Article Reading Time:

6 min.

Opinion

As Democrats and Republicans in the U.S. try to agree on a debt ceiling, investors are waitingThe cryptocurrency did not show serious dynamics last week.

Bitcoin

During the week of May 19-26, the price of bitcoin fell by 1.9%.After a serious bull rally in the first quarter of the year, the second quarter turned out to be calmer.On the evening of Friday, May 26, the price of BTC is just over $26,000 .The first cryptocurrency in terms of capitalization has not been so cheap since March.

Source: tradingview.com

This is largely due to the strengthening of the US dollar since the beginning of May 2023.If BTC has lost almost 10% during this period, then the U.S.The Dollar Index, which shows the relative value of the U.S. currency to a basket of foreign money, strengthened by almost 2.5%.

Source: tradingview.com

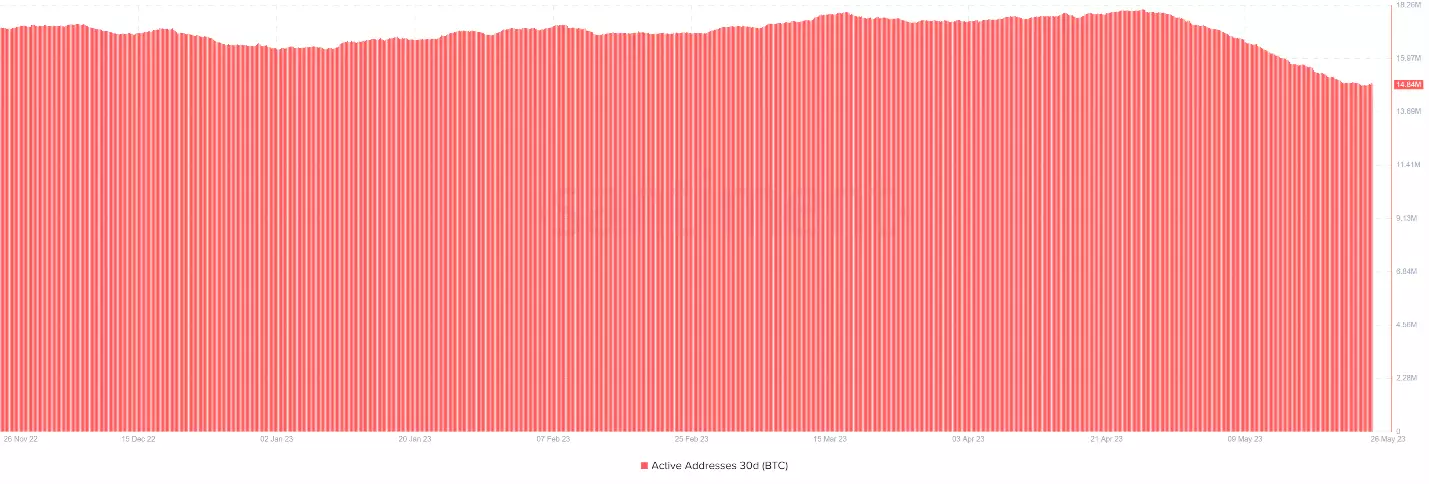

In addition, Bitcoin's lack of movement coincided with a general decline in activity on the network.From the end of April and throughout May, the number of addresses involved has been decreasing.If on April 25 the figure reached more than 18 million, then on May 25 only 14.88 million.

Source: app.santiment.net

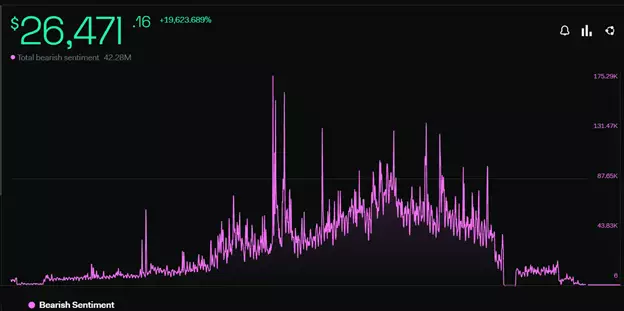

Well, bitcoin does not fall because there are no people who want to sell.According to analytics portal LunarCrush, the overall bearish sentiment is at its lowest since September 2022.And in general, the indicator has been decreasing since the end of March.

Source: lunarcrush.com

From the point of view of technical analysis , bitcoin is in a sideways movement.The nearest support level is $25,800 , the nearest resistance level is $27,666 .

Source: tradingview.com

Glassnode Analysts

noted the concentration of large volumes of coins that are "temporarily inactive" in the wallets of individual large investors.Experts believe that the growth in the number of holders may be due to the expectation of a rise in the price of the cryptocurrency and its further sale.

Weekly Fear & Greed Index

remained virtually unchanged, rising from 48 to 49.It is still in the neutral zone.

Ethereum

Over the past seven days, the dynamics of ether was zero again.The coin fell in price by 0.25%.The volatility of Ether continues to remain low.In a week, the price has changed by more than 2% only twice in a day, which is for cryptocurrenciesis a rather ridiculous result.

Source: tradingview.com

In America, which is a kind of "cryptocurrency Mecca" and a place of concentration for many players, there is stillhave not decided on the increase in the national debt ceiling.Time until June 1, when it is expected to beNaturally, this is a matter of concern for US citizens.

The results of technical analysis characterizethe situation is like a sideline. The price of ETH is clamped in the range of $1 750-$1 850. A rise above the upper limit or a fall below the lower one will become the starting point of some kind of movement. For now, the best thing traders can do is stay away.

Source: tradingview.com

The situation around is not encouraging eitherLedger hardware wallets. First, the developers launched an update that gave access to part of the users' seed phrase. Then it was announced the launch of a new firmware that would give third parties access to the private keys of crypto wallets. And then the launch of the Ledger Recovery access recovery service was postponed. The result is a confusing story. The only thing that is clear is that Ledger’s reputation as a reliable crypto wallet, to put it mildly, has been shaken.

Avalanche

Avalanche cryptocurrency for the last seven daysdropped in price more than Bitcoin and Ethereum. The fall was slightly more than 3.9%. Moreover, it fell almost entirely on one day – Wednesday, May 24, when the price fell immediately by 3.83%.

Source: tradingview.com

In general, Avalanche has seen a downtrend since 19April. However, from the point of view of fundamental indicators, the platform is doing well. This week it became known that Circle was launching a stablecoin called EUROC, pegged to the euro on the Avalanche blockchain. Before this, it only worked on Ethereum.

Avalanche's parent company, Ava Labs, announced

about the launch of AvaCloud. How the service is positioned in the company itself is a certain

a launch pad for Web3 designed to help companies build fully managed blockchains without code.

But from the point of view of technical analysis,The picture for the Avalanche is not the rosy one. The coin continues to decline in price. It is difficult to say when the fall will stop. Perhaps this will happen after reaching the support level of $13.1. Resistance level = $15.34. Bearish sentiment is also confirmed by the fact that the price is below the 50-day (marked in yellow) and 200-day (marked in purple) moving averages.

Source: tradingview.com

In other words, the current situation onThe crypto market is characterized by calm. It is explained by investors' expectation that the issue of default in the United States will be resolved, as well as the lack of desire on the part of large players to buy or sell at current prices.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.