Published on 02/09/2020 by Sergey Golubitsky

You've probably heard rumors about an incredible boom.It's not clear where it's going to be: it's like it's back on the crypto market, and it's like, in some other mysterious place called DeFi.

For those who live on a very remote planet, I report: in the market of decentralized financial systems, so-called.DeFi (it is a rather narrow and complex ecosystem of financial relations, functioning on the Ethereum blockchain) is unfolding now events that overshadowwhat was happening in the market of initial offers of crypto-monitors (ICO) in December 2017 - January 2018.

For you to imagine the scale of mind-blowing: YFI's control token, created to manage the DeFi system YEarn.finance, has increased in price in two months by 130 times!

This can not pass by the mainstream and, judging by the way the volumes are growing, it is easy to assume that the world media have already fully connected to the unwinding of psychosis, and the deranged crowd of sheep has already fallen to the slaughter!

Buratins see that in early July it was possible to invest 1000 dollars, and in two months to get 130,000, and rodshods.

So that's it. It is imperative that you all have an absolutely clear understanding: the insane profitability that has developed around the DeFi system governance tokens today is definitely and unconditionally a Ponzi pyramid and bubble!

As soon as the bubble bursts, the cost of tokenswill fall to the ground, and cannon fodder, that is, stupid hamsters who are now buying DeFi protocol tokens at wild prices, will sooner or later lose all their investments! It is impossible to guess when the bubble will burst, it will happen at any second, the collapse will be instantaneous and dizzying.

Therefore, if you have acquaintances who are committing such madness (direct purchase of management tokens on the exchange), stop them immediately!

There is, however, the MOST IMPORTANT MOMENT that sets the QUALITATIVE difference between the modern DeFi boom and the Shitcoin crypto bubble of 2017! It was for this moment that I undertook to write this post.

The point is that by itselfThe decentralized finance (DeFi) ecosystem was created and exists for completely different purposes!Main purpose of DeFi:provide an opportunity for investment, primarily in stable crypto coins (so-called stablecoins), which are pegged to the dollar exchange rate.

You are not investing in speculative tokens,and into stablecoins, whose rate fluctuates in the technical range of ± 5% of the value of the dollar (there are even stablecoins that are tied not to the current value of the dollar, but to its value adjusted for inflation, that is, taking into account the CPI index). These investments serve as a pool of liquidity across various trading and lending decentralized marketplaces and generate direct income either through the commissions that are paid on each exchange transaction on these marketplaces (1) or through collateralized lending to other ecosystem participants (2).

In other words, the direct returns from investing in DeFi liquidity pools are comparable to those of banks, stock brokers and market makers in traditional finance.

The size of such a basic return from DeFi is 2-10% per annum, which today is incomparably higher than the return on bank deposits or investing in debt securities (of the state or private companies).

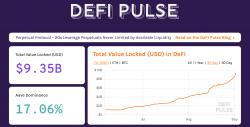

DeFi's increased baseline return is,of course, a payment for additional risks, primarily associated with the likelihood of detecting errors in smart contacts in the future (in DeFi, all cash flows are managed by computer programs, not people). Judging by the fact that now the amount of money invested in DeFi smart contracts is more than $ 9 billion, it can be assumed that these additional risks correlate well with the possibility of additional profit.

Exactly this kind of return (2-10%) from investmentat DeFi, we saw at the beginning of the summer, when our Crypto School was completely immersed in the magical reality of decentralized finance. What happened next?

Then competition was born between various DeFi protocols, which began to issue their own so-called. management tokens for two purposes:

1) attract additional liquidity forthe account of the distribution of "incentives" (in the form of these very tokens) to all those who invest money in the liquidity pools of stablecoins of these specific protocols;

2) ensure the transition to self-government protocolsDeFi (in the DAO format, a decentralized autonomous organization), where all decisions are made by voting with these very governance tokens.

Since the management tokens immediately got toexchanges (first DEX, decentralized, then ordinary, centralized), and the attractiveness of the entire DeFi ecosystem was quite obvious, these tokens began to grow in price exponentially.

Let's say that the already mentioned YFI token has grown in price from zero to 38 thousand dollars apiece (this is THREE TIMES more expensive than bitcoin itself!)

It is significant that the creator of Yearn.finance André Cronier constantly emphasizes: the DeFi protocol management token does not have ANY other intrinsic value, except for the right to manage the protocol itself, and even then in a very limited set of functions. Cronje, by the way, handed out all the tokens, leaving none for himself!

As a result, two markets were created.

- The first market is purely investment in nature,when money is invested in stablecoins, and the income from these investments consists of two components: basic due to commissions (see above) + incentive, due to constantly accrued smart-contract management tokens.

- The second market is a classic stock exchange speculative bubble, when money goes to buy the SAME control tokens traded on exchanges.

Everything that I wrote above about the Ponzi pyramid aroundthe DeFi boom is exclusively associated with the Second Market. It is there, when the bubble collapses and the markets crash, people will lose all their money, because all their money is invested in speculatively inflated governance tokens.

Unfortunately, the First Market is prohibitively difficultfor the townsfolk. Without proper training, there is no chance to understand something and learn to work on it. Therefore, 99% of naive people today rushed to the Second - pyramidal - market, where a sad fate awaits them ...

Let's see, however, what is happening now in the First - the DeFi investment market.

As a result of the growth in the cost of management tokens, investing in stablecoin liquidity pools began to bring in an order of magnitude more money.

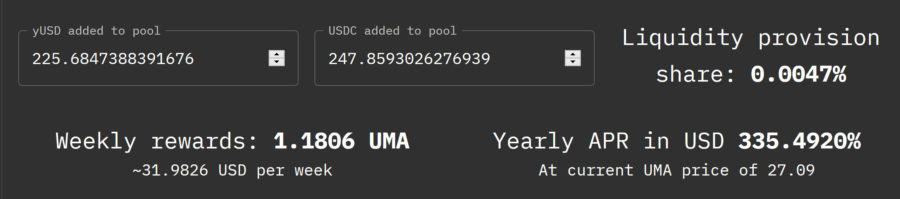

I will give just one example. At the end of July, a liquidity pool was created on the Balancer platform, represented by two stablecoins: one - a regular USDC stablecoin; the second is a synthetic collateralized stablecoin yUSD (this is something from the category of aerobatics: not only does it have a lifespan as a derivative, but it also does not use the system of "oracles" for price coordination with the dollar - about oracles, do not blame me, I'll tell you another time :)).

Synthetic stablecoin yUSD is based on the derivative protocol (= set of smart contracts) UMA, whose team pays out weekly rewards in its management token (UMA of the same name).

In general, this pool of liquidity of two stablecoins constantly brings three types of profit: the share of commissions from all swaps in this pool on the Balancer trading platform, where this pool is organized, + BAL reward tokens + UMA reward tokens. Charge weekly.

When this pool was created at the end of July,the yield on it was about 30% (due to the addition of all three components). This morning the yield was already 335% per annum. Exclusively due to the rise in the price of the UMA token on the exchange (it increased in price by 12 times).

Now imagine that the exchange bubble bursts and UMA, BAL tokens and all others like them collapse to zero.

What happens in the Second Market (those who bought tokens on the exchange at a speculative price)? That's right, all the money is lost.

What happens in the First Market (where is all the moneyinvested in stablecoin liquidity pools)? That's right, investors are deprived of the opportunity to receive more than 335% per annum and return to the original figures - 2-10% per annum due to the basic return on commissions.

And what about the main capital? It is where it was originally - in stablecoins pegged to the dollar! The collapse of the stock market bubble did not affect him in any way. In other words, the First DeFi Market will go bankrupt much later - along with Uncle Sam, who prints his money.

I broke into this longread for two reasons: firstly, to warn you, my readers, and ask you to warn your friends and acquaintances: do not let them buy DeFi tokens directly on crypto exchanges!

In the next few months, unprecedented insanity in this direction around the world is expected, followed by an equally unprecedented disappointment.