The decentralized exchange Uniswap has replaced deposits and the order book with an automated market maker,who chooses the most favorable exchange rate.

How does Uniswap work?

Uniswap – it is a decentralized protocolto automatically provide liquidity to Ethereum token trading pairs. Each trading pair has a special smart contract that stores reserves and rules for changing these reserves. Anyone can become a liquidity provider by investing tokens in a smart contract and receiving pool tokens in return. These pool tokens track the liquidity provider's share of the total reserves and can be exchanged back to the underlying asset at any time.

Uniswap charges a fee of 0.30% on alldeals. When a liquidity provider returns its tokens from the pool, it receives a prorated amount from the total fees accumulated when its funds were locked in the pool.

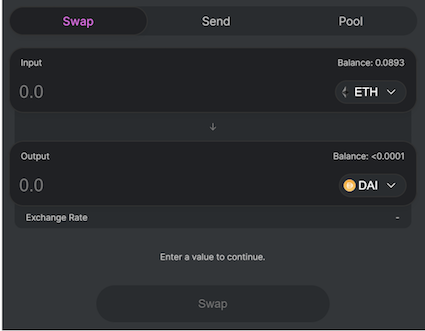

The Uniswap interface allows you to trade tokens, send tokens to another address through automatic replacement, and add or remove liquidity from pools.

Adding liquidity via Uniswap

To start providing liquidity on UniswapA Web 3 wallet is required (Metamask, Trust Wallet, Mist, etc.). In this case, you need both ETH and the target ERC20 token (for example, Dai). They must be in the same wallet. Using the "Exchange" function, you can directly exchange ETH for Dai.An important rule:Only pairs of tokens with equal dollar values can be contributed to pools (for example, $200 in ETH and $200 in Dai).

Next, you need to go to the “Pool” tab andMake sure “Add liquidity” is selected at the top of the page. The asset to trade will be automatically selected in the top field. The asset you want to receive must be selected in the lower field.

Next, you need to select the number of tokens foradding liquidity to the pool. The corresponding ETH amount will automatically appear in the upper field. The current exchange rate and pool size will be displayed at the bottom. Click on "Add liquidity" and confirm the transaction notification through your wallet. From now on, Uniswap will automatically process the transaction and update the balance of the specified wallet.

After confirming the transaction in the blockchain, you canview the volume of provided liquidity ETH and DAI, as well as the percentage of your pool. This liquidity is used when users make ETH-DAI trades on Uniswap, which means your ETH to DAI ratio may change over time, but the dollar value will remain constant.

With every provisioning transactionliquidity provider, you automatically receive Uniswap liquidity provider (LP) tokens. These tokens track your contribution to the pool and are used to distribute your share of the transaction fees accumulated over the time period for which you provide liquidity.

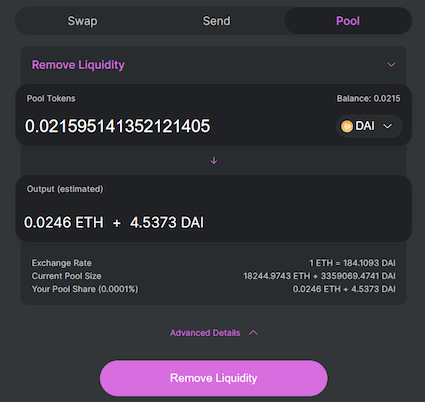

To remove liquidity and getreward, on the "Pool" tab in the drop-down menu select "Remove liquidity". Select the ERC-20 token for which you have provided liquidity and the balance shown above will be equal to your number of LP tokens.

Below you will see the calculated result, whichincludes your share of accumulated transaction fees. The ratio of ETH to DAI may differ from the amount you deposited due to transactions made by other users. Click on "Remove liquidity" and confirm the transaction notification.

After confirming the transaction on the blockchain, you will receive the ETH and DAI withdrawal to your wallet, the LP tokens will be burned, and your pool share will return to 0.

Subscribe to ForkNews on Telegram