Good afternoon friends! Yesterday I was on the road, I couldn’t quickly post a post about the logic of purchases using BTS, about whichspoke earlier…

So according to the delta analysis - from the buyer's side - what we have:

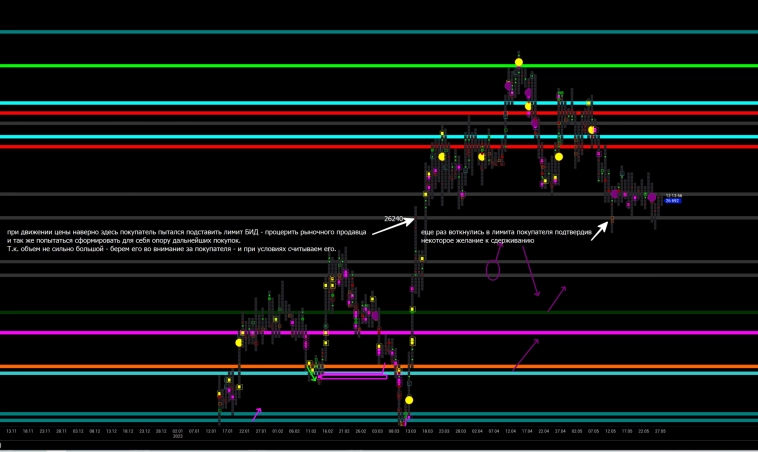

The previously marked op day area is 26240, the buyer who threw bids:

In continuation of this thought, a small digressionto understand this market process: When the price moves upward, the buyer who moves the price places a bid (a limit order to buy during the CD move) to try, hold the price - and at the same time check the market seller - who will sell at the market at this bid, and if the price turns out later above this bid - we understand that the seller was insignificant and will perceive this bid as an action to drive the price on the part of the BUYER!

full size screen

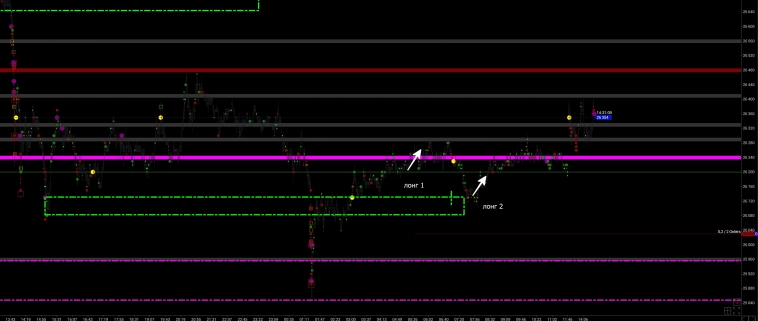

Next, we move on to M1, and also remember the post from May 23, and the place of the buyer of the M1 moment who reversed the price - namely, in conjunction with D1 - 26240.

When the price returns to this place, it will be most profitable to buy, because. an imbalance of power has arisen towards the buyer too, look at the logic of M15.

Those.It turns out that before the daily area of 26240, a liquidity collection is formed on the buyer’s side in the form of a set of bids, i.e. is trying to hold back - whether it will work is a question, but this is the action of the buyer in the buyer's area, so I repeat - the purchases will be more reasonable.

According to M1, you should read the chart and observe the presence of demand from the buyer in his area. I paint in detail what happened in the screen.

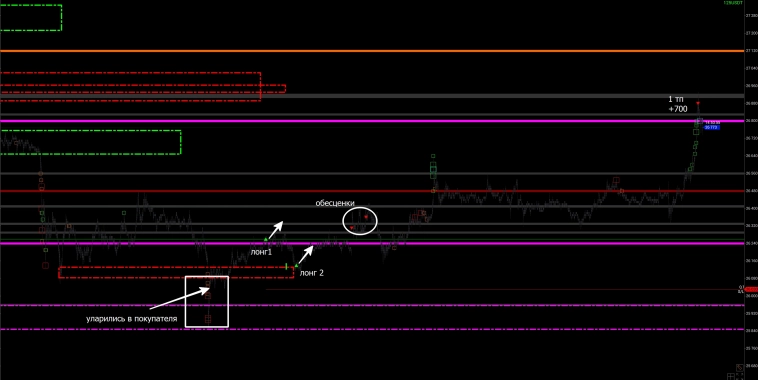

Trade at a point in time:

Full screen

And the result is +700 ticks I closed the first part. Closed in front of the local seller's place. In general, I think it worked well:

Full size screenshot.

Understanding what is happening on the daily D1 chart -You can enter and take away potentials of 1 to 5 on average, even if you are working against the main team. Seeing this balance of power makes it possible to take trades from 1 to 10 and higher. This is how I work: I enter exactly, then I exit to the bookkeeping account upon closing 50 percent of the position from the stop size, and even if I am then hit by the stop, I only receive expenses in the form of a commission. Then it’s a matter of reading - seeing the place and working out the power of the moment, you already compare your risks, try on the previously designated places.

Now I will watch more in the market because... I’m waiting for news on June 1-5 regarding the US national debt.

A more global balance of forces is laid out on the YouTube channel - for the seller it remains up to 31800. The buyer is 25120-24560, and 22800 and 21800. But these are the most senior forces.