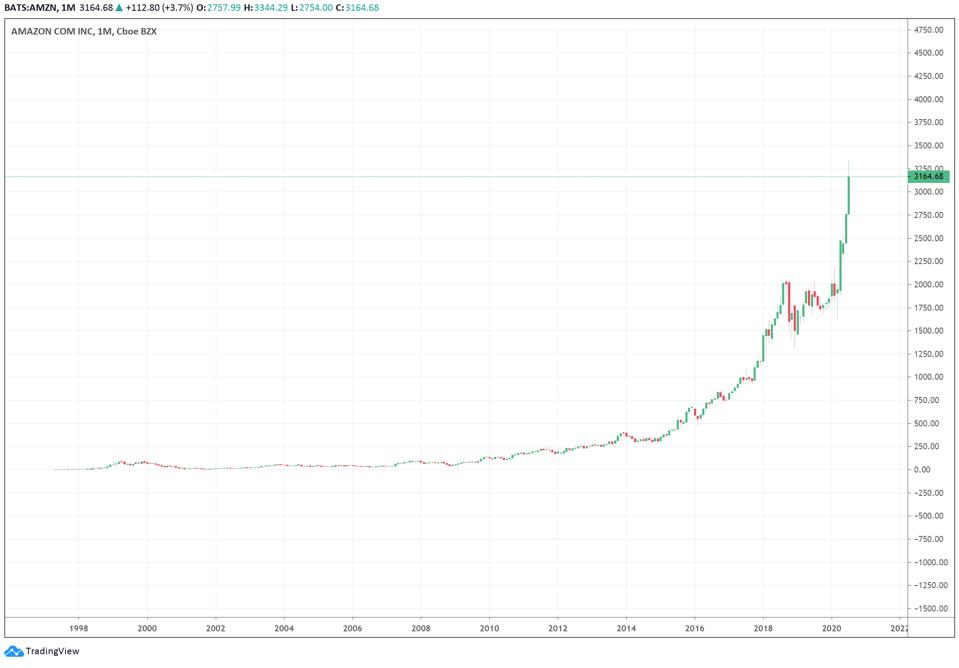

Cameron Winklevoss, billionaire and co-founder of the Gemini crypto exchange, believes that “not having Bitcoin now — Thisworse than not investing in Amazon.” Amazon shares rose from $250 to $3’160.

One of the Winklevoss twins said in an interview with Forbes:

“Not investing in Bitcoin today would be a worse investment decision than not investing in $APPL, $GOOG, $AMZN and $MSFT in the early 2000s.”

We consider his arguments on the facts.

Comparison not by class, but by situation

At the same time, Cameron — not the first influentialan investor who makes a comparison between Bitcoin and Amazon. In November 2018, when the price of Bitcoin fell to $4,000, venture capitalist Fred Wilson compared BTC to Amazon:

“Thus, although crypto asset priceshave declined by 80-95% in dollar terms over the past year, they can and probably will decline. "Amazon shares were down 80% in the bear market when the bubble burst and were losing half their price when they were issued, they were peaking again two years later."

For a correct understanding, Bitcoin and stocks arevarious assets. Bitcoin is perceived as a new asset and its position is being contested. While some view it as a store of value, others still view it as a risk asset. At the same time, both the legal and investment position of the shares are completely clear.

But there is one thing in common between these assets - each of them was at one time considered an instrument of speculation.

In the early 2000s, after technologicalbubble, the market was skeptical about the survival of technology stocks. After Amazon topped at $90, the stock price dropped to $6 before recovering. In the sense that Bitcoin is in its early stages of development as an asset and technology, there are similarities to Amazon.

Wilson said two years ago:

“Amazon peaked in the internet bubble at the end of1999 at about $ 90 per share. Nearly two years later, in the trough, you could briefly buy Amazon at $ 6 a share. And then, until the end of 2007, Amazon was trading above the 1999 highs. But, of course, this is all ancient history, and if you look at the Amazon chart today, all this turbulence is now barely noticeable. "

From June 27, within four days, the price of Bitcoin rose from $8,800 to $12,000, an increase of approximately 35%.

</p>Winklevoss named the reasons for the rapid growth of BTC:

"Unlike 2017, this rally is being fueled by both bitcoiners and inflation hedgers and DeFi on Ethereum investors who are afraid to miss out on profits."

Cameron's words about the activity of existinginvestors (bitcoiners) are confirmed by data from the analytical company Glassnode, which we recently wrote about. From blockchain analytics it is clear that not only old whales are increasing their assets, but new hodlers are also entering the crypto market, whose assets exceed 1,000 BTC.

FOMO returns to the crypto market

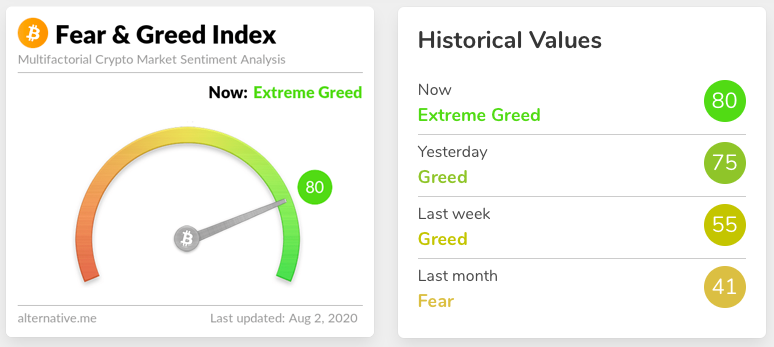

In support of the view that fear is the driving forcestrength, it is worth noting that the last time Bitcoin rose 3.5 times and reached a new all-time high of $20,000, the Bitcoin Fear and Greed Index was at its peak. According to data from Alternative, the metric now indicates “extreme greed”:

As a rule, it is new investors who are afraidmiss an investment opportunity, buy an asset, raising its price higher and higher. Now, according to Cameron Winklevoss, a similar story has happened to a new area in cryptocurrency - decentralized finance (DeFi), which is pulling Bitcoin along with it.

Means of protection

In support of the inflation bailout idea, billionaire Paul Tudor Jones also said in May that he views Bitcoin as a hedge against inflationary US monetary policy.

Also, it is a fact that countries throughoutunprecedented amounts of freshly printed money are being allocated around the world to avert an impending financial crisis, and some of this money goes into bitcoin, devoid of fiat inflation.

It's been 11 years, but Bitcoin is still in its early days.growth stages. Improved perception of Bitcoin as a store of value and potential safe-haven asset could support BTC's long-term momentum, confirming Cameron Winklevoss's forecast.

</p> 5

/

5

(

1

voice

)