Friends, welcome!

Warm your bones a little on the beaches of Antalya and Alanya, as well as study the life and decorationIt is time to return to their ancient peoples of Cappadocia, who inhabited underground cities and caves... currency pairs.

(If anyone is interested in reading notes about the holiday, you are welcome: https://vk.com/wall279557_6224)

Last week, Hachiko finally waited for the start of an upward correction in the American #DXY index.

This coincided with the publication of the protocolsMHIF on Wednesday. However, it is impossible to say that the Fed’s “minutes” contained anything new or any positive notes - the situation remains unchanged. With all the new stimulus packages being approved, the printing press is running non-stop. Inflation is steadily creeping downwards, and interest rates remain where they are, according to the tickets purchased (printed by the Fed). It looks like this performance will last for more than one act and there is no happy ending in sight. Summarizing what has been said, we note that the publication of the “minutes” did not provide fundamental reasons for the growth of the dollar. But don’t forget about technical correction. Still, not all greenback sellers have nerves of iron and stop valves of steel – periodic taking of profits from the sale of dollars before important news provokes that same technical correction.

There is only one question - how serious this rollback will be, whether it will degenerate into an index reversal, at least within the medium term.

Now the key outpost of bears islevel 93.90-94.00. At this "latitude" is the trend line, postponed from the top of May 18, plus psychological and historical levels. If the bulls manage to break this point of resistance, then targets at 95 and 96 figures will open. But let's not run ahead of the locomotive and wait for the price reaction when approaching this mark. For the bears, this is also a good chance to seize the current initiative and launch an offensive at the 92nd mark.

Princescreen in the best extension can be viewed here:

https://vk.com/wall-75313_4092

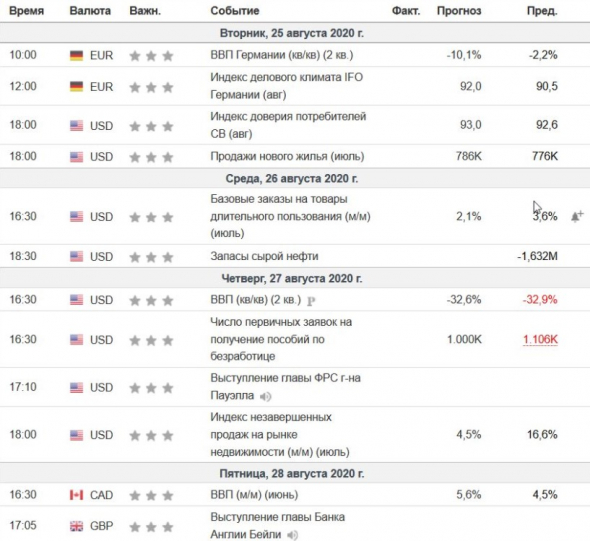

In addition to the technical picture, do not forget about the market fundamentals, especially since this week it will be quite intense:

Of particular note are Q2 US GDP and Powell's speech scheduled for Thursday.

They can either support the upward impulse of the dollar or lower it below the current waterline.

Moreover, a greater bet can be placed not even on Mr. Jerome’s rhetoric, but on actual GDP figures.

The values better than the forecast may well be enough for dollar bulls to storm new heights. So we stock up on popcorn and wait for the data.

Friends, you can see the forecast for the rest of the currency pairs, as well as for # bitcoin, on our morning webinar:

Good luck to you and make only informed trading decisions!