that bullish mood prevails in social networks now. If you believe in the wisdom of the crowd, then with an increase in the index of bulls and bears, you should buy bitcoin, and if you fall, sell.

Bitcoin Sentiment Index

Bitts sentiment index developed by BittsAnalytics, is another indicator of moods in social networks, which is designed to give an idea of what crypto investors think at one time or another.

The indicator value is calculated using machine learning tools that scan messages on social networks where Bitcoin is mentioned.

This index can give you a uniqueinformation, although critics argue that assessing the viability of a given instrument is difficult because it is not very clear which factors are taken into account in the calculation process.

How to use this index?

The Bitcoin sentiment index is a little more complicated than the index of fear and greed and the index of bulls and bears.

However, most traders are ratherall agree that using it is not so difficult. When the indicator line falls, the market sentiment becomes bearish. When the indicator’s sentiment line rises, investors begin to express more bullish sentiment in social networks.

How to trade bitcoin using sentiment analysis tools?

Ultimately, it’s important to keep in mind thatmarket sentiment does not always determine future price changes. Even if, for example, all the indicators mentioned indicate that now is the time to buy bitcoin, still the price may suddenly fall due to completely different factors.

Therefore, the indicators of bitcoin mood ideallyshould complement a number of many other tools in your investor arsenal. Using them as the sole basis of your trading strategy is quite risky.

So, if you as a trader create a wide range of tools, this will help you get more professional and more informed assessments of the further market movement.

Thus, understanding one or moreThe indicators discussed above can be useful when you try to predict price movements based on trading data obtained through technical indicators.

As they say, knowledge is power. And the more you know, the more you can potentially earn!

</p> 5

/

5

(

1

voice

)