Article Reading Time:

1 min.

Bank of America changed its rating of shares of the crypto exchange Coinbase to "underweight" in connection with the lawsuit by the US Securities and Exchange Commission (SEC).

Banking analysts state:The SEC is paying increased attention to platforms that allow trading not only in Bitcoin and Ether, but also in other crypto assets that the regulator has already considered or may consider to be unregistered securities. The SEC is particularly interested in companies that provide staking services: when a client agrees to lock up their crypto assets for a certain period of time in order to receive profit from them. Regulator believes that this practice is similar to an investment contract and must comply with certain regulatory parameters.

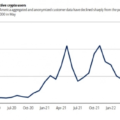

Bank of America analysts noted that about23% of Coinbase's net revenue in the first quarter came from transactions not involving Bitcoin or Ether, and about 10% came from staking rewards. Since the beginning of the year, cryptocurrency trading volumes on the trading platform have been noticeably lower than in 2022, despite the market recovery.

American regulator's claim toCoinbase Global is that the exchange is not registered as a broker, securities exchange or clearing agency. Bank of America specialists are confident that this could threaten Coinbase’s business model.

According to Bank of America data last year, crypto investors began to favor stablecoins pegged to the US dollar or gold due to the prolonged recession in the United States.