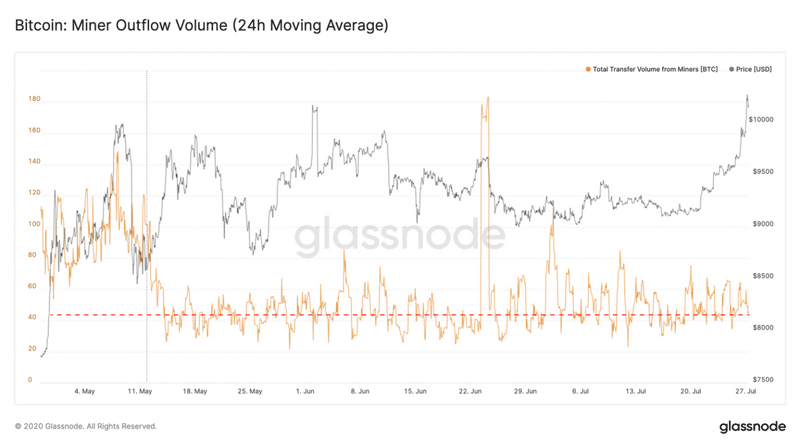

According to the observations of Glassnode specialists, miners walk most of the mined bitcoins after overcomingThis behavior is seen in the face of a spike in the flow of coinscentralized exchanges to the highest level in the last three months.

The GNI index, which characterizes the state of bitcoin blockchain based on a number of network metrics, rose by 8 to 70 points.The biggest contribution was made by the improvement of the sub-index of sentiment by 34 points, due to the increase in purchases of BTC walkers.The improvement in the consolidated indicator was also influenced by the growth of liquidity components due to theinflow of the exchange and the growth of onchaine activity.

#Bitcoin inflows into centralized exchanges have started to significantly increase.

We are currently seeing the largest hourly net flow spike (24h MA) in over three months.

Chart: https://t.co/mWByVkVUEA pic.twitter.com/MswxZZUeBL

— glassnode (@glassnode) July 27, 2020

GNI is in the bullish region for the ninth week in a row.Last week the index showed one of the highest values this year.

With $BTC breaking $10k and on-chain fundamentals growing stronger, #Bitcoin hit one of its highest GNI scores this year — pushing deeper into the bullish regime.

Read more in the latest Week On-Chain? Https: //t.co/ftrbRbz1kE pic.twitter.com/SELOsY3Vks

— glassnode (@glassnode) July 27, 2020

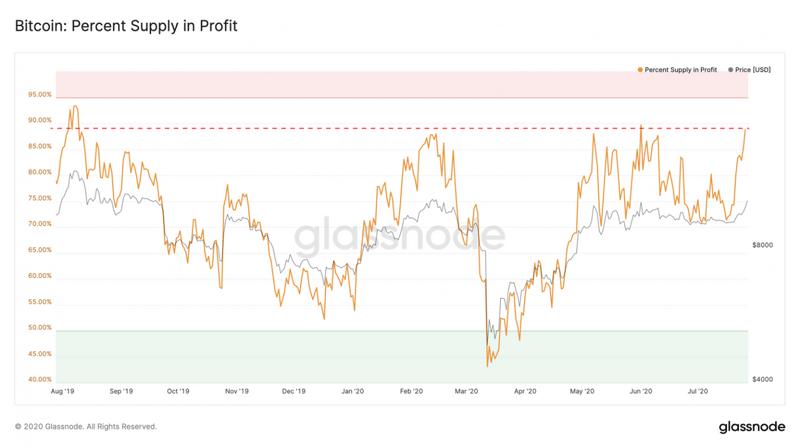

Researchers refrained from predicting after bitcoin overcame a psychological milestone of $10,000.At the same time, they noted that early signals of onchaine-state createAt the time of writing, 89% of the BTC purchased were profitable for their holders.

Miners are in no hurry to get rid of the minedcoins, despite the sharp influx of bitcoins to centralized exchanges. According to experts, this may indicate their confidence in the potential for further growth.

Note that one of the reasons for BTC’s growth to a new high since September 2019 was the massive liquidation of shorts on Bitcoin derivatives. Their total volume exceeded more than $500 million.

</p>Rate this publication