Data from Cointelegraph Markets and data provider lookintobitcoin shows that the fundamentals of the bitcoin network andIts current profitability indicates a positive future for the cryptocurrency asset.

Bitcoin halving occurred almost a month ago, andmany analysts say that this event did not lead to the expected rally. However, despite the absence of a sharp jump, retail and institutional investors continue to accumulate bitcoins and other cryptocurrencies.

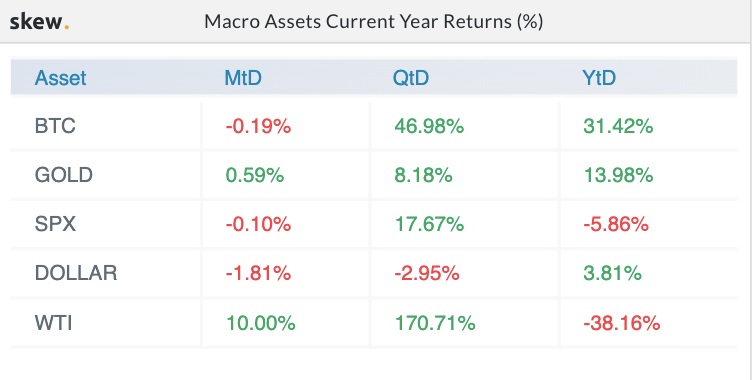

According to Skew, Bitcoin continues to lead in profitability among other asset classes, and the price increase since the beginning of the year was 31.42%.

Growing interest of institutional investors inBitcoin is confirmed by recent reports that after a halving on May 11, management companies such as Grayscale Investments are buying up bitcoins more intensively than miners manage to produce them.

Also an important milestone in the acceptance of Bitcoin was the announcement by hedge fund manager Paul Tudor Jones that he was allocating about 1-2% of his funds to Bitcoin.

Retail interest

Square also recently noted a sharpgrowing consumer interest in cryptocurrencies and digital payment services. The company's revenue from bitcoins increased by 71% compared to the previous quarter - up to $ 306 million.

Bitcoin is rapidly entering the lives of people in Africa and Latin America, as evidenced by the growing number of transactions on bitcoin exchanges such as Paxful and LocalBitcoins.

Optimism

Lookintobitcoin points out that bitcoin optimism still persists despite the fact that there are threats of surrender to miners and unrest in world markets.

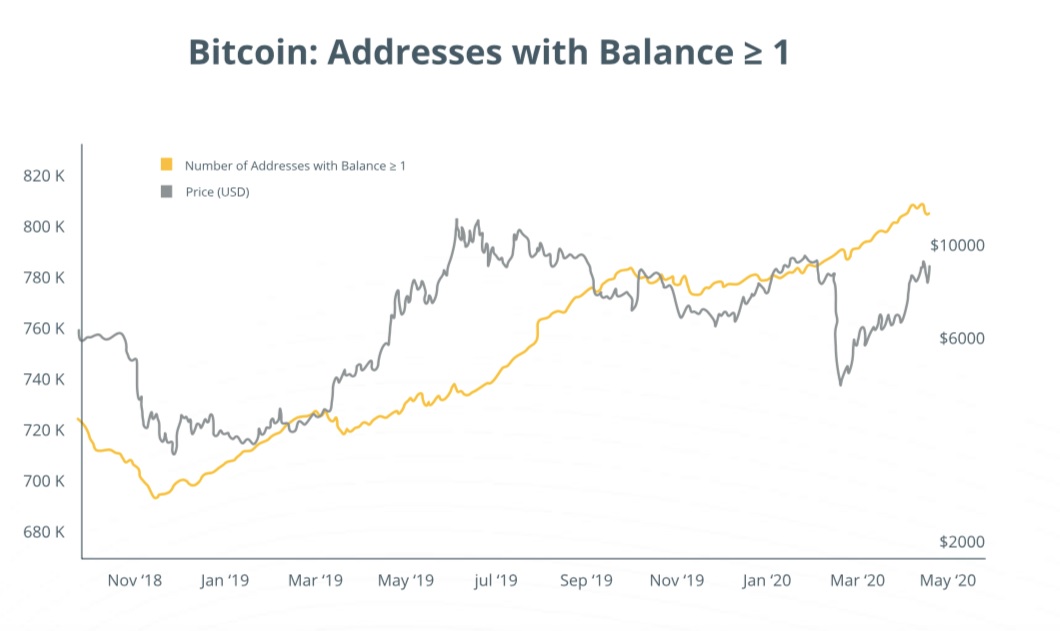

Also, despite the catastrophic drop in bitcoin to $ 3,750 on March 13, the number of bitcoin addresses with a balance of more than 1 BTC continued to grow.

The data also show that long-terminvestors continued to hold bitcoins during the March crash and during the halving. This suggests that they do not intend to sell coins in the short and medium term.

Depreciation - the opportunity to buy

At the moment, the price of bitcoin continuesmeet resistance at $ 10,000, also in an uptrend, while investors tend to buy coins when they fall below $ 9,500. Lookintobitcoin creator Philip Swift noted:

"The recent merger of 200-day MA and 128-day MAcreates an area of important support for the price. In the bull market 2016/2017 128 MA has often acted as a key support for the price. Two weeks ago, we also saw that the price immediately rebounded from it and returned to the $ 10,000 area. ”

Swift also said that while Bitcoin continues to re-test $ 10,000, “a rollback from $ 10,000 is becoming less and less brutal,” and buyers are looking forward to breaking through this barrier.

</p>Rate this publication