Common trader tools are protective orders such as stop loss and take profit. Howeverways to control trading risks are notare limited. More advanced capital protection and risk management tools include cross-margin and isolated margin. These tools are critically important in the cryptocurrency market, which is known for its unique dynamics.

To understand how these two tools work,It is necessary to first define them. Cross margin is margin that is spread across an open position using the full amount of funds in the available balance, reducing the risk of liquidation of a losing position. Isolated margin is margin that is individually allocated to an outstanding margin position with a fixed collateral amount. As we can see from the definitions, these two tools exclude each other, and in the vast majority of cases, trading platforms provide the opportunity to use only one of them. However, there are companies that allow you to combine cross margin and isolated margin within one user account. One such company is CEX.IO Broker, and using its example we will look at all the advantages of using these tools in trading.

What is Cross Margin?

The point of cross margin is that allbalance ensures positions. The operating algorithm of this tool is very simple: on any trading account, transactions exist as long as the minimum margin requirement is met. Unprofitable positions reduce the margin level, while profitable positions, on the contrary, increase it. In cross margin, the winnings of one position help meet the margin requirements of another position. Of course, if there is a loss on all positions and the margin level falls below that set by the platform, the transactions will be closed automatically, i.e. are being liquidated. This occurs in order to avoid uncontrollable losses by the user and the platform. However, in the case when some of the transactions are profitable, cross margin becomes a very useful tool, since in many cases it allows you to survive the minus and, ultimately, turn unprofitable positions into profitable ones or break even.

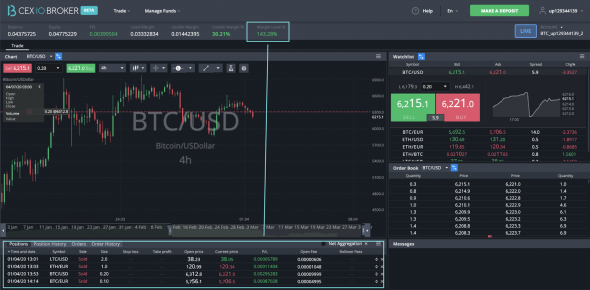

CEX.IO Broker margin trading platform. Margin Level is calculated for the entire trading account as a whole</em>

CEX.IO Broker allows you to see each of your open positions separately and easily understand how each of them is performing at any given time.

For example, in the image above you can seeprofitability of each individual transaction. Whenever we like the financial outcome of one position, we can close it while leaving the rest open. However, it is important to monitor the Margin Level, which is displayed for the entire trading account and determines the status of the final balance. It is important to maintain this indicator above the minimum required level (usually the platform will warn the trader if he approaches this level to avoid automatic liquidation of positions).

What is Isolated Margin?

Isolated margin is an instrument thatimplies the ability to isolate the margin supporting some transactions from the margin of other transactions. The simplest example of implementing this feature is trading on two or more independent trading accounts within one user account. Thus, the margin will be isolated between accounts, that is, a loss on one account will not lead to a change in the balance on another.

CEX.IO Broker account with positive balance is isolated from account with negative balance</em>

For example, you opened in CEX.IO Broker has two accounts: one for working with a short-term strategy, the other for long-term positions. Let's imagine that an account with short-term positions has gone into negative territory, but trading on an account with positions opened for a longer term is very successful. Isolated margin between individual trading accounts assumes that profits on a more successful account will not be “eaten away” by losses on a less successful account. Also, this tool allows traders to control profit / loss within trading strategies linked to different accounts.

One tool is good, two is better!

When choosing a platform for margin trading in cryptocurrencies, a trader needs to find a platform that would enhance his trading and risk management capabilities.

In CEX.IO Broker newbies who have not yet figured out the peculiarities of trading digital currencies can experiment with different strategies on different accounts, and at the same time control their risks as much as possible with the help of isolated margin. It is extremely important for beginners to develop an effective strategy and adhere to its rules in a disciplined manner. And the ability to open multiple trading accounts can help them solve this problem.

In this case, the cross-margin inside the trading accountallows beginners to master the “lock” or locking strategy - this is a type of loss management, when two opposite transactions are opened for the same financial asset. On the one hand, you can close the loss, on the other hand, you can establish an opposite position and try to resolve the situation in the future to your advantage. For experienced traders, cross-margin opens up opportunities for hedging positions and arbitrage trades aimed at profit from narrowing or widening spreads between various financial assets.

Trading with CEX.IO Broker, both beginners and professionals can take advantage of cross margin and isolated margin, and thus gain more flexibility in both developing trading strategies and protective mechanisms. At the same time, you don’t have to choose between testing new features and a conservative approach to risk management, because you can use both methods at the same time.