On-chain metrics show that older «old» coins are selling off as the price of BTC rises, indicatingBut while this trend may bealarmingly, historically it is an extremely bullish signal.

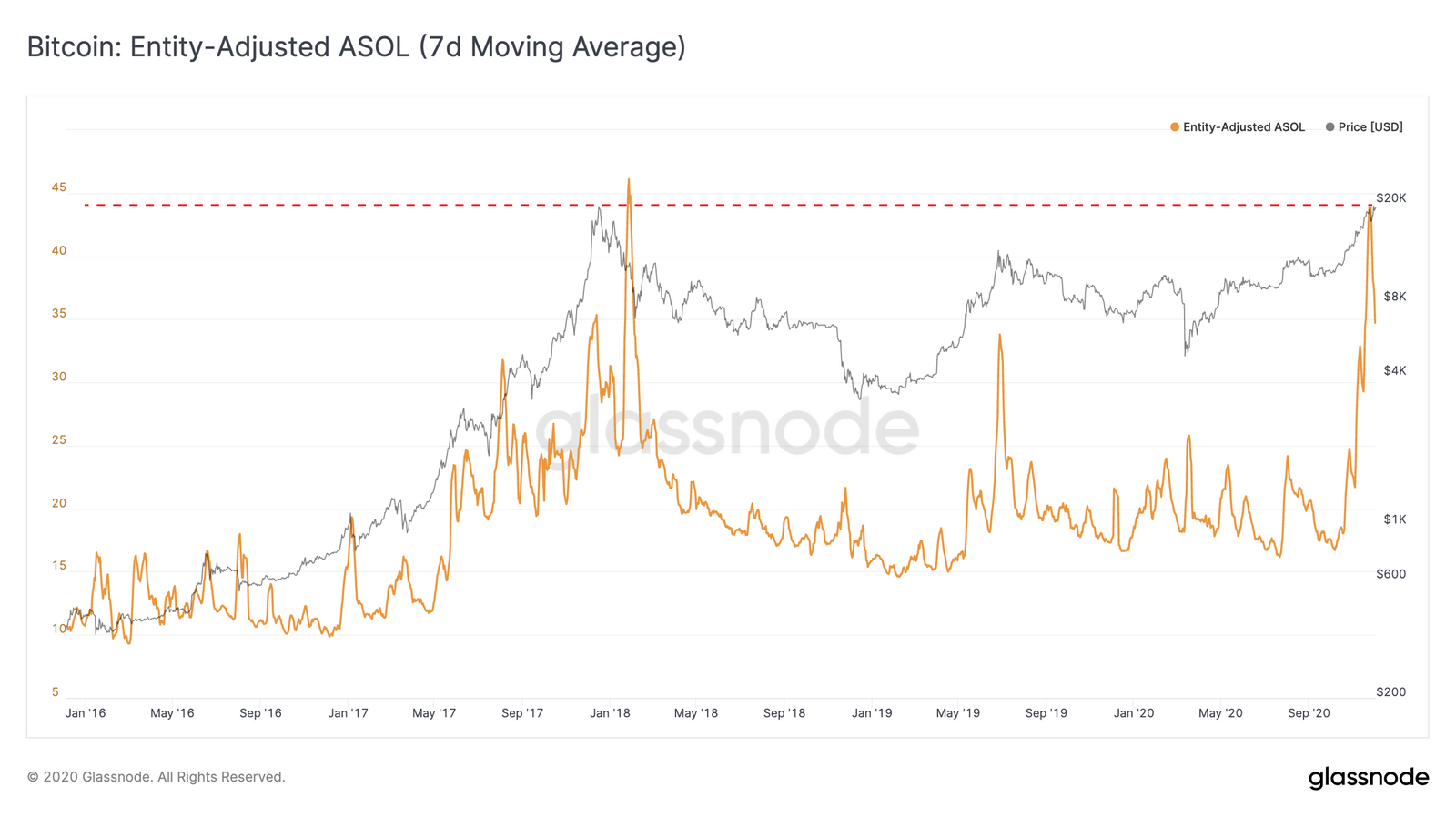

Entity-Adjusted ASOL indicator (adjustedby users, the average lifespan of a spent output) from Glassnode shows that when the price of BTC rises, older «old» coins.

During the last rally, more «old» coins (Glassnode Studio)

ASOL indicator shows average agecoins transferred in transactions. Entity-adjusted ASOL is an improved version of the indicator, which does not take into account «internal» transactions between different addresses assigned to the same user or company. That is, the user-adjusted ASOL more accurately reflects real economic activity and provides better signals compared to the regular version of the indicator, based solely on UTXO. When BTC reaches high levels (like what we are seeing now), older coins begin to move, which could signal profit-taking by longer-term Bitcoin holders.

In this analysis, we will try to take a closer look at the behavior of long-term investors (here: holding their bitcoins for at least 155 days) to see if they are truly capitulatingat current price levels and what it can mean for the market.

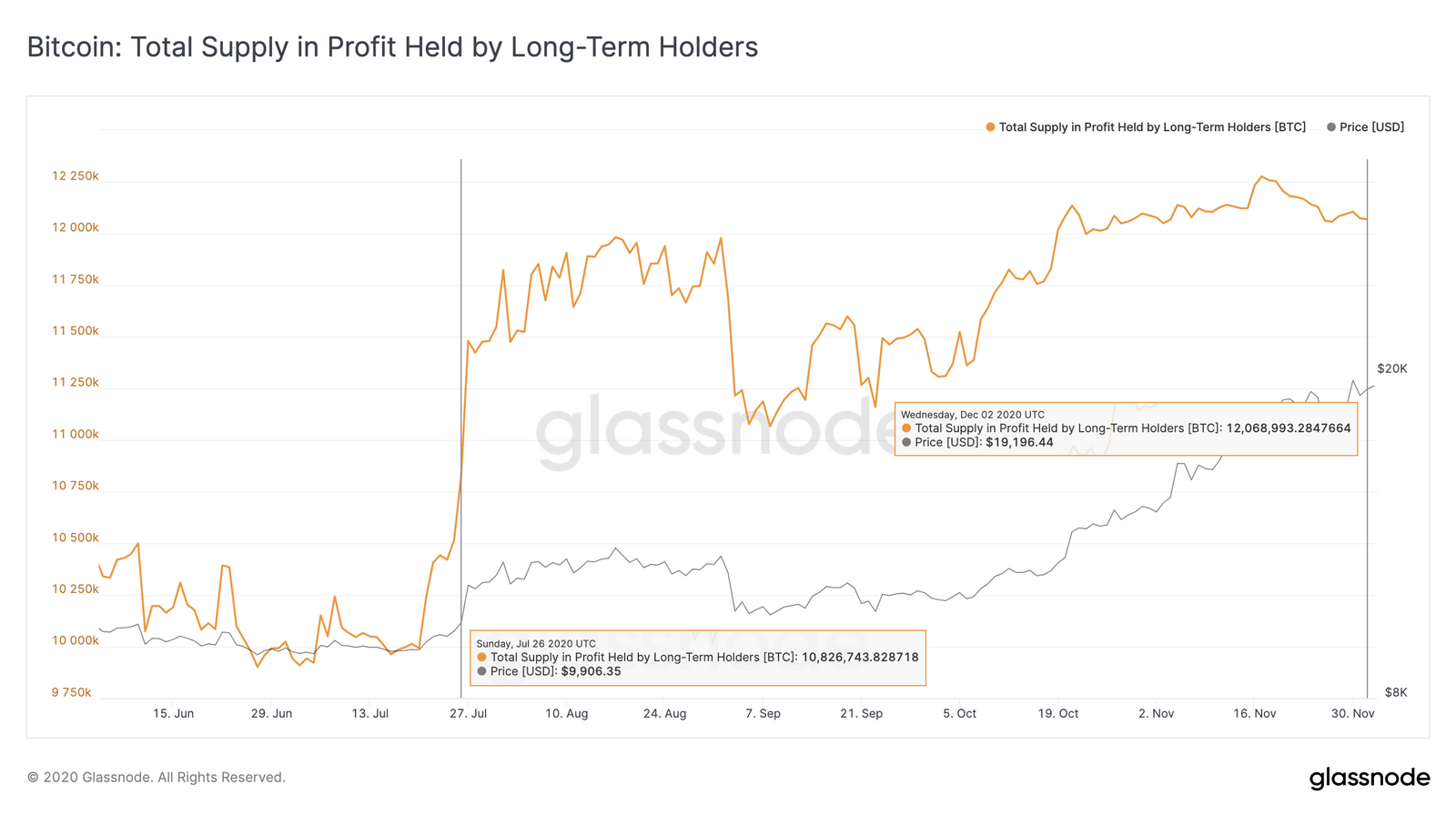

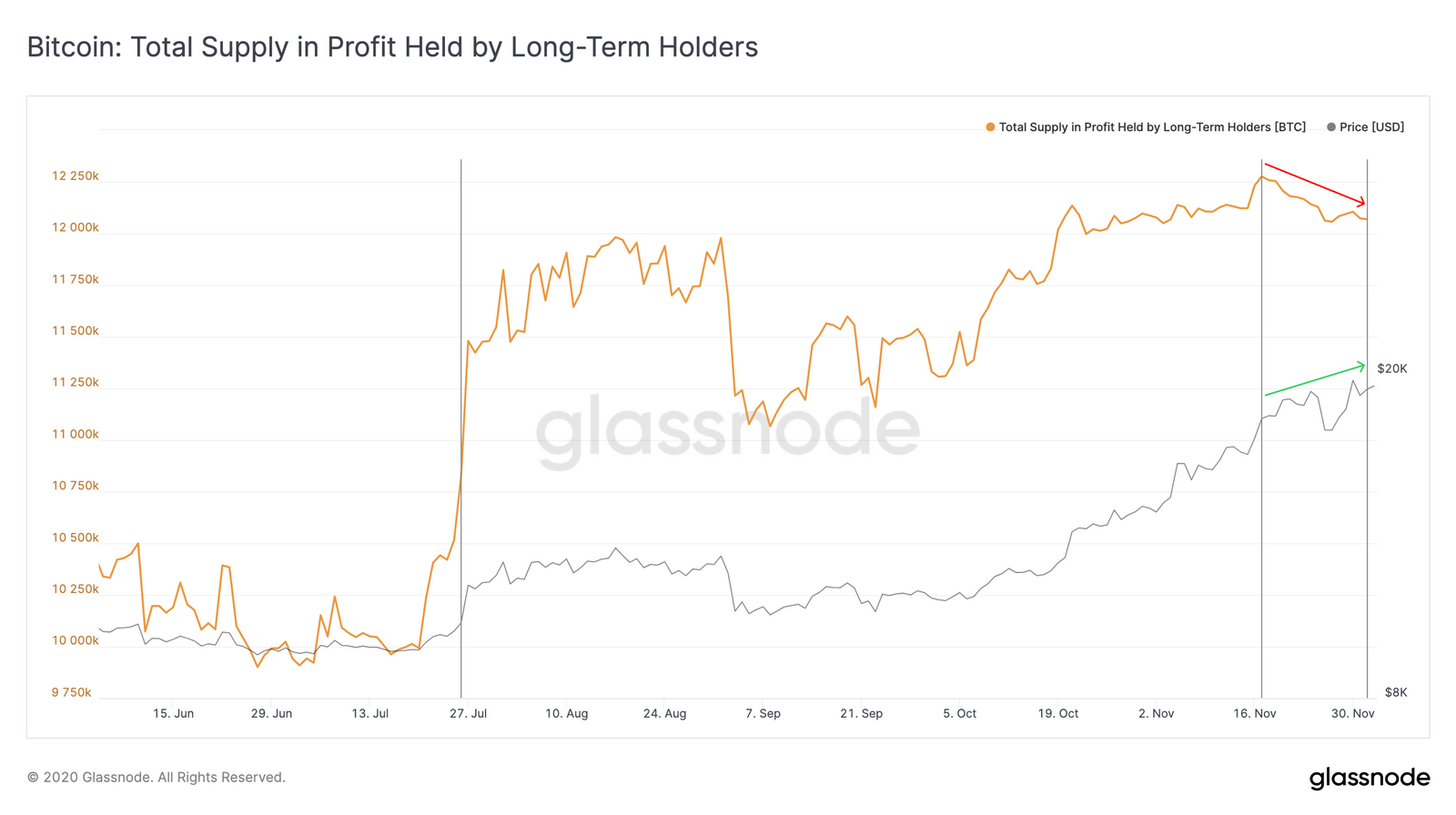

The number of long-term and profit-held coins is decreasing

When the last time the price of BTC was below the $10,000 mark (July 26, 2020), the number of bitcoins with profits held by long-term holders was 10.8 million.Since then, the price has almost doubled, but the number of long-term and profit-held BTC has increased by only 11.5%, to 12.1 million.

The number of long-term and profit-held BTC stagnated despite continued growthPrices (Glassnode Studio)

Although the generalAmountprofits increased due to a sharp rise in prices,Quantitycoins in profit did not grow that muchsignificant, indicating that the majority of long-term holders purchased their BTC below the $10,000 mark and held it for most of the latest rally. However, the growth of ASOL at the end of November suggests that some long-term owners have stopped «walking» their BTC and began to take profits.

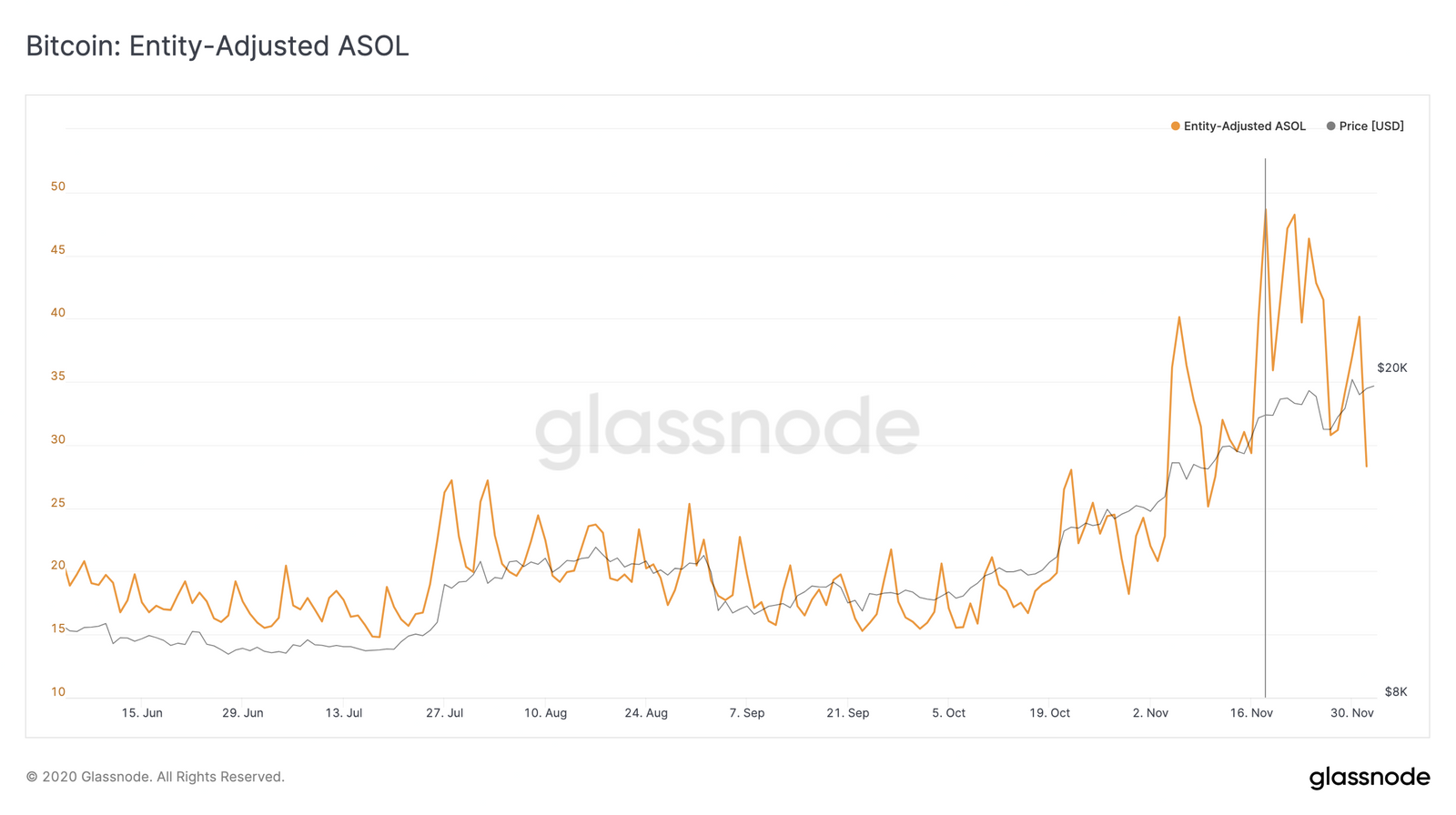

Entity-adjusted ASOL reached a local peak on November 18th, when the most «old» coins (Glassnode Studio)

This is confirmed by the total number of long-term and long-term holding coins, which peaked at $12.3 million on November 17, when the price of BTC was about $17,670.Since then, the price has increased by 9%, but the total number is long-term and with the profit of the held coinsdecreased by about 200,000 BTC.

After the recent surge of ASOL the number of long-term and profit-held coinsshrinking, even as prices rise (Glassnode Studio)

This confirms that a significant amount of BTC held by long-term owners was indeed sold at the end of November since then, despite the increaseprices, the number of long-term and profit-held BTC decreased.

Selling long-term holders is a bearish signal?

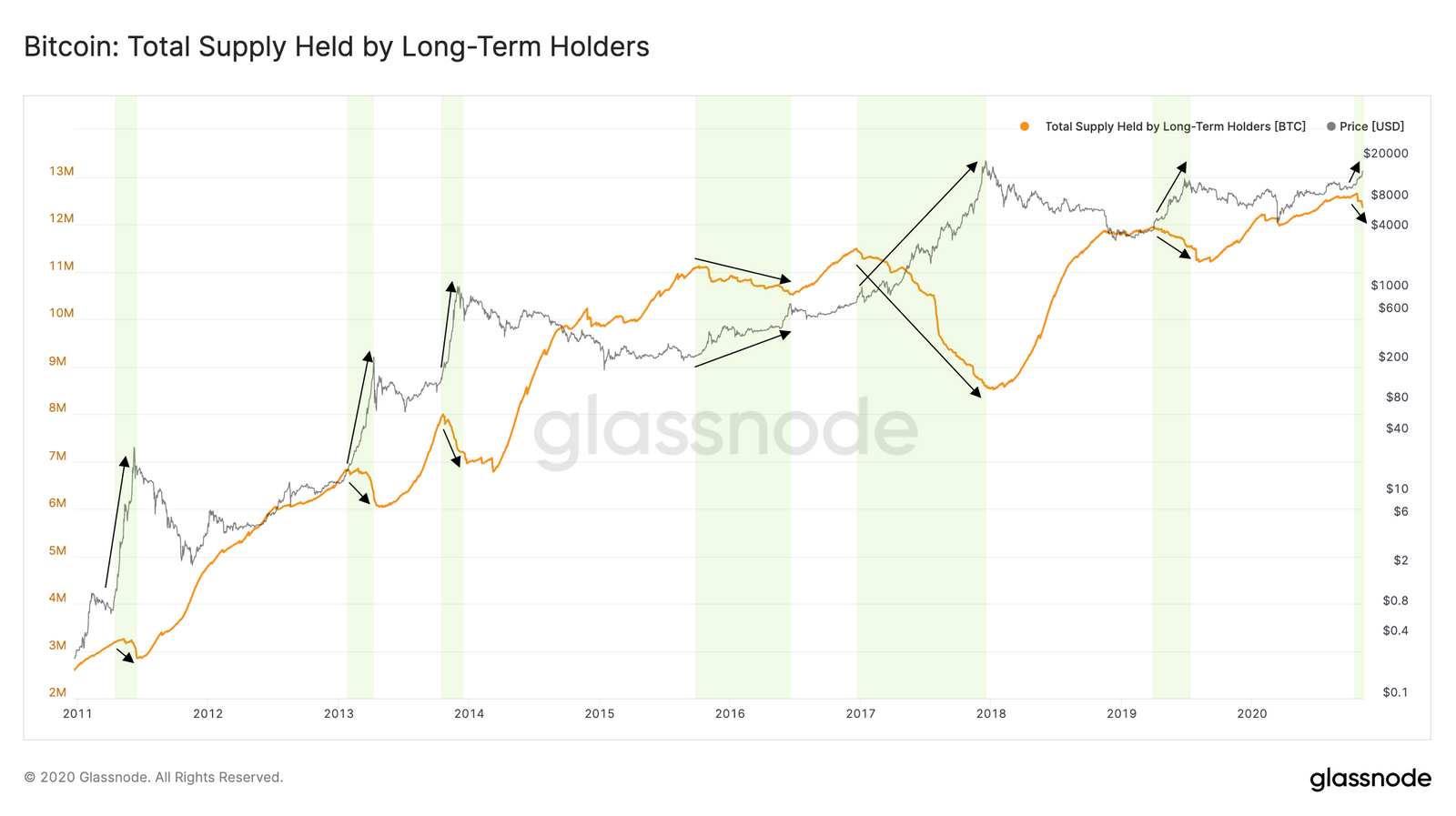

So, we have established that part of the long-termholders have actually sold their coins and taken profits recently, but is this a bearish signal? In short, no. In fact, historically long-term holders sold coins and took profitsbeforebull rallies and during them.

As a result of this trend, the total number of coins held by long-term owners - and held at a profit, respectively, is usually reduced long before the market peaks.

The total number of coins held by long-term owners usually begins to expire before the start of a full-scale bullish rally (Glassnode Studio)

This trend can be intuitively explained by the fact that long-term owners, fixing profits, releasespace to enter the market of new retail investors, the influx of which has historically served as the main fuel for the largest bullish trends of bitcoin.

What does this mean for the market?

Long-term holders seem to tend to gradually accumulate BTC during bear markets and then take profits on the way up, but importantly,beforepeak formation.

Historically, these periods of decline in the number of long-term holding (including profit-made) coinslasted several months to almost a year, making it difficult to predict how far away we are fromVertex.

But if the price of BTC follows this historical trend, then we are waiting forcontinuation of the price rally and setting new highs before the market formsa new peak.

The article does not contain investment recommendations,all opinions expressed are solely the personal opinion of the author. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>