Financial conglomerate Wells Fargo, one of the "Big Four" banks in the United States, has published a new investmentA report with a separate page under the heading"Bitcoin is the most productive and most volatile asset of 2020"The authors do not directly encourage clients to invest in digital assets, but in general, they adhere to an optimistic tone regarding their prospects.

"Over the past 12 years, they have grown literally from nothing to a market with a capitalization of $560 billion.Hobbies don't usually last 12 years"Wells Fargo writes.

Despite the rather obvious statements made for the participants of the cryptocurrency space, they canThe Bank notes that Bitcoin (BTC) has grown by 170% in a year, but warnsabout its high volatility.

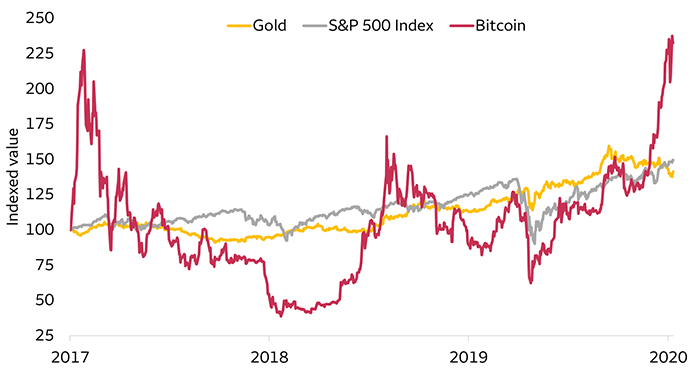

The chart shows that bitcoin has indeed outperformed gold and the S&P 500 index over the past three years, but look at the volatile path that bitcoin investors had to endure to get here.- analysts urge.

Up to the last two months, the three-year yield was mainly in line with other asset classes, but volatility was different.Investing in cryptocurrencies today is akin to living in the early days of the gold rush of the 1850s, which included more speculation than investing."

As the chart shows, Bitcoin, gold, and the S&P 500 started from the same point and showed a comparable trajectory for three years, but at the end, the Bitcoin line went up sharply.

"However, someday cryptocurrencies may earn attention as an investment asset", - the analysts conclude, adding that they will continue to monitor the development of the bitcoin market in 2021 and share their observations with potential investors.

Notably, in mid-2018, Wells Fargo prohibited customers from using its credit cards to buy cryptocurrencies.

Rate this publication