Article Reading Time:

6 min.

The rise in prices for cryptocurrencies in the first four months of 2023 gave way to a decline in May, which turned into a sideways trend against the backdrop of certain events.

Bitcoin

In seven days, from May 12 to May 19, Bitcoin rose by0.35%. The largest increase was observed on Wednesday, May 17 - 1.36%, and the largest drop was on Thursday, May 18 - 2.14%. Overall, BTC was in the range of $25,800-$27,666 last week.

Source: tradingview.com

The main reason for any surges inThe cryptocurrency market is a situation of uncertainty with the government debt ceiling in the United States. So far, American congressmen are continuing negotiations, but no visible progress has been achieved. This increases the anxiety of crypto investors, as a very specific prospect looms - default.

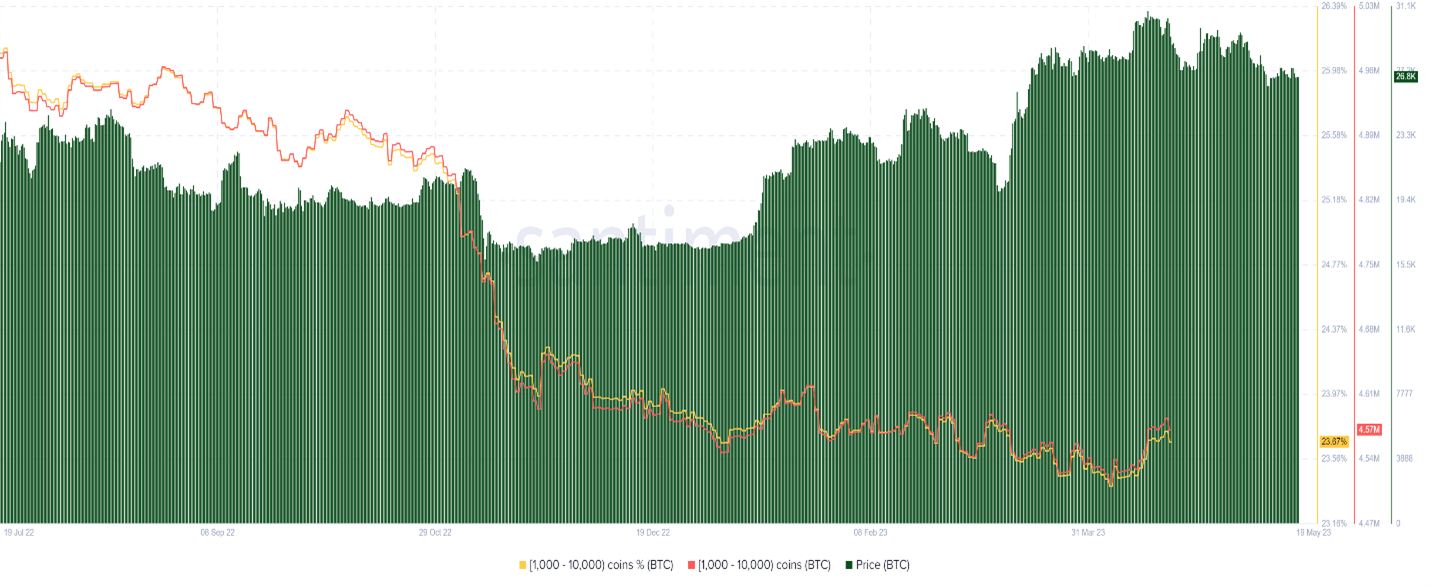

At the same time, large players (those who haveaccounts from 1,000 to 10,000 BTC) this development of events is clearly not confusing. They have been increasing their positions for the past five weeks. This can only speak in favor of the fact that institutional investors expect the price to rise. They won’t buy only to end up at a loss, will they?

Source: app.santiment.net

According to technical analysis, Bitcoin is insideways. It is important that during the week it broke through the support level of $26,500 several times, but closed higher. Thus, the bears were unable to reign in the market. In case of growth, the nearest resistance level should be the current week's high at $27,666.

Source: tradingview.com

The fear and greed index remained virtually unchanged over the week, dropping from 49 to 48. It is still in the neutral zone.

Ethereum

</p>Ethereum price has changed over the weekslightly - from $1,808.5 at closing on Friday, May 12, to $1,810.3 as of May 19. Thus, the growth was less than 0.1%. A special feature of this week was the lack of volatility in ETH: on all days the price changed by less than 1.5%.

Source: tradingview.com

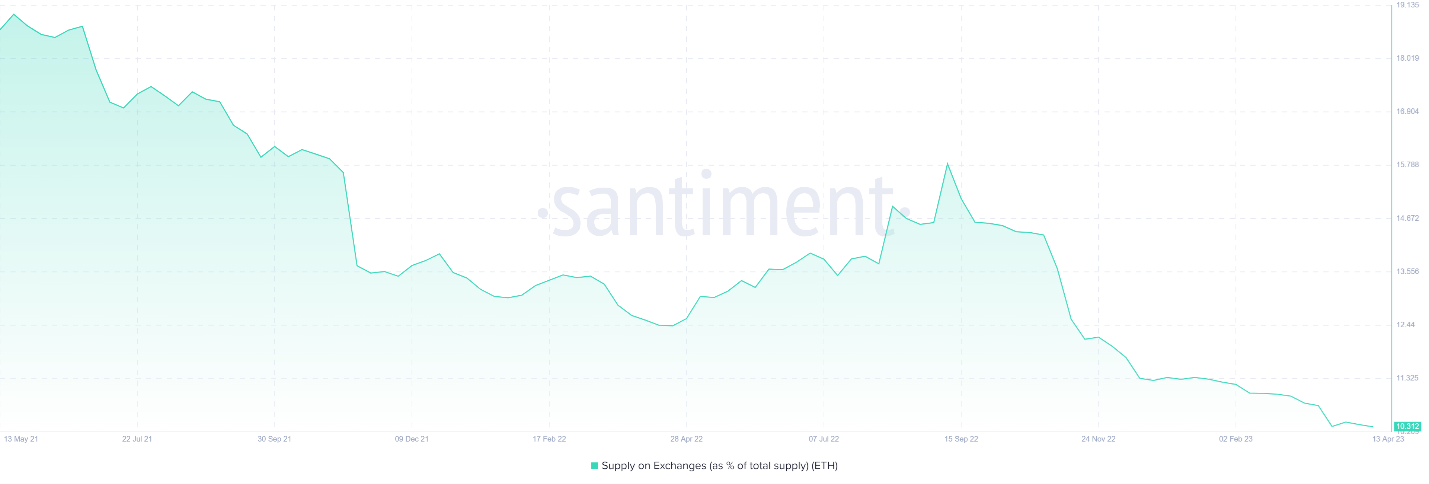

According to the analytical platformSantiment, the decrease in activity is due to the fact that the amount of cryptocurrency held on exchanges is only 10.1%. This is a historical minimum for broadcasting since 2015.

</p>“While Ether dropped to $1,780Today, we see how supply on exchanges continues to decline. The percentage of Ether on exchanges is at its lowest level since public trading began in 2015, at 10.1%. This is essentially an all-time high for assets held in OTC wallets.”

Source: app.santiment.net

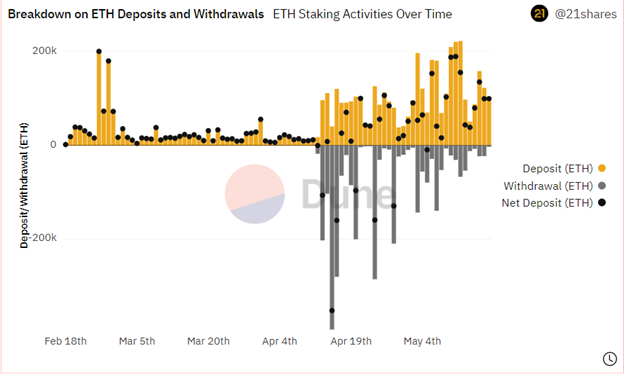

It is likely that crypto enthusiastsThey now prefer not to try to make money on cryptocurrency exchange rates, but rather participate in staking. The amount of Ethereum staked still far exceeds the amount withdrawn, with a difference of more than 650,000 ETH over the past seven days.

Source: dune.com

From the point of view of technical analysis, the second cryptocurrency by capitalization is sideways. The levels remained unchanged from last week: support – $1,750, resistance – $2,000.

Source: tradingview.com

Polygon

Over the past week, the price of Polygon (MATIC)changed slightly - the increase was only 0.6%. Cryptocurrency has been falling in price globally since February 18. Since then the decline has been more than 40%. The most interesting moment over the past seven days was the price drop on May 16 by more than 30%. However, this was only a fleeting phenomenon.

Source: tradingview.com

While the price of MATIC is falling,platforms are doing well. According to the NFT Tech platform, which promotes Web3 technologies, Polygon is the most popular blockchain for brands by May 2023. It accounts for 41%. By this indicator, it recently overtook Ethereum, said Polygon CEO Ryan Wyatt.

In addition, the platform is going to develop andenvironmental agenda. This week it became known about Polygon's agreement with the startup Solid World, which provides financial and technical tools to combat climate change. According to Solid World CEO Stenver Jerkku, a forward pool of carbon credits will be created where emissions permits will be sold at prices determined by an automatic market maker. Carbon credits are emission permits.

</p>But from the point of view of technical analysisThe picture is relatively bleak. MATIC's price is below both its 50-day (green) and 200-day (orange) moving averages. In addition, the first recently crossed the second from top to bottom, which means that a so-called dead cross has formed, which most likely indicates a further decline. The support levels are $0.7 and $0.6 - the minimum of the current week. Resistance level – $1.05.

Source: tradingview.com

Thus, while in the cryptocurrency marketthere was a lull. The price of Bitcoin, Ethereum and Polygon changed by less than 1% over the week. The main reason for this is general macroeconomic uncertainty.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.