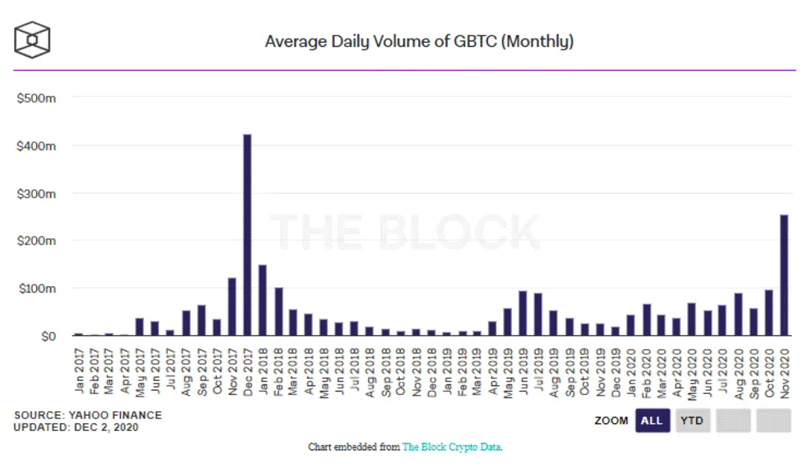

Average daily trading volume at Grayscale Bitcoin Investment Trust (GBTC) in November reached its highest levels since 2017.

Volumetrading increased by 165%

Average daily trading volume for a productGrayscale's Bitcoin Investment Trust (GBTC) exceeded $245 million in November and grew by more than 165% compared to the previous month, The Block reports. The last autumn month was the best in the fund's history, second only to December 2017, when the average daily volume reached $422.95 million.

Seven of the top 20 trading days were in November 2020, although the highest figures were still recorded in 2017.

As of early November, Grayscale Investments managed assets worth more than $9 billion. The lion's share in this portfolio (over $7.6 billion) is occupied by Bitcoin (BTC).

Grayscale Ethereum is in second placeTrust. It has approximately $1.1 billion in assets under management. These investments also look very promising given the bullish factors behind Ethereum (ETH), including the developers' promised quick transition to the new Ethereum 2.0 protocol.

Grayscale massively buys up bitcoin

Shortly after the May halving on the Bitcoin network,Grayscale Investments acquired almost 20,000 BTC. In September, the company purchased more than 17,000 more coins, bringing its total investment in Bitcoin to 449,000 coins. Experts are confident that Bitcoin will reach record price levels in the coming 2021, so they are ready to stock up on cryptocurrency now.

Also, according to Plan B, a well-known cryptocurrency analyst and blogger, Paypal, Grayscale and Square are preparing to replenish their bitcoin reserves.

Note that previously the investmentGuggenheim Partners said it will buy bitcoin through the Grayscale Bitcoin Trust. By doing so, the investment manager will join a long list of Wall Street companies that have taken notice of the benefits of the cryptocurrency asset.

Rate this publication